STP Phase 2 Customer Guide - AU

Welcome to the MYOB Exo Employer Services STP Phase 2 Customer Guide.

This guide assumes that:

- You are a supervisor user who can run the Single Touch Payroll (STP) Phase 2 procedure.

- You will upgrade your MYOB Exo Employer Services to the 2021.09 release version.

This manual summarises the:

- The compliance changes to report payroll information using Single Touch Payroll (STP) Phase 2 for the 2021–22 financial year

- What the change means for you and the action you need to take

- Tasks that require to be performed before you start to report payroll information using STP Phase 2.

What is STP Phase 2?

STP Phase 2 is an expansion on the role that the Australian Taxation Office (ATO) plays in collecting and administering information from employers on behalf of other government agencies such as Services Australia.

STP Phase 2 is a result of the Treasury Laws Amendment (2020 Measures No.2) Bill 2020.

The intent is to simplify reporting obligations for employers. For example, you will no longer need to send an Employment Separation Certificate to Centrelink. The Australian Government also expects that the government agencies now involved with using STP data will be able to respond more quickly in their services.

Your current STP reporting won't change. But before STP Phase 2 starts, you'll need to make sure your payroll information meets the new requirements. This includes updating some employee details and checking your STP reporting categories.

Even though MYOB is ready for STP Phase 2, you might not be. To give you plenty of time, we've obtained a deferral from the ATO.

This means you have until the end of August 2022 to update your payroll information for STP Phase 2.

For more information, see the ATO website.

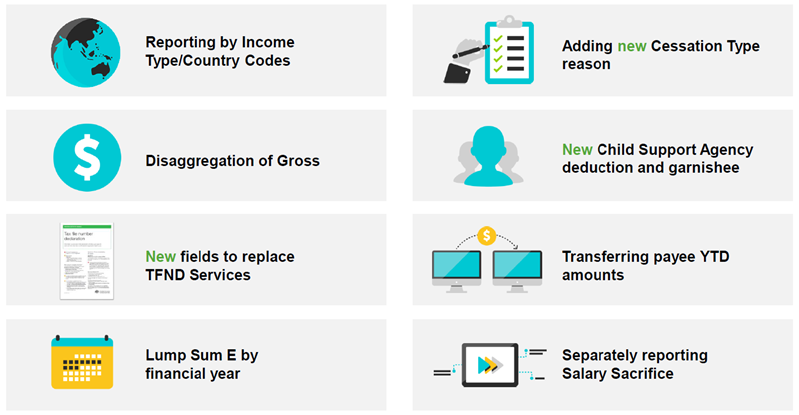

What are the key changes?

Reporting by Income Type/Country codes

Employee income type

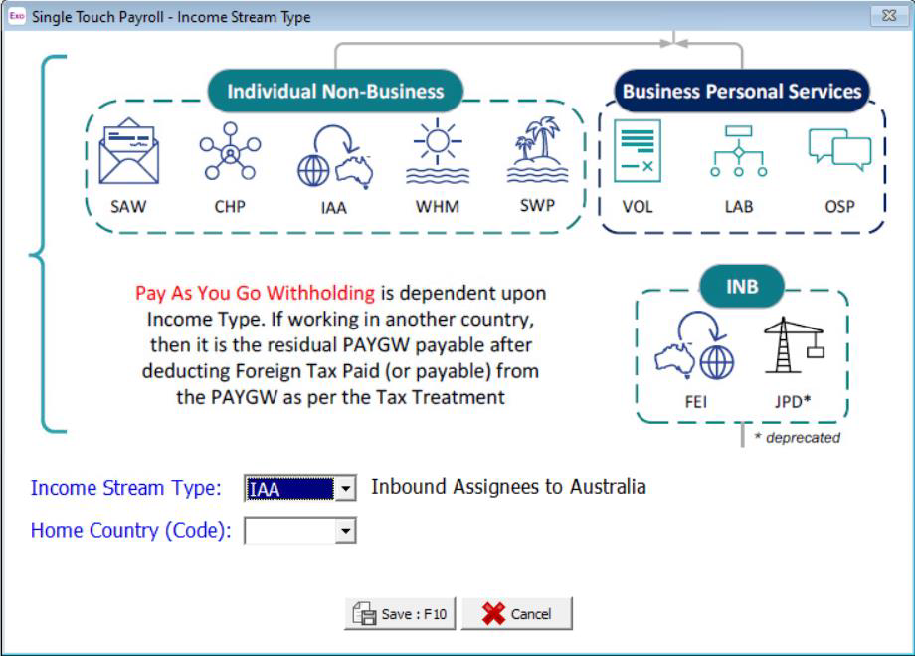

In STP Phase 2, the terminology previously used was payment summary type. This has been replaced with a new term and definitions. The new term is “income stream type”.

This change has the most impact on those employees currently reported as payment summary type Individual Non-Business (INB). The ATO now requires this group to be split-up and add 3 new types:

- Salary & Waged employees (SAW)

- Inbound Assignees to Australia (IAA) (New)

- Closely Held Payees (CHP) (New)

- Seasonal Workers Program (SWP) (New)

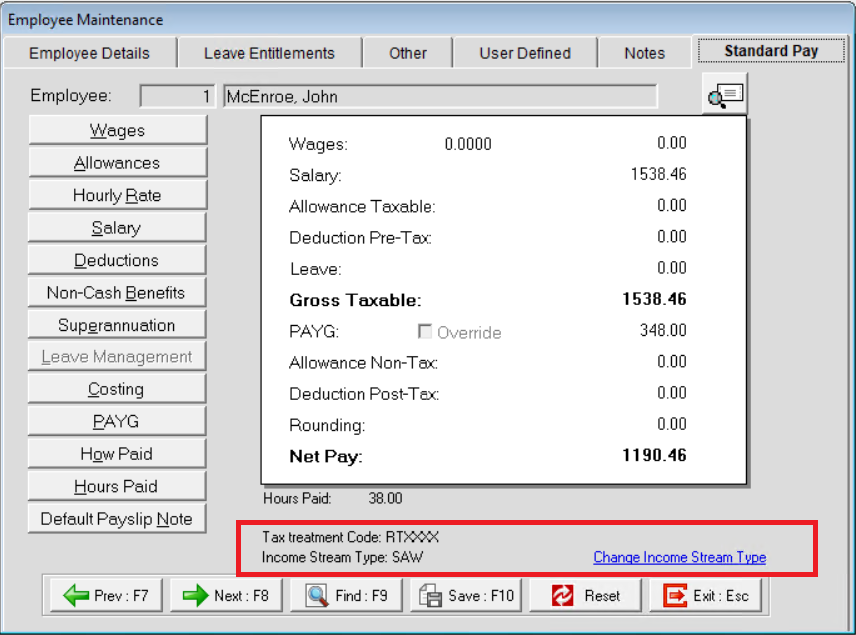

The assigned income type will be visible on the Standard Pay tab of the Employee maintenance screen.

