There's a few reasons why you might need to reverse and reprocess a payment made using Pay Super, like a payment being returned from a super fund.

If you've received an email from the Pay Super Team, it will detail why you need to reverse and reprocess a super payment. Otherwise you can contact the super fund for more details.

Check employee and fund details

If a super contribution was returned because of incorrect employee or super fund details, update these details in MYOB. You might need to confirm some details with the employee or their superannuation fund. Find out how to update employee details or update super fund details.

1. Record the returned super

The returned super contribution will be deposited into the bank account it was paid from. If you use bank feeds on this account, you can allocate this deposit to your superannuation payable account.

Or you can record the payment in MYOB using a receive money transaction.

