Multi-currency features are only available in AccountRight Premier 2018.3 and later. Not sure what version you're using? Open AccountRight and go to Help > About AccountRight.

If you deal with suppliers or customers in foreign currencies, you can create multi-currency transactions in AccountRight.

Want to give it a try? Before turning on the multi-currency features in your working company file, why not have a play in AccountRight's sample company file. You can then see what multi-currency can and can’t do and work out if it's right for you.

Using a classic AccountRight version? If you’ve used multi-currency in AccountRight Classic (v19 and earlier), find out how multi-currency has changed (for the better). Also find out about upgrading multi-currency enabled AccountRight Premier v19 company files (conditions apply - learn more here).

Setting up multi-currency

To use the multi-currency features, a company file administrator will need to turn on the multi-currency preference. You can then enter exchange rates, choose each card's default currency, and create foreign currency bank accounts.

Let’s get started.

1. Turn on the multi-currency preference

Once you turn on the multi-currency preference, you can't turn it off.

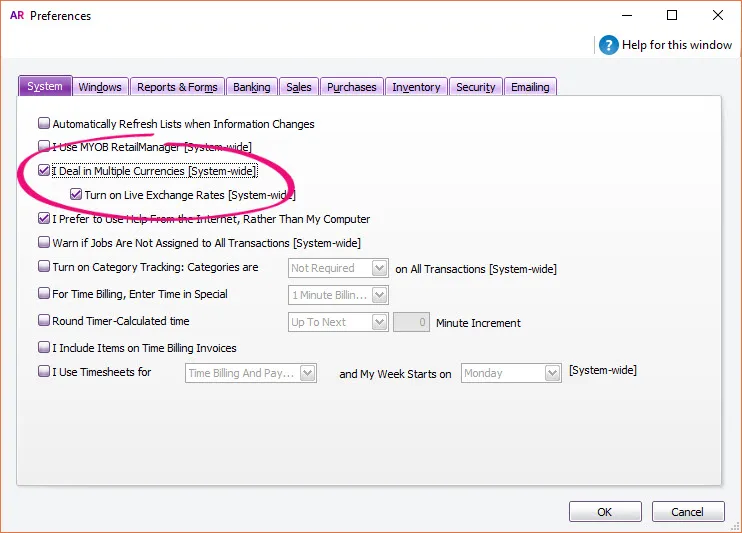

Go to the Setup menu and choose Preferences.

On the System tab, select the option I Deal in Multiple Currencies.

If you don't see this preference, make sure you're using AccountRight Premier 2018.3 (or later). To check, go to the Help menu and choose About AccountRight.

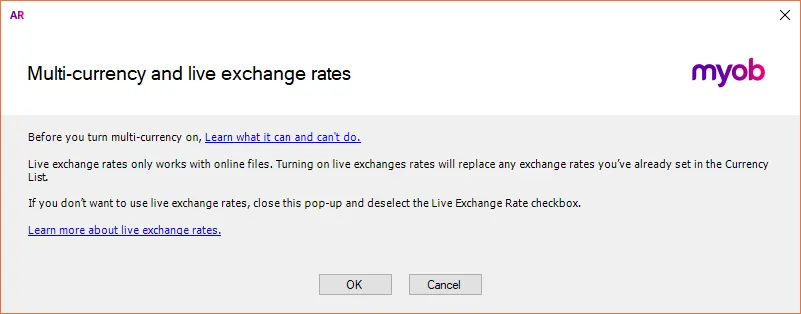

Read the displayed message about what multi-currency can and can't do and live exchange rates.

Click OK to return to the Preferences window.

Click OK to save the preference. The multi-currency features are now turned on.

By turning on this preference:

The Currencies List is now available from the Lists menu. Learn more about the Currency List

Currency information is available in cards and the Enter Purchases, Enter Sales, Receive Payments, Pay Bills, Spend Money, Receive Money, Purchases Register, Reconcile Accounts, and Find Transactions (Bill, Account, and Invoice tabs) windows

A new income account (4-9999 Currency Gain/Loss) is created to track gains and losses from exchange rate changes, and this account is set as the default linked account for currency gains and losses

The currency code field can be added to service and item layout forms (except remittance advice forms). Learn more about customising your forms

Once you turn on the multi-currency preference, you can't turn it off.

2. Set your exchange rates

By default live exchange rates (online files only) will be turned on when you enable the multi-currency preference. The exchange rates will automatically update every 5 minutes.

If you don't want to use live exchange rates you can manually set rates or change the rate when entering a transaction. Alternatively, you can deselect the Turn on Live Exchange Rates preference (see above).