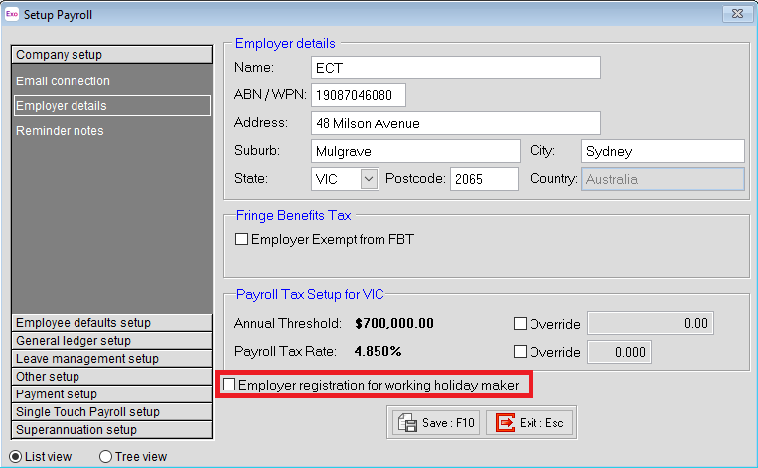

Employer registration for Working Holiday Makers (WHM)

Exo Employer Services has introduced a configuration that will mark the payer as registered for WHM. This setting will contribute to the automatic allocation of tax treatment codes for employees using the Working Holiday Maker tax classification.

Country codes

Australia has tax treaties with many countries to reduce or eliminate double taxation caused by overlapping tax jurisdictions.

Income types must report the year to date (YTD) income by country code to assist Australia with meeting its international commitments. However, this only impacts employees classed as Inbound Assignees to Australia (IAA) or a Working Holiday Maker (WHM):

- IAA employees must report the country they were a tax resident of before coming to Australia.

- WHM employees must report their home country.

Employer Services supports the country code you need to capture via a new field called Home Country (Code). To access this field, go to the Employee maintenance screen, click the Standard Pay tab and click the Change Income Stream Type link.

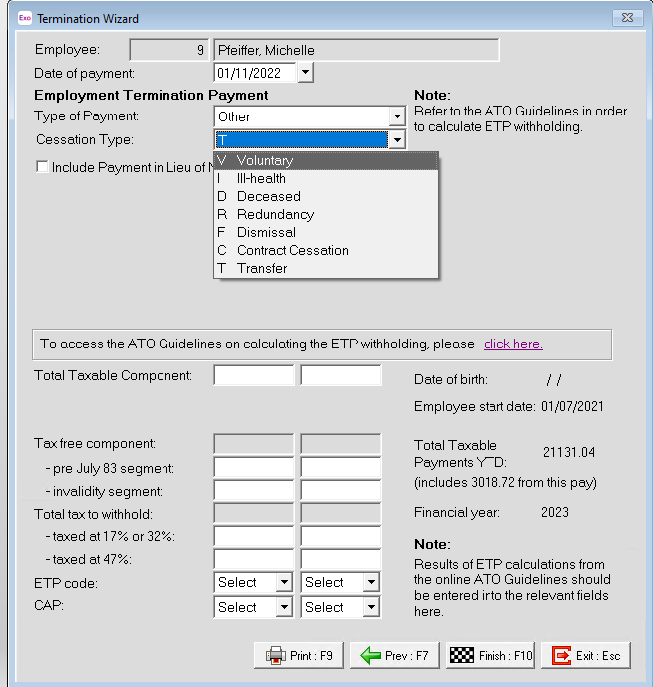

Cessation types

The ATO now collects data that was previously reported to Centrelink via an Employment Separation Certificate. One of the data items the ATO now needs to collect for the Department of Services is a Cessation Reason.

Exo Employer Services supports the cessation reason in a new field called Cessation Type located on the Termination Wizard.

Disaggregation of gross

The employee gross amount you report to the ATO has been disaggregated into different income assessment groups with each group reported as separate amounts. The social services agencies require these income assessment groups to administer their programs.

The amount that was reported as Gross for Individual Non-business employees in STP Phase 1 will now, in STP Phase 2, exclude payments classified as the following:

- Paid leave

- Allowances (Extension and rule changes to what was already reported)

- Overtime

- Bonuses and commissions

- Directors’ fees

- Lump sum W (Return to work payment)

- Salary sacrifice

There are rules that define what can be included against each income type.

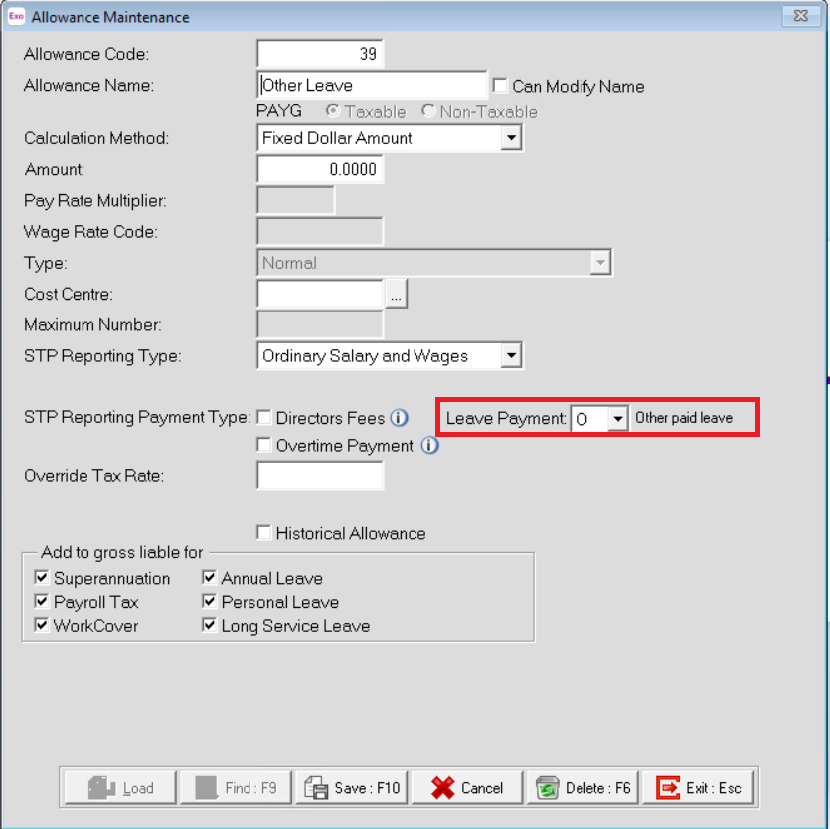

Exo Employer Services supports these rules with the following changes made to the Allowance Maintenance screen:

- All Leave allowances will require the Leave payment field to be populated.

