Do you provide your employees benefits that the ATO considers 'fringe benefits'? These fringe benefits are reportable if the total taxable value exceeds the threshold set by the ATO.

To tell the ATO about Reportable fringe benefits amounts (RFBA), enter the grossed-up taxable value of those benefits when finalising your employees at the end of the financial year.

To enter RFBA

Go to the Payroll menu and choose Single Touch Payroll reporting.

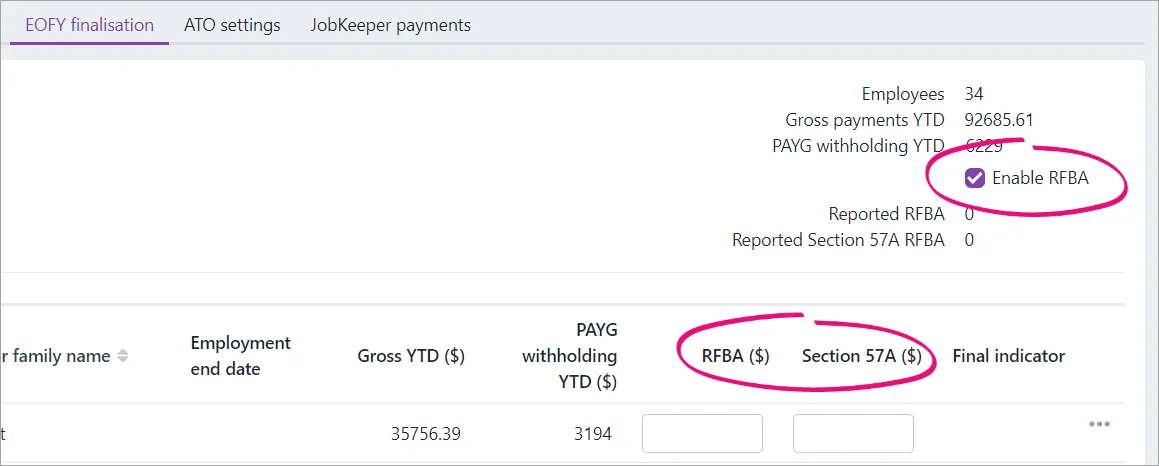

Click the EOFY finalisation tab.

Select the option Enable RFBA. Columns for RFBA ($) and Section 57A ($) appear.

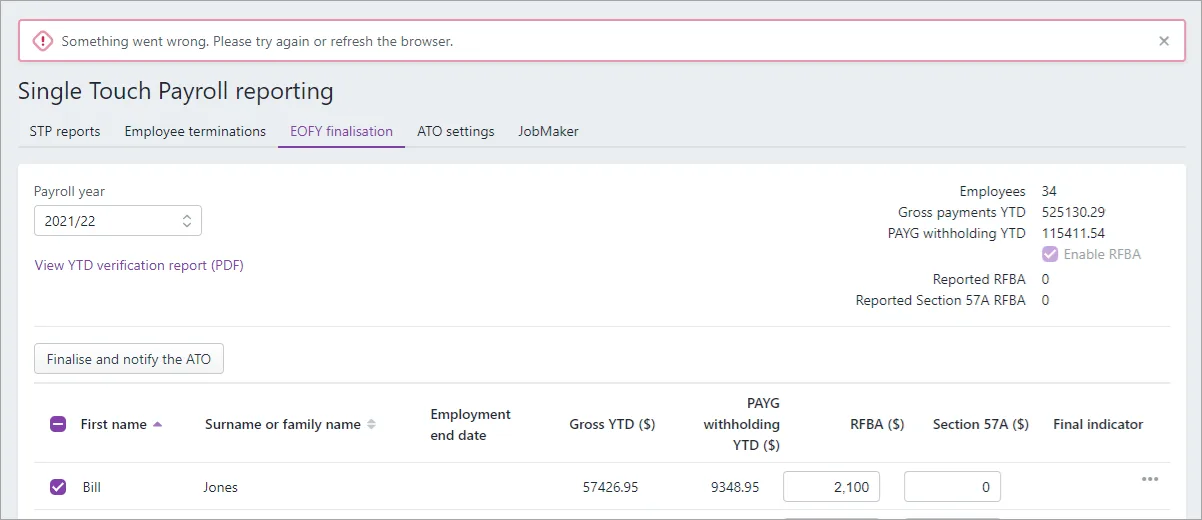

For each employee with fringe benefit amounts, enter the reportable values. The combined value of these must be above the thresholds set by the ATO.

RFBA ($) - these are reportable fringe benefit amounts

Section 57A ($) - these are fringe benefit amounts exempt from FBT under section 57A (see the FAQ below for details).

Select each employee you want to finalise, then click Finalise and notify the ATO.

When prompted to send your payroll information to the ATO, enter your details and click Send.

FAQs

Why am I getting the error "Something went wrong" when entering RFBA amounts?

This error can occur if the RFBA amount you're reporting is below the ATO's threshold. Make sure the combined value of an employee's RFBA is above the thresholds set by the ATO.

If unsure what to report, check with your accounting advisor or the ATO.

How do I enter reportable benefits covered by Section 57A of the FBTAA 1986?

If Section 57A of the Fringe Benefits Tax Assessment Act 1986 applies to you, you can report this to the ATO via Single Touch Payroll reporting.

Affected businesses are mainly not-for-profit organisations, such as public benevolent institutions, health promotion charities, some hospitals and public ambulance services.

If Section 57A applies, you need to report the benefits that fall under that section in the Section 57A ($) field, and show other reportable fringe benefits provided to the employees in the RFBA ($) field.

These don't need to be reported separately.