- Created by admin, last modified by AdrianC on Jun 28, 2017

This information applies to MYOB AccountRight version 19. For later versions, see our help centre.

https://help.myob.com/wiki/x/-wKc

ANSWER ID:35783

AccountRight Plus, Premier and Enterprise, Australia only

To deduct child support payments from an employee's pay, you'll need to set up a new payroll deduction category, then remit the deducted amounts to the relevant party (usually the Department of Human Services).

We'll step you through the set up tasks and how to remit the payments.

If you need more information on child support payments, including payment amounts and thresholds, seek advice from the Department of Human Services or visit humanservices.gov.au

You'll need to set up a liability account into which the employee's child support deductions will be credited. This lets you keep track of these payments and allows you to pay the child support payments using the Pay Liabilities function.

- Go to the Accounts command centre and click Accounts List. The Accounts List window appears.

- Click the Liability tab.

- Click New. The Account Information window appears.

- For the Account Type, select Other Liability.

- Specify an Account Number that suits your accounts list.

- Enter a suitable Account Name. See our example below.

- Click OK.

You need to set up a child support deduction category which will be used to deduct the required amounts from the employee's pay. If you have more than one employee requiring child support deductions of different amounts, you might need to set up separate deduction categories for each - this will depend on how much is being deducted, or how the deduction is calculated.

- Go to the Payroll command centre and click Payroll Categories. The Payroll Category List window appears.

- Click the Deductions tab.

- Click New.

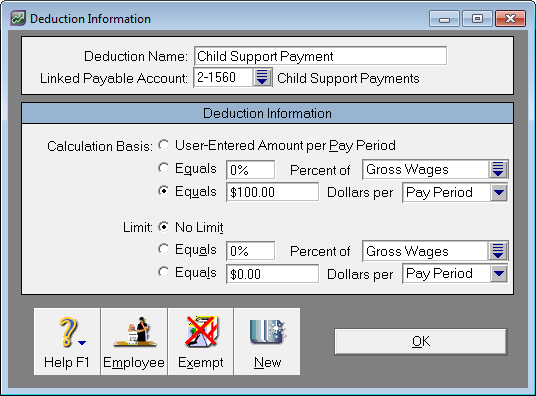

- Enter a suitable Deduction Name, such as 'Child Support Payment' or similar.

- For the Linked Payable Account, select the liability account created in the previous task.

- Select the applicable Calculation Basis. This will depend on the amount you have been advised to deduct for the employee. If unsure about the amount or calculation method, seek advice from the Department of Human Services or visit humanservices.gov.au.

- Select User-Entered Amount per Pay Period if the amount to be deducted varies each pay. You will then need to specify the payment amount each time you pay the employee.

- Select Equals X percent if the amount to be deducted is a fixed percentage of a specified wage category, e.g. Gross Wages.

- Select Equals X Dollars if the amount to be deducted is a fixed value per pay period, month, year or hour. See our example below where the employee is required to pay $100 in child support per pay period.

- Click Employee.

- Select the employee to whom this deduction applies.

- Click OK to return to the Deduction Information window.

- Click OK.

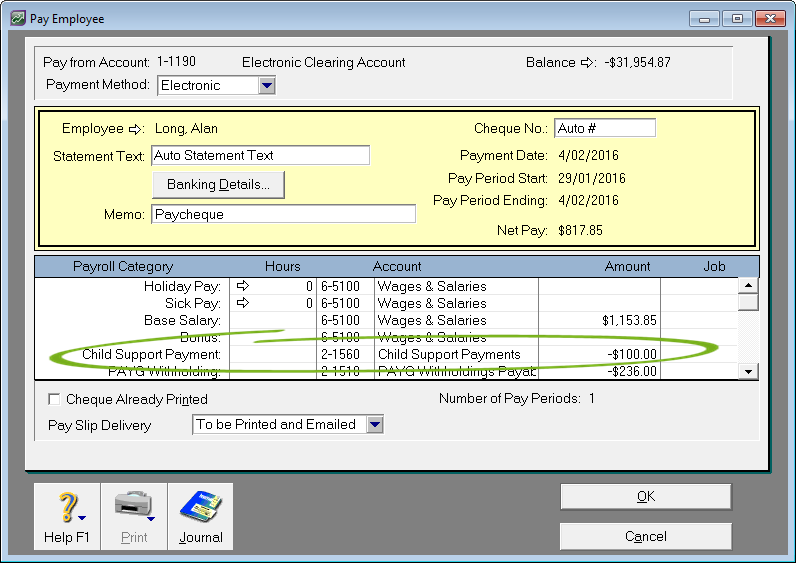

When you process the employee's pay, the child support deduction will display. If you selected User-Entered Amount per Pay Period when you set up the deduction category, this is where you would specify the amount to be deducted in the Amount column.

Process the employee's pay as normal. The child support payment will be deducted and "held" in the child support liability account created earlier in this process.

The next task describes how to pay those amounts to the applicable party and clear that account.

The child support payments deducted from the employee's pay will need to be paid to the applicable party (usually the Department of Human Services). Who the payments go to and how frequently you'll need to pay will depend on the employee's circumstances. If unsure, seek advice from the Department of Human Services or visit humanservices.gov.au.

Because we set up a separate liability account for the child support payments, it's easy to pay those amounts using the Pay Liabilities feature in your software.

This is how to do it:

- Go to the Payroll command centre and click Pay Liabilities. The Pay Liabilities window appears.

In the Pay from Account field, type or select the account you're making the payment from. Alternatively, you can select Group with Electronic Payments if you're making the payment electronically. For more information, see Making payments electronically.

Bpay payments

Bpay payments can't be processed through AccountRight. Instead, choose the AccountRight account the payment is coming from (in the Pay from Account field), complete the Pay Liabilities transaction, then manually process the payment through your internet banking software.

- In the Supplier field, select the card for whoever the payments are going to, such as the Dept. of Human Services. If a card doesn't exist, you'll need to create one.

- For the Liability Type, select Deductions.

- For the Payroll Categories, select the child support deduction category. All payments deducted using that deduction category will be listed.

- In the Dated From and Dated To fields, enter the period in which the child support payments were withheld. The list of child support payments made during that period will be listed.

- Click in the select column next to the child support payments you want to include with this payment. The total of the selected payments appears in the Total Payment field. See our example below.

- Click Record.

For information on remitting child support payments to the Department of Human Services, visit humanservices.gov.au

There are 2 reports you can use to keep track of the child support payments you've withheld, and those that you have paid.

To access these reports:

- Go to the Reports menu and choose Index to Reports.

- Click the Payroll tab.

- Under the Payroll Liabilities sub-heading, you'll find the 2 reports you can run:

- Payroll Liabilities By Category: This report displays payroll liabilities for a specified period or date range, and can display those that are paid, not paid, or both.

- Liabilities Payment Register: This report displays payroll liabilities paid using the Pay Liabilities function within a given date range.

For more information on running, filtering, or customising reports, see the AccountRight help.