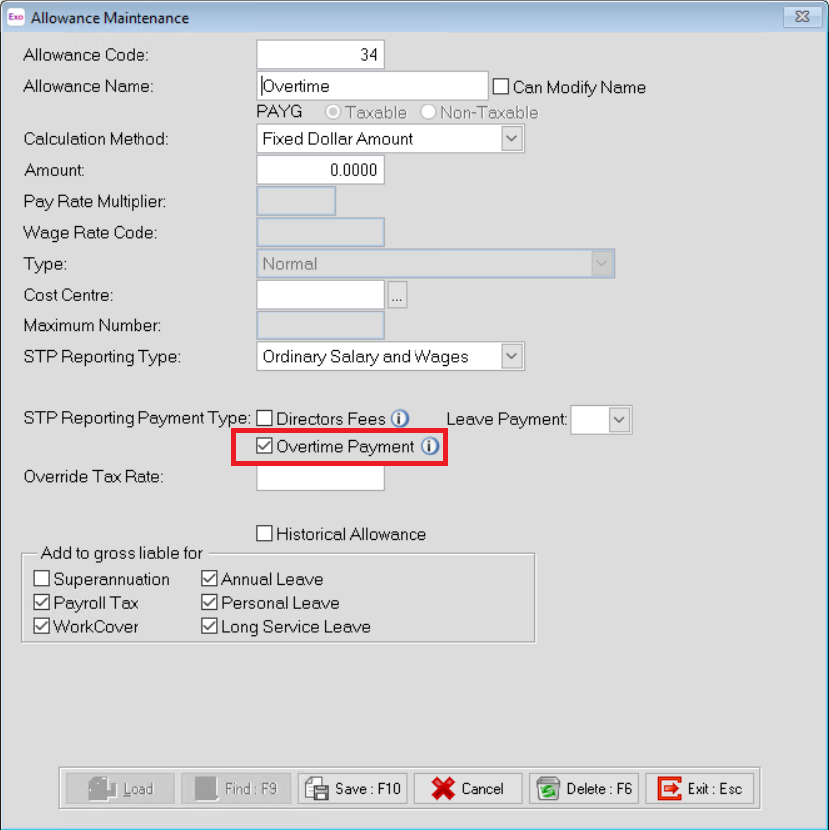

- All Overtime allowances will require the Overtime payment field to be selected.

- Directors Fees allowances will require the Directors Fees field to be selected.

- New STP Reporting Payment Type options.

- Validation on allowance setting combinations.

- Automated mapping of your allowance records to the STP Category on upgrade.

Paid leave

Paid leave is required to be reported into separate groups:

- Other paid leave

- Paid parental leave

- Workers’ compensation

- Ancillary and defence leave

- Cash out of leave in service

- Unused leave on termination (paid leave type U).

What are the paid leave changes in Exo Employer Services?

- Leave allowances can no longer be used for more than one purpose,

e.g., an allowance used for leave taken cannot be the same allowance used to pay-out unused leave on termination. - Time off in lieu (TOIL) allowances that relate to overtime must be reported as Overtime, not Paid leave. If you currently use only one allowance for this purpose you will now require two; one in relation to OTE (ordinary time earnings) hours (this is deemed paid leave) and the other in relation to overtime hours.

- All leave allowances will require the Leave payment field to be populated.

- Leave payments that have balances tracked through the Leave Management tool, i.e., annual leave, sick leave, carer's leave, long service leave and rostered days off (RDO) will be automatically reported in STP Phase 2 on upgrade to 2021.09 or newer.

- Leave allowances that do not have leave balances tracked through Exo Employer Services and are usually created as allowances on the Allowance Maintenance screen will require the Leave Payment field to be manually set. This is because it is not automatically possible to determine what the leave is for. And depending on what the leave is for, the ATO may require it to be reported as something other than paid leave.

When an allowance that relates to paying leave is used, the relevant leave balances require to be manually adjusted (like cash out of leave in service).

Allowance Payments

In STP Phase 1 reporting, some allowances are reported separately, and some were reported as part of gross income.

In STP Phase 2, you now need to report all allowances separately. This impacts most income types, not just expense allowances that may have been deductible on your employee’s individual income tax return.

Do not report:

- Reimbursements – These are amounts that reimburses an expense which was or will be incurred by the employee in the course of their duties and can be verified by receipts. Some reimbursements may be subject to Fringe Benefits Tax (FBT).

- Fringe benefits – These are not amounts that you are paying to your employee. These amounts, if reportable, will continue to be identified using the ATO reporting category Reportable fringe benefit.

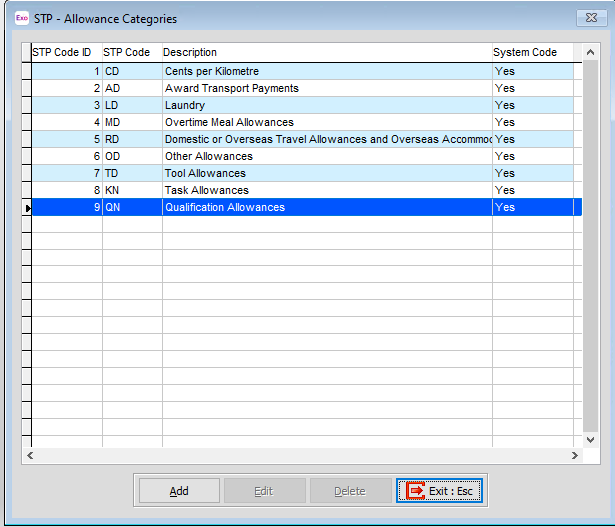

The allowance payment types you will separately report in STP Phase 2 are:

- CD—Cents per Kilometre

- AD—Award Transport Payments

- LD—Laundry

- MD—Overtime Meal Allowances

- RD—Domestic or Overseas Travel Allowances and Overseas Accommodation Allowances

- OD—Other Allowances

- TD—Tool Allowances (new)

- KN—Task Allowances (new)

- QN—Qualification Allowances (new)

As per ATO requirements, anything you report as Other Allowances needs to have a description. The descriptions you can use are: G1 (general), H1 (home office), ND (non- deductible), T1 (transport/fares), U1 (uniform) and V1 (private vehicle).