3. Set the default currency for each card

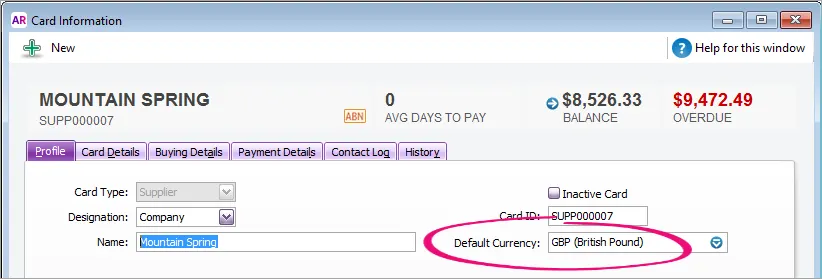

You can set the default currency for customers and suppliers in their card. If needed, you can choose a different currency when recording purchases.

Go to the Card File command centre and click Cards List.

Click the Supplier or Customer tab.

Click the blue zoom arrow to open the card.

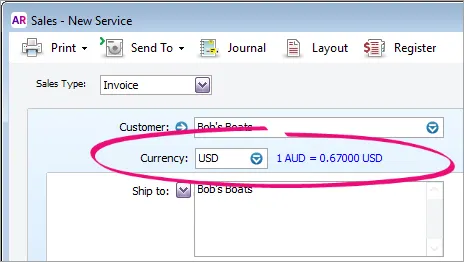

On the Profile tab, select the Default Currency. Here’s an example:

Click OK.

Repeat for other cards.

4. Create foreign bank or credit card accounts

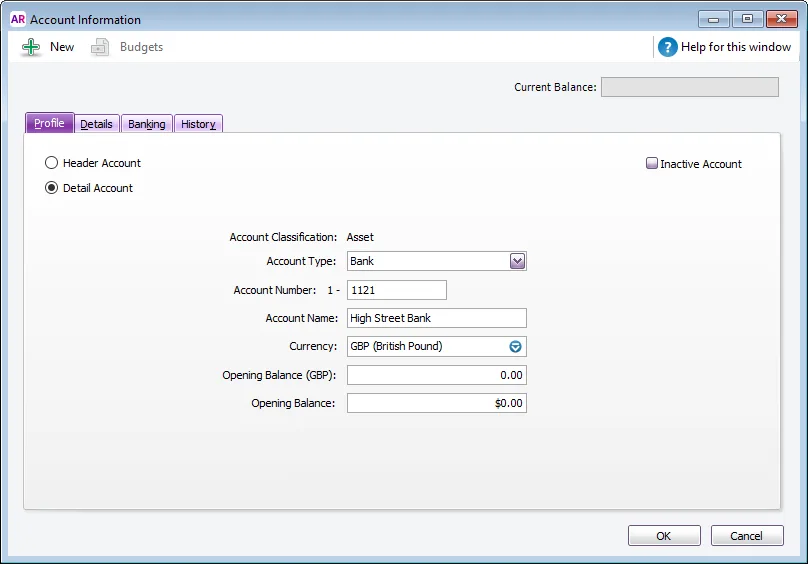

If you have a bank or credit card account in a foreign currency, you can create a matching account in AccountRight. These accounts can only be Bank or Credit Card type accounts.

Once an account is created, you can’t change the account type or currency.

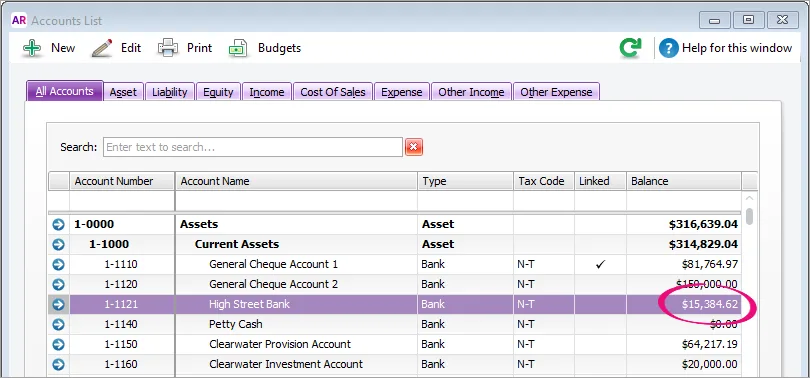

Go to the Accounts command centre and click Accounts List.

Click New.

Select Bank or Credit Card as the Account Type.

Enter an Account Number and Account Name.

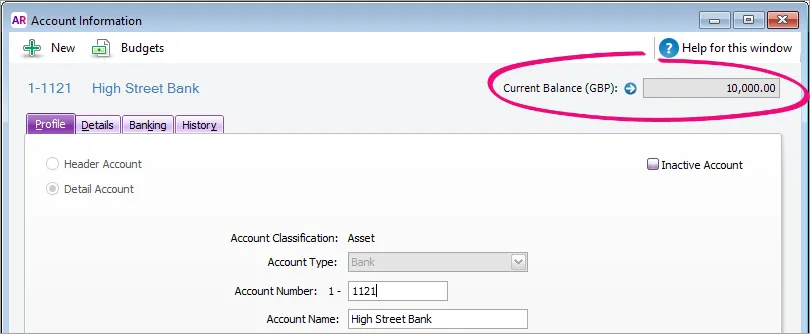

Select the Currency for this account. Here’s an example account:

Opening balances

If the account has a balance, you can enter it here in both foreign and local values. You'll need to manually calculate the local value based on the currency's exchange rate.

Click the Details tab.

Select the Tax/GST Code for this account. Check with your accounting advisor if unsure.

Click OK.

Repeat for additional foreign bank accounts.

Once an account has been used in a transaction, the Accounts List window shows the account balance in your local currency.

To see the account’s foreign currency balance, double-click to open the account.

Transacting in multiple currencies

Now that you're set up, you can start recording multi-currency transactions. But first, you might need to transfer funds into a foreign currency bank account (created during the setup above).

Transfering funds into foreign bank accounts

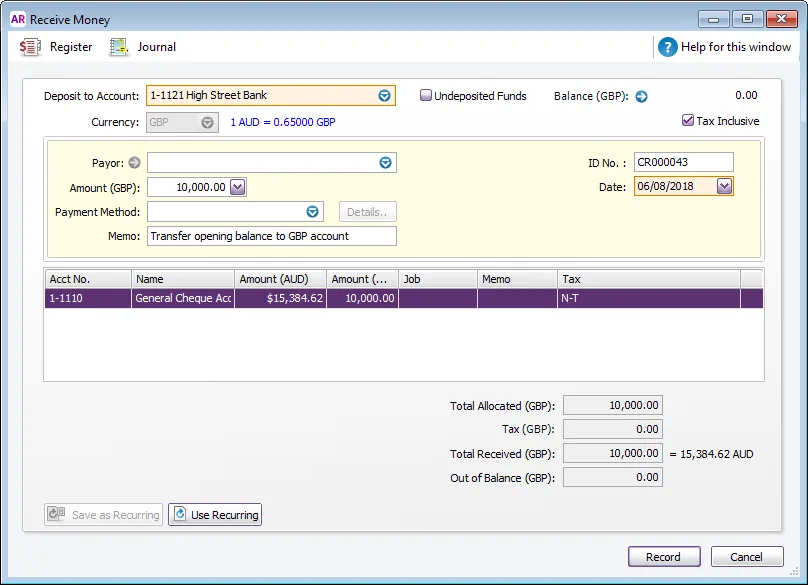

Use a Receive Money transaction to transfer funds from one AccountRight bank account into a foreign bank account.

Here’s how:

Go to the Banking command centre and click Receive Money.

In the Deposit to Account field, select the foreign bank or credit card account. The Currency field updates based on the account chosen, and the exchange rate is shown.

If required, click the exchange rate to change it. The Currency window appears.

Changing the Default rate will update the rate set against the currency list.

Setting a Custom rate will use that rate for this transaction only.

Enter the Amount of the transfer (in foreign currency).

On the first line of the transaction, select the Acct. No. the funds are coming from.

The local Amount is calculated and cannot be changed.

The foreign currency Amount is copied from what you entered above. This can be changed if needed.

Ensure the correct Tax/GST code is selected. Here’s an example transaction:

Click Record.

Entering foreign currency purchases

By turning on the multi-currency preference as described earlier, currency information is available when recording purchases (quotes, orders and bills).

This means you’ll see the purchase value in both local and foreign currencies. The live exchange rate or custom rate set against the currency is used, or you can choose a custom transaction rate.

Only the Item and Service layout is currently supported.

OK, let’s create a foreign currency purchase.

Go to the Purchases command centre and click Enter Purchases.

Click Layout and choose Item or Service.

Professional layout

This layout is coming soon for foreign currency purchases. Until then, you can use the Service layout and add the date to the start of the Description field for each line.

Choose the Purchases Type (Quote, Order or Bill).