Allowance change details

Allowances reported in groups 1–6, have some new ATO guidelines. If you are unaffected by the new guidelines, the only change is how the data displays in the STP payload.

Allowances reported for groups 7–9, may have either been reported as other allowance in STP Phase 1 or was included in gross income. In Exo Employer Services these allowances will require the ATO Reporting Category to be set/modified.

Refer to the allowance payment type links above for more details to help you determine whether you need to remap your existing allowances and/or create a new allowance record to support the new rules.

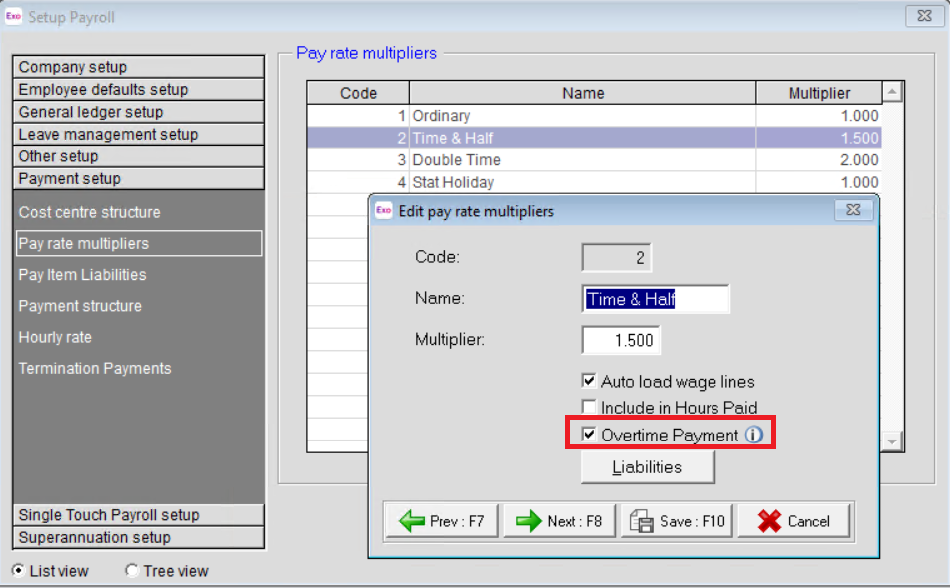

Overtime

You will need to review how your organisation has been recording/transacting payments relating to overtime, i.e., work done:

- beyond the ordinary hours of work

- outside the agreed number of hours

- outside the spread of ordinary hours (the times of the day ordinary hours can be worked). This means you will need to check that the option Overtime has been selected when required.

In Exo Employer Services, this option has been added into the Pay rate multiplier screen, under Setup Payroll and on the Allowance Maintenance screen.

Special cases to be reported as overtime:

- Time off in lieu (TOIL) allowances—Only cashed-out amounts are to be reported as overtime. If you have been using one allowance to manage TOIL, you will now require a minimum of 3:

- TOIL taken

- TOIL cashed-out

- TOIL unused leave on termination

- Call back/recall allowances—These are overtime when an employee has left the workplace or completed their ordinary time but, without any prearranged agreement to work overtime, is called back to work overtime.

- On call/stand-by or availability allowances—May or may not be classed as overtime. Please check the employee’s award. For example, if paid as per:

- clause 31.2 of the MA000036: Plumbing and Fire Sprinklers Award 2010, these types of payments are not ordinary time earnings and should be reported as Payment Type – Overtime

- clause 20.3 of the MA000031: Medical Practitioners Award 2020, these payments are ordinary time earnings and should be reported as Allowance Type-KN (task allowances).

- Leave loading—If leave loading is demonstrably referable to a notional loss of opportunity to work overtime, it is not ordinary time earnings and should be reported as Payment Type – Overtime.

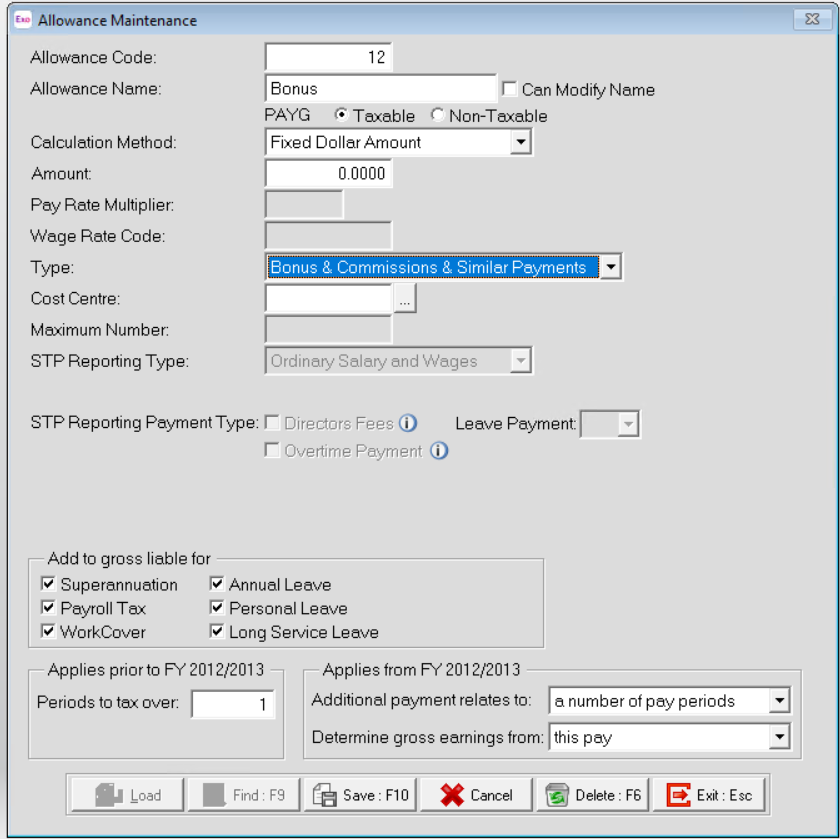

- Commissions & Bonuses

- Commissions & Bonuses that refer to overtime hours worked are not ordinary time earnings and should be reported as Payment Type – Overtime.

- Commission referable to ordinary hours worked must be reported as Payment Type – Bonuses and Commissions.

- Identifiable Overtime component of Annualised Salary—If not already set up as a separate allowance, it will now need to be.

- Part time additional hours—These are paid at a penalty or overtime rate that do not accrue leave entitlements. If not already setup as separate allowance, it will now need to be so.

- Travelling time—Travelling time outside of ordinary span of hours. If not already set up as a separate allowance, it will now need to be.

- Cents per Km Allowance—If not already setup as separate allowance, it will now need to be so.