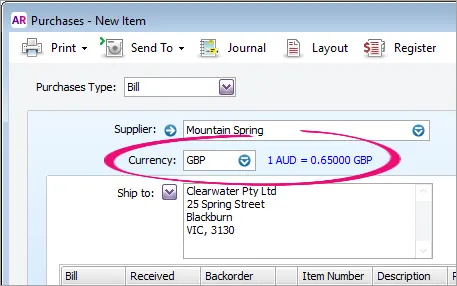

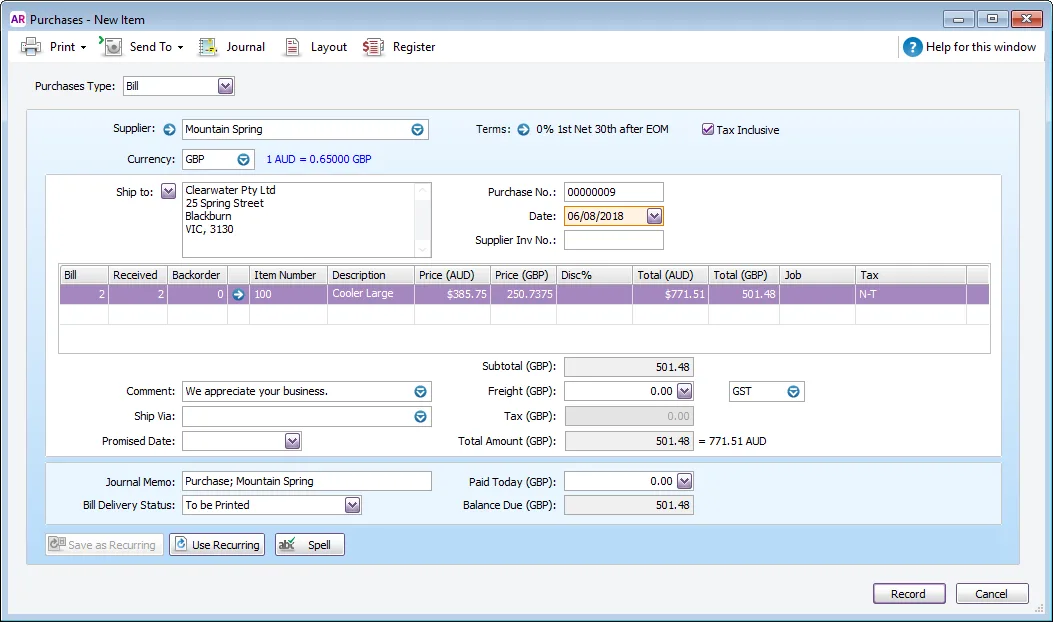

Choose the Supplier. The default currency set in their card is shown. If required, you can click the dropdown arrow to choose a different currency for this purchase.

If required, click the exchange rate to change it. The Currency window appears.

Changing the Default rate will update the rate set against the currency list.

Setting a Custom rate will use that rate for this transaction only.

Enter the details of the purchase.

Only the foreign currency amount can be entered. The local currency amount is calculated for you.

.

Here’s an example:

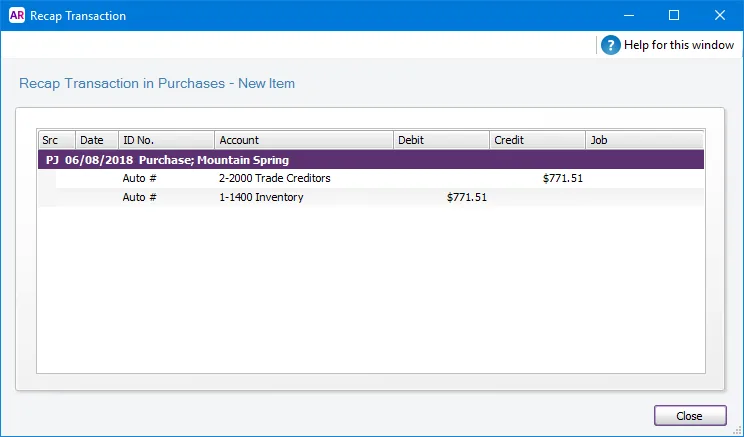

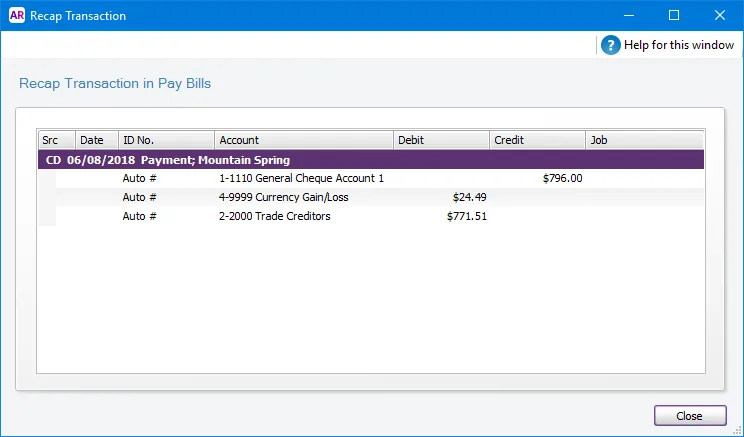

(Optional) Recap the transaction (Edit menu > Recap Transaction) to view journal postings in local currency, then click Close.

Click Record.

The way you change a quote or order into a bill remains the same. Learn more about Changing the purchase type.

Paying foreign currency bills

Paying foreign currency bills is similar to paying other bills, but with some handy extras.

Let’s take a look:

Go to the Purchases command centre and click Pay Bills.

Choose the Pay from Account. This can be a local or foreign currency bank account.

Choose the Supplier. Their open bills are listed.

Bills are grouped by currency (if you’ve recorded bills in multiple currencies).

Click a currency to see those bills - the exchange rate and amounts on the window update accordingly.

The Owed columns and Total Paid field show local and foreign values.