Bonuses and commissions amount

Only bonus and commission payments that relate to OTE hours are to be reported as Payment Type – Bonuses and Commissions.

In Exo Employer Services your OTE Bonus or Commissions allowances will need to have the Type value Bonus & Commissions Similar Payments.

Important: If you have not previously had separated bonus or commission amounts into OTE and non-OTE payments, you will now need to have these as separate allowances.

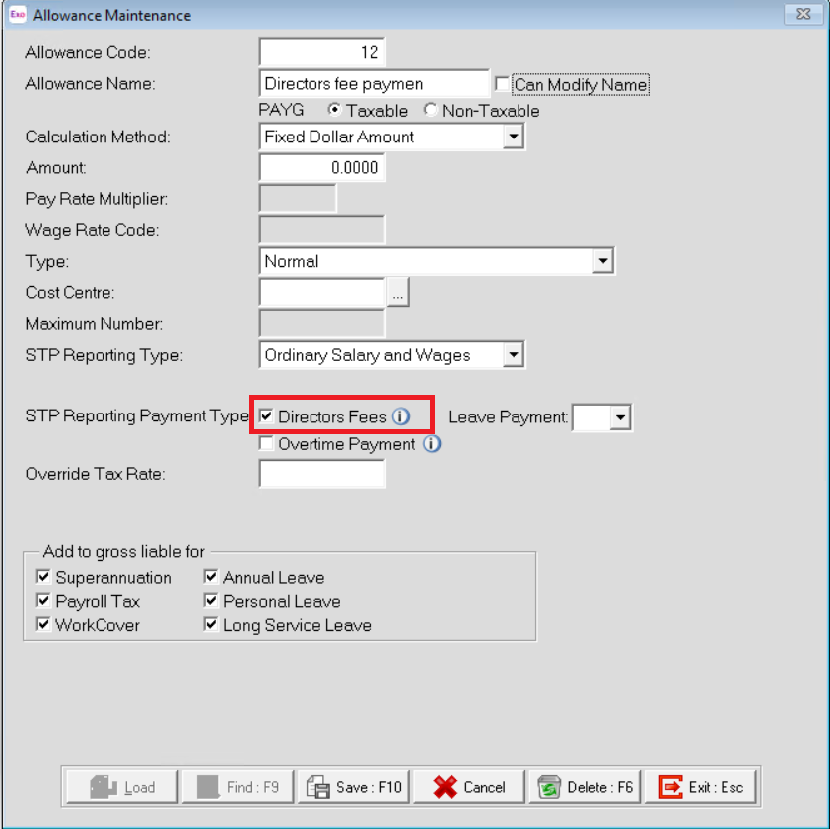

Directors fees

Directors fees include payments to the director of a company, or to a person who performs the duties of a director of the company.

In Exo Employer Services your allowances will need to have the STP Reporting Payment Type value Directors Fees.

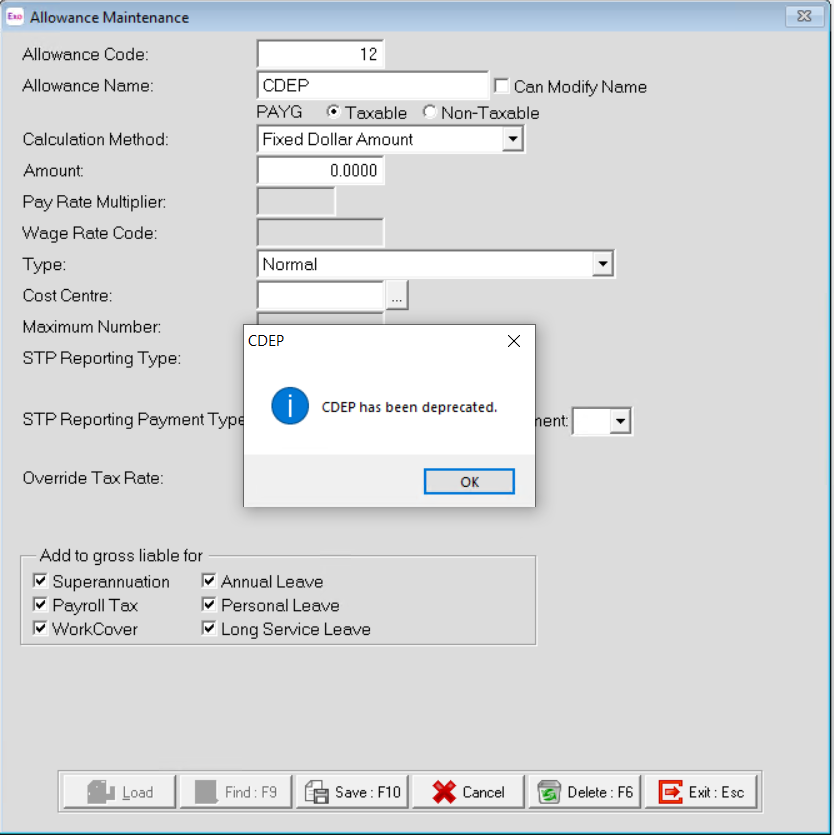

Community Development Employment Projects (CDEP) amount

CDEP values are no longer reportable in STP.

Salary sacrifice amount

Not previously reported in STP.

Superannuation

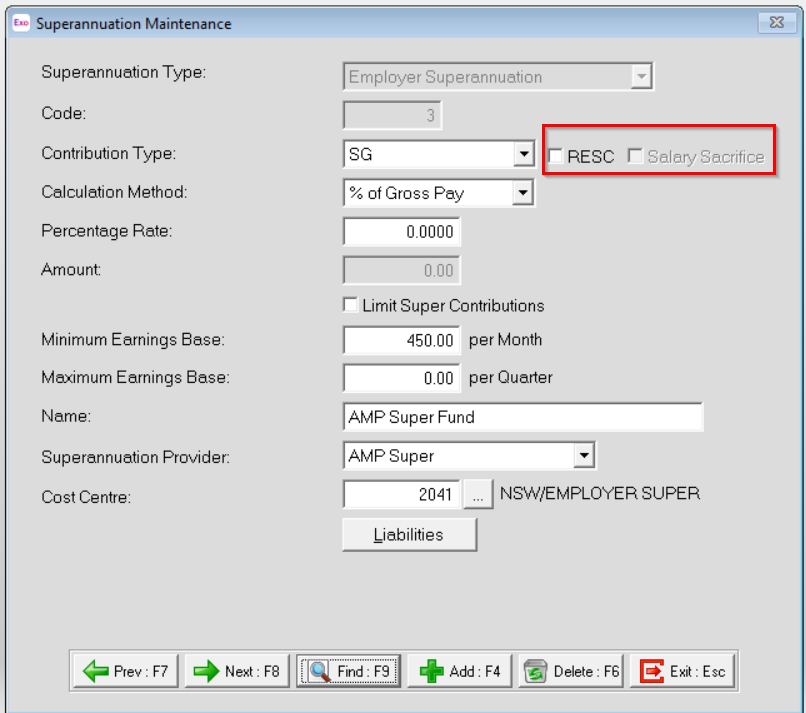

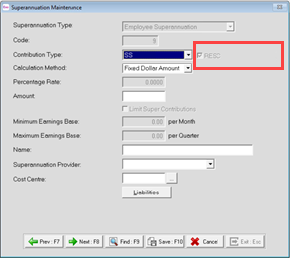

The Superannuation Maintenance screen includes an option for Salary Sacrifice. This option will mark the employer/employees' contributions that should be reported in STP as salary sacrifice.