If required, click the exchange rate to change it. The Currency window appears. Changing the rate will result in a realised gain or loss.

Changing the Default rate will update the rate set against the currency.

Setting a Custom rate will use that rate for this bill payment only.

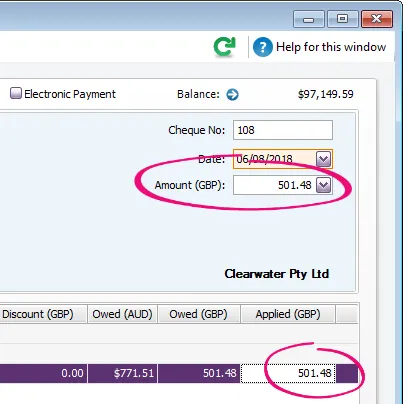

In the Amount field, enter the total foreign currency amount being paid.

In the Applied column, enter how much of the payment you want to apply to each purchase in that currency.

Click Pay All to pay all a supplier’s bills for the same currency. The total payment amount appears in the Amount field and the individual payment amounts are applied to each open purchase in that currency.

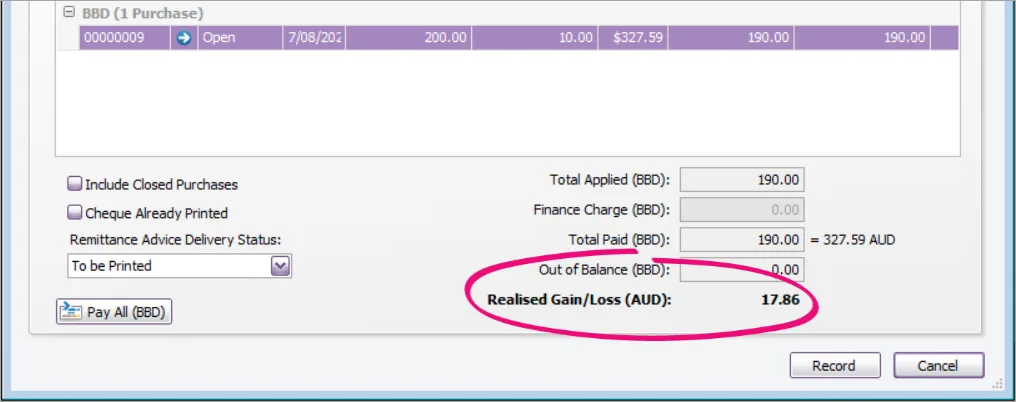

Ensure the Out of Balance is zero. An out of balance will show if the Total Paid and Total Applied fields don’t match. Notice the converted local value is also shown, and any realised gain or loss resulting from any exchange rate changes since the bill was recorded.

Finance Charges can’t be applied to foreign currency transactions. What are your thoughts on this? Let us know on the community forum.

(Optional) Recap the transaction (Edit menu > Recap Transaction) to view journal postings in local currency, including any realised gains or losses. Then click Close.

Click Record.

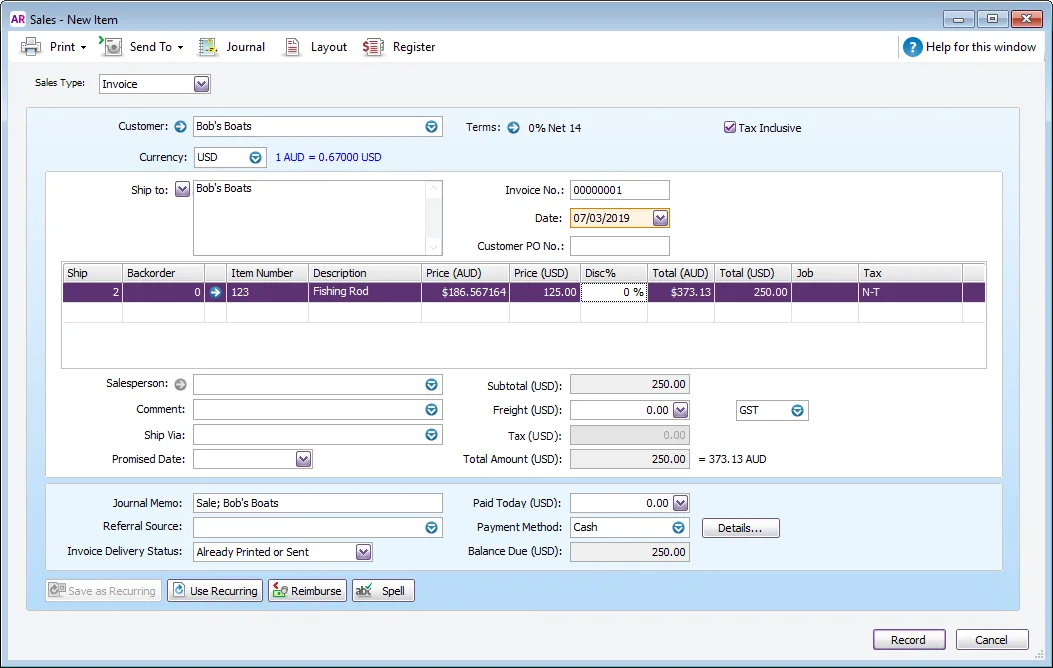

Entering foreign currency sales

By turning on the multi-currency preference as described earlier, currency information is available when recording sales (quotes, orders and invoices).