Other Employee Benefit – Pre-tax deductions

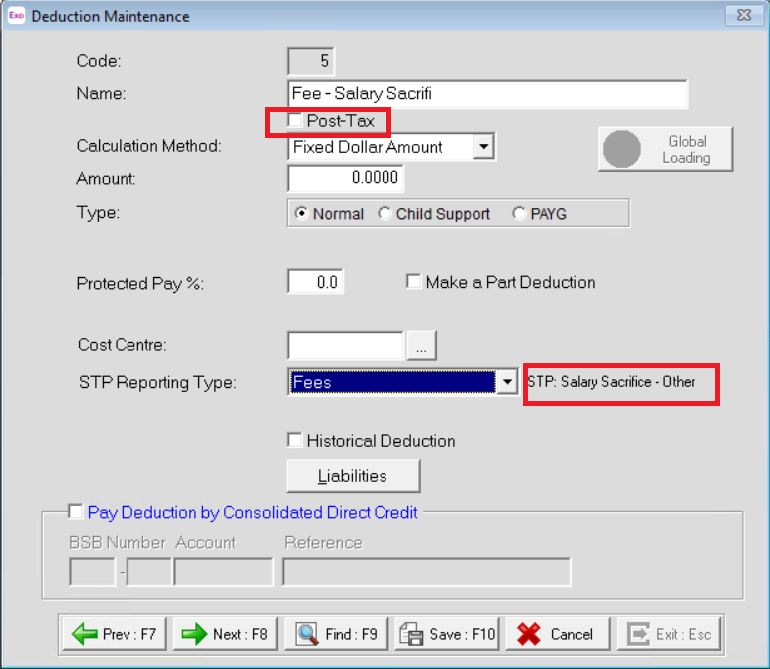

If the employer and employee agree to salary sacrifice the fees or workplace giving, the amount is to be reported in STP Phase 2 as salary sacrifice - other employee benefits. A new STP reporting type, Salary Sacrifice – Other, has been added on the Deduction Maintenance screen. This option may be used to create a pre-tax deduction that will be reported in STP as salary sacrifice – other employee benefits.

Other Employee Benefit – Non-cash Benefits

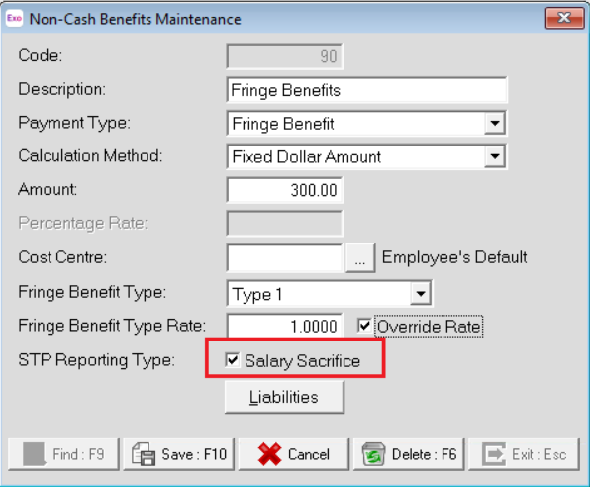

A new STP reporting type Salary Sacrifice has been added on the Non-Cash Benefits Maintenance screen.

When an employee receives a FBT exempt item, like a portable electronic device, the new option will report the benefit in STP as salary sacrifice - other employee benefits.

Lump Sum E

Exo Employer Services will report to the ATO the Lump Sum E per each financial year(s) it relates to.

Lump Sum W (return to work)

Not previously reported in STP.

A return-to-work amount is paid to induce a person to resume work, for example, to end industrial action or to leave another employer. It does not matter how the payments are described or paid, or by whom they are paid.

These types of payments, to induce workers to return to the workplace, cannot be classified as Payment Type – Bonuses or Commissions or Lump Sum Type-E but must be taxed as return-to-work payments (as per NAT3347 Return to Work Payments) and reported as Lump Sum Type-W YTD amounts.

A new STP reporting type Return to Work Payment has been added to the Allowance Maintenance screen.

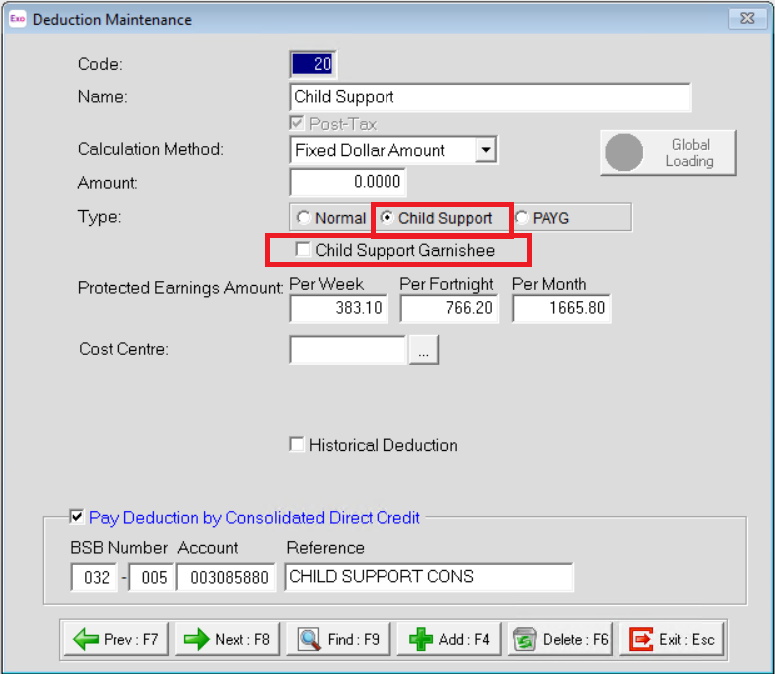

Child support garnishees and child support deductions

The ATO are now collecting child support payment data on behalf of Services Australia. This must be reported as either:

- Child support—This reflects deductions made under a notice as per section 45 of the Child Support (Registration and Collection) Act 1988.

These are your standard child support repayments - Child support garnishee—This reflects deductions made under a garnishee notice as per section 72A of the Child Support (Registration and Collection) Act 1988.

Exo Employer Services supports this via new options within the Deduction Maintenance screen.

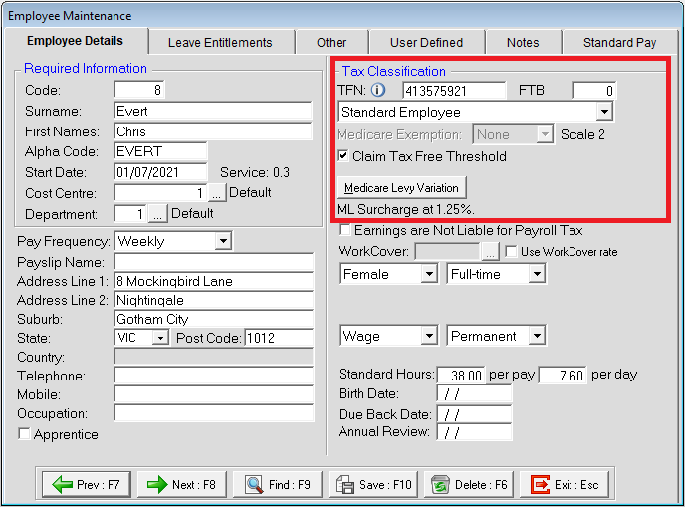

Improved Employee tax classification

This data has been improved by adding new Tax classifications, displayed under the dropdown on Employee details window.

Tax treatment codes

Tax treatment codes help the ATO identify how the employee’s monetary tax values have been calculated.

Exo Employer Services will automatically handle the codes to be assigned to each employee.

Tax offset amount

Not previously reported in STP 2018. Exo Employer Services does not capture the tax offset amount.

Transferring payee YTD amounts

In some cases, it may be necessary to update employees' STP data after their employee ID code has changed or after the business management system (BMS) used to manage them has changed.

These cases include:

- if an employee is rehired under a new employee code

- if an employer changes payroll systems and assigns new employee codes in new system

- if an employer moves employees from one database location to another, where the same system is still used but employee codes change

- if an employer needs to change existing employee payroll IDs for other reasons.

To update employees in these cases, select Single Touch Payroll > Update using Previous BMS/Employee ID from the Pay menu.

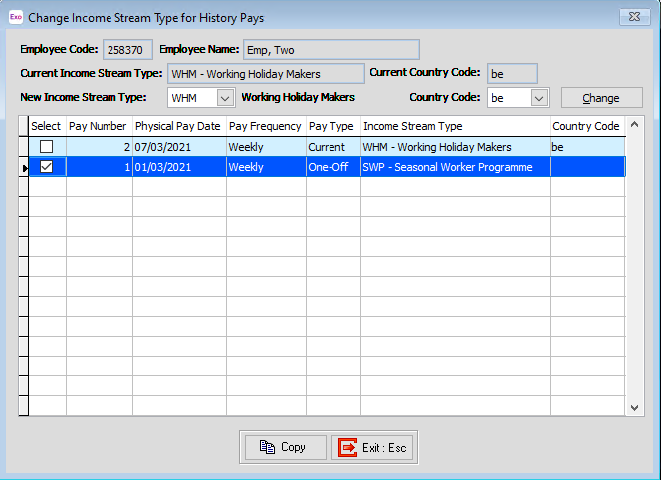

Updating the employees’ income types/country codes

If an employee’s income stream type changes within a financial year, the YTD amounts need to be submitted to ATO for each of the income stream type/country code combinations. This is supported in Exo Employer services by a new Update Income Stream Type of History Pays screen that helps update the STP income stream type for previous pays.

What action do I need to take for these changes?

Before upgrading

Ensure that any pay runs have been submitted successfully to the ATO.

During the upgrade

Employee Maintenance—Employee Details tab

Employees now require an income stream type, which is a further level of classification under their tax scale. The options available for an employee’s income stream type depend on their tax scale setting. A country code must also be supplied for employees with the following income stream types:

- Inbound Assignees to Australia (IAA)

- Working Holiday Maker (WHM).

The system now assigns employees a Tax Treatment Code, which is reported via STP. An employee’s Tax Treatment Code is assigned based on their settings in the Tax Classification section of the Employee Maintenance window.

During the upgrade process, the system is going to automatically assign the STP phase 2 categories as detailed in the tables below:

Employment Basis: Mapped from the existing fields as detailed below:

Employee details fields | STP2 - Employment basis (New) |

|---|---|

Full-time | F (Full time) |

Part-time | P (Part time) |

Casual | C (Casual) |

Contractor | L (Labour Hire) |

Combination of: ABN and Withholding Variation | V (Voluntary Agreement) |

Combination of: TFN, Withholding Variation and ATO defined variation (New) | D (Death Beneficiary) |

Combination of: TFN, Withholding Variation and ATO defined variation (New) | N (Non-Employee) |

Income Stream Type: Mapped based on the existing Tax Classification.

Original Field | STP2 – Income Stream Type (New) |

|---|---|

All Tax Classifications except Working Holiday Maker and Withholding Variation | Salary and Wages (SAW) |

New | Closely held Payee (CHP) |

New | Inbound assignee to Australia (IAA) |

Working Holiday Maker | Working Holiday Makers (WHM) |

New | Seasonal Worker Programme (SWP) |

Withholding Variation | Voluntary Agreement (VOL) |

Country Code: Only applicable for Income Stream Type IAA, WHM and SWP.

Category of tax scale: Mapped based on the existing Tax Classification.

Tax Classification | STP2 - Employee Category (New) |

|---|---|

Standard Employee | Regular – R |

Standard Employee with Student Loan | Regular– R |

Actors, variety artists and entertainers (New) | Actor – A |

Horticultural Foreign Resident Horticultural Resident Shearer Foreign Resident Shearer Resident | Horticulturists and Shearers – C |

Senior Single with Student loan | Seniors and Pensioners – S |

Option of tax scale: Mapped based on the existing option Claim Tax free Threshold.

Allowance maintenance

Not every allowance can be automatically assigned to a valid STP reporting type and STP Phase 2 payment type. Post upgrade you are strongly advised to review the settings of all your allowances and adjust, as necessary.

Original Field | STP2 – Allowance Category (New) |

|---|---|

Cents per Kilometre | CD – Cents per Kilometre |

Award Transport Payments | AD – Award Transport Payments |

Laundry | LD – Laundry |

Overtime Meal Allowances | MD – Overtime Meal Allowances |

Domestic or Overseas Travel Allowances and Overseas Accommodation Allowances | RD – Domestic or Overseas Travel Allowances and Overseas Accommodation Allowances |

Other Allowances | See Note |

New | TD – Tool Allowances |

New | KN – Task Allowances |

New | QN – Qualification Allowances |

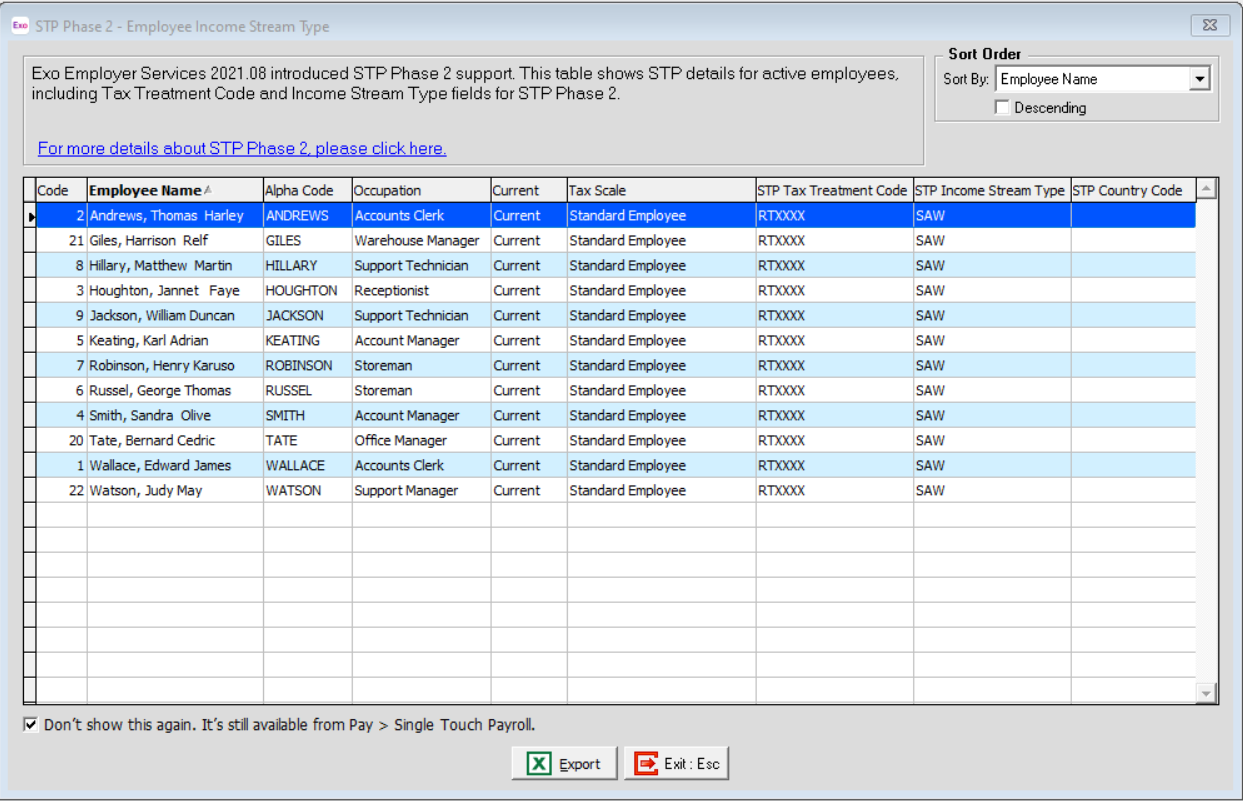

Post upgrade

After upgrading MYOB Exo Employer Services to 2021.09, we’ll automatically assign an income stream types and tax treatment codes to each employee. The first time you open Exo Employer Services after upgrading to 2021.09, a window will appear, showing you an overview of the changes that have been made to each employee record:

Below is a list of steps to complete to make sure the system is correctly setup for reporting in the new format STP Phase 2:

| Data to Review | Description |

|---|---|---|

1 | Review your employee records to determine if you have CHP, IAA or WHM employees. | IAA employees will need the following employee fields updated: Standard Pay>Change Income Stream Type> Income Stream Type = IAA Standard Pay>Change Income Stream Type> Home Country (Code) |

WHM employees will need the following employee fields updated: Standard Pay>Change Income Stream Type> Home Country (Code) | ||

2 | Review your employee records and assign Medicare variations or reductions. | Medicare variations and reductions is a new feature in Exo Employer Services starting from version 2021.09 or newer. |

3 | Review your Pay rate multiplier settings, under Utilities > Setup Exo Payroll menu, Payment setup option. | Review the Overtime payment option and for rates that relate to the employee's overtime. Review the Add Wages to gross liable for: Superannuation option. It should be selected for rates that relate to the employee’s ordinary time earnings. |

4 | Review the current Allowances and update the options for STP reporting. | STP Reporting Type / STP Reporting Payment Type / STP Category Review the Overtime payment option. The option Add to gross liable for superannuation is correctly set to the relevant allowances that relate to the employee’s ordinary time earnings. E-type Lump sum Payments should be used for all lump sum payments that relate to previous tax years. Return to work should be used only for non-WHM employee payments. |

5 | Check the Allowances in use for paying out Bonuses and Commissions. | Bonuses must have a Type set as “Bonus & Commission & Similar Payments”. |

6 | Check the Allowances in use for paying out leave. | For the STP Reporting Payment Type, leave allowances must have an option from the Leave Payment menu selected. Example: Bereavement Leave Allowance |

7 | Review the current Deductions of type Fees or Workplace Giving | Any existing pre-tax deductions that have an STP Reporting Type of “Fees” or “Workplace giving” will be automatically reported as Salary Sacrifice – Other employee benefit. Review and adjust. |

8 | Review Salary Sacrifice Arrangements - Allowances | Payments that can be salary sacrificed include commissions, bonuses, directors’ fees or allowances. Ensure that where a portion of these payments are salary sacrificed, that there is a corresponding pre-tax deduction in effect, which caters for the sacrificed portion. |

9 | Review Child Support Deductions | Amend as required the existing Child support and create separate deductions for Child Support Garnishee amounts. |

10 | Review Non-Cash benefits | Update the non-cash benefits that are part of a salary sacrifice agreement. The Screen allows now to configure these as Salary Sacrifice – Other employee benefit |