This means you’ll see the sale value in both local and foreign currencies. The default exchange rate set against the currency is used, or you can choose a custom rate.

Only the Item and Service layout is currently supported.

OK, let’s create a foreign currency sale.

Go to the Sales command centre and click Enter Sales.

Click Layout and choose Item or Service.

Choose the Sales Type (Quote, Order or Invoice).

Choose the Customer. The default currency set in their card is shown. If required, you can click the dropdown arrow () to choose a different currency for this sale.

If required, click the exchange rate to change it. The Currency window appears.

Changing the Default rate will update the rate set against the currency list.

Setting a Custom rate will use that rate for this transaction only.

Enter the details of the sale.

Only the foreign currency amount can be entered. The local currency amount is calculated for you.

Here’s an example:

(Optional) Recap the transaction (Edit menu > Recap Transaction) to view journal postings in local currency, then click Close.

Click Record.

The way you change a quote or order into an invoice remains the same. Learn more about Changing the sale type.

Receiving payments in foreign currencies

Receiving payments in foreign currency is similar to receiving payments in local currencies, but with some handy extras.

Let’s take a look:

Go to the Sales command centre and click Receive Payments.

Choose the Deposit to Account. This can be a local or foreign currency bank or credit card account.

Choose the Customer. Their open invoices are listed.

Invoices are grouped by currency (if you’ve recorded invoices in multiple currencies).

Click a currency to see those invoices - the exchange rate and amounts on the window update accordingly.

The Due columns and Total Received field shows local and foreign values.

If required, click the exchange rate to change it. The Currency window appears. Changing the rate will result in a realised gain or loss.

Changing the Default rate will update the rate set against the currency.

Setting a Custom rate will use that rate for this payment only.

In the Amount field, enter the total foreign currency amount being paid.

In the Applied column, enter how much of the payment you want to apply to each sale in that currency.

Click Receive All to pay all a customer's invoices for the same currency. The total payment amount appears in the Amount field and the individual payment amounts are applied to each open sale in that currency.

Ensure the Out of Balance is zero. An out of balance will show if the Total Applied and Total Received fields don’t match. You'll also see the realised gain or loss resulting from any exchange rate changes since the invoice was recorded.

Finance Charges can’t be applied to foreign currency transactions. What are your thoughts on this? Let us know on the community forum.

(Optional) Recap the transaction (Edit menu > Recap Transaction) to view journal postings in local currency, including any realised gains or losses. Then click Close.

Click Record.

Reporting on foreign currency transactions

We’re still working on adding multi-currency info to AccountRight’s reports. Here are some ways to get information currently.

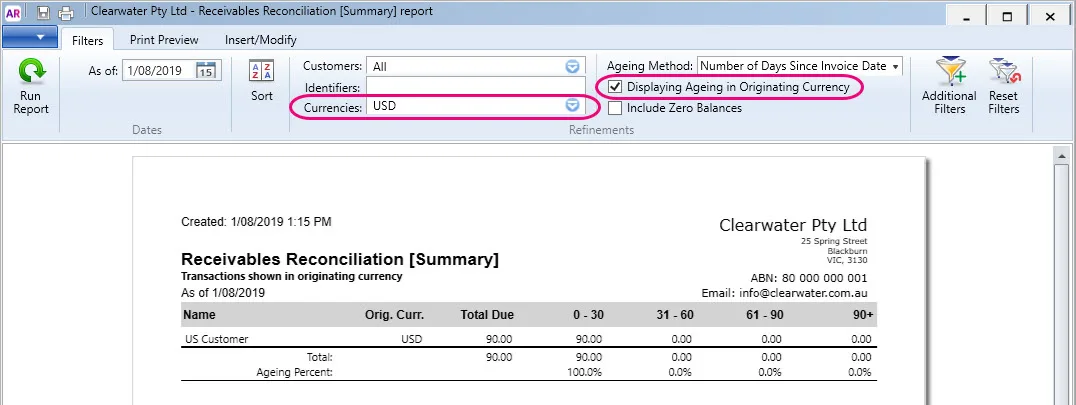

Report on foreign currency receivables

From the Reports menu choose Index to reports.

Click Sales.

Click Receivables Reconciliation [Summary].

Enter the As of date and click Display Report.

Choose the currency.

Select the option Display Ageing in Originating Currency to display foreign currency amounts.

Click Run Report to refresh the report based on the filters.

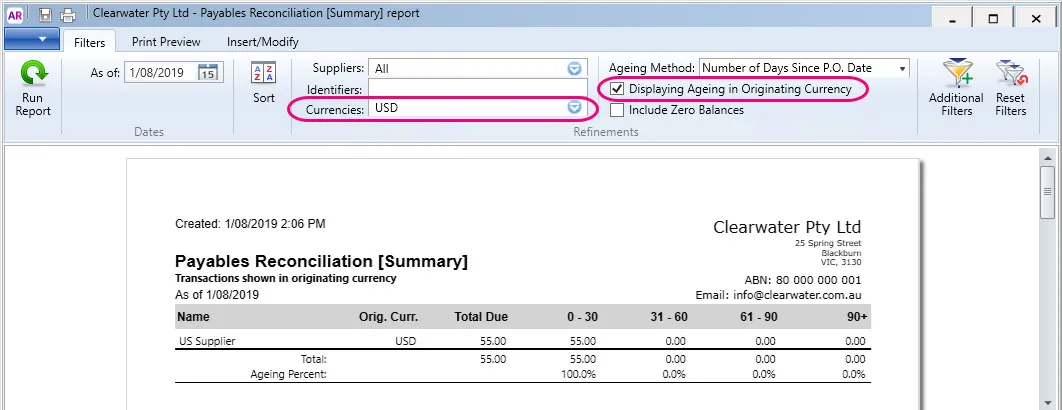

Report on foreign currency payables

From the Reports menu choose Index to reports.

Click Purchases.

Click Payables Reconciliation [Summary].

Enter the As of date and click Display Report.

Choose the currency.

Select the option Display Ageing in Originating Currency to display foreign currency amounts.

Click Run Report to refresh the report based on the filters.

Using the sales / purchases register

We’ve enhanced the Purchases Register and Sales Register to give you some great insights into your multi-currency transactions.

Once you’re in the Purchases/Sales Register (accessible from the Purchases/Sales command centre), here’s just a few things you can do.

Clicking Print from the Purchases/Sales Register will display the Purchases/Sales Register Detail report in local currency values only.

The amount due in local currency is calculated using the exchange rate entered in the Currency List window rather than the transaction rate. This provides a more accurate view of what's owing if paid today.

Try this | Details |

|---|---|

Expand the window to see all columns | We’ve made the Purchases/Sales Register window wider to accommodate the new foreign exchange columns Amount (FX) and Amt Due (FX) . |

Group by currency | Right-click the Currency column and choose Group By This Column .Currencies are then grouped with subtotals. |

Group by multiple levels | Right-click and column heading and choose Show Group By Box. Now drag the columns you want to group by, such as by supplier, then by currency. |

View your realised gains and losses | The Realised G/L column shows any gains or losses (in local currency) resulting from exchange rate changes. Negative values are losses, and positive values are gains. |

Analyse your data further | Copy info from the Purchases/Sales Register to paste into Excel for further analysis. Right-click the list and choose Copy to Clipboard, then paste into Excel. |

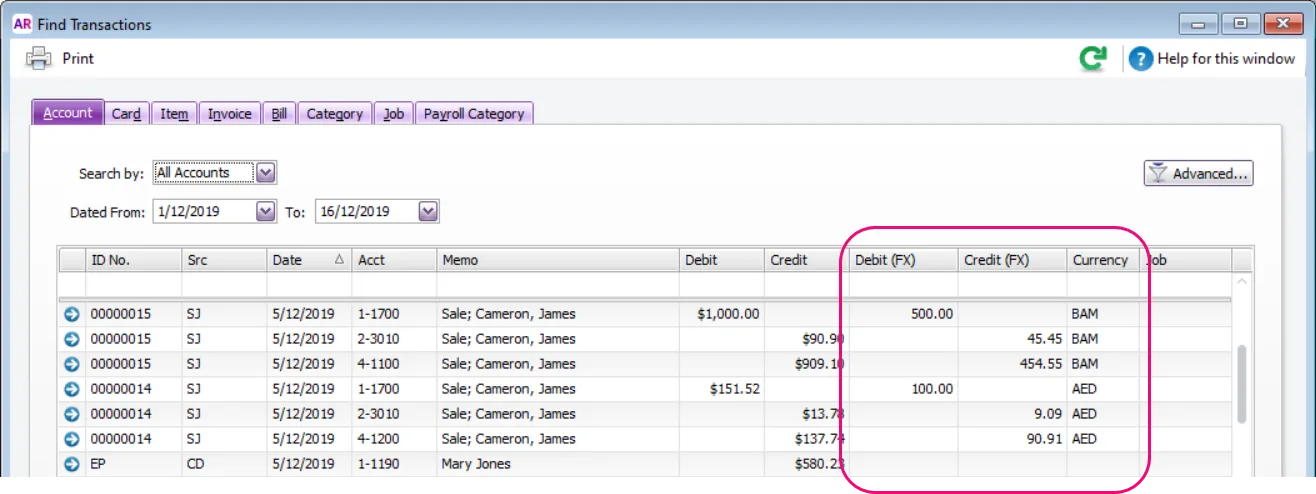

Using the Find Transactions window

On the Find Transactions window, the Account, Invoice and Bill tabs have foreign currency columns to help keep track of your multi-currency values.

You can get here by clicking Find Transactions at the bottom of any command centre.

Once the Find Transactions window shows what you're after, right-click in the window and choose Copy List to Clipboard. You can then paste the data into a spreadsheet to manipulate and display the info however you like.

Foreign customer statements are a great way to report on detailed outstanding invoices from your foreign customers. Learn how to show currency codes on your statements and how to print or email customer statements.

FAQs

What can and can’t be done with multi-currency in AccountRight?

CAN do | CAN’T do |

|---|---|

Create foreign purchases and sales, so it suits both importers and exporters. Track realised gains/losses on payments. Use item and service layouts for quotes, orders, and invoices/bills. Print and email foreign sales orders, purchase orders and remittance advices. Full inventory tracking, including receipting of stock off an order (Receive Items). Set default currencies on supplier cards. Set global exchange rates from the currency list. Set custom exchange rates for a specific transaction. Create and reconcile bank accounts using foreign currencies. Create spend money and receive money transactions using foreign bank accounts. Pay foreign bills and track the realised gain or loss. Upgrade from AccountRight Classic (v19). Show me how. Import purchases, spend money and receive money transactions. Create foreign bank and credit card accounts. Use live exchange rates (2019.2 and later online files only) Create foreign transactions with a tax/GST rate that is higher than 0% (2019.2 and later) Email/print customer statements in foreign currencies (2019.3 and later) Item prices - base selling price is treated as foreign price in multi-currency transactions (2019.3 and later) Use multi-currency endpoints from the AccountRight API to create foreign sales and purchase orders, invoices and bills, and payments of these Record general journal entries in foreign currencies (to bank, credit card, other asset and other liability account types) Send foreign currency remittance advices for pay bills and spend money transactions Choose your own linked account for currency gain and loss from Setup menu > Linked accounts | Use professional or miscellaneous layouts. Create or use recurring transaction templates for foreign transactions Create time billing invoices in foreign currencies Report on outstanding foreign currency balances (unrealised gains/losses) Use multi-currency endpoints from the AccountRight API to create foreign sales/purchase quotes, and sales/purchase returns Set a local currency other than AUD or NZD Export foreign transactions to Excel/CSV Link foreign customer cards to jobs, or use job reimbursable. Import foreign sales from CSV/TXT files |

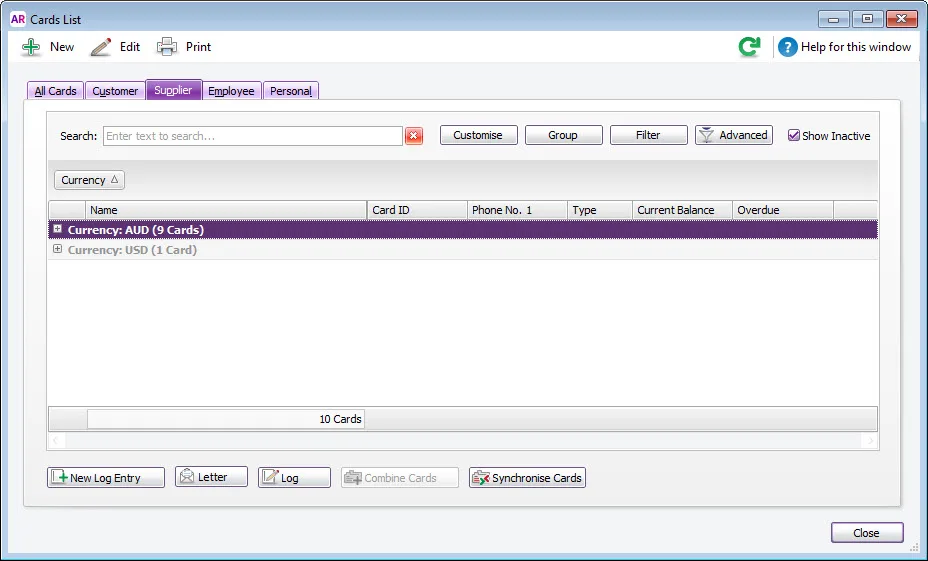

How do I sort my cards by currency?

You can add the Currency column to the Cards List so you can group your suppliers and customers by currency.

Here's how:

Go to the Card File command centre and click Cards List.

Click the Supplier or Customer tab.

Right-click a column heading and choose Column Chooser.

Double-click Currency from the list. The Currency column is added to the list. If you like, click and drag the column heading to move the column to a new position.

Right-click the Currency column heading and choose Group By This Column.

Learn more about searching, filtering and grouping in the Cards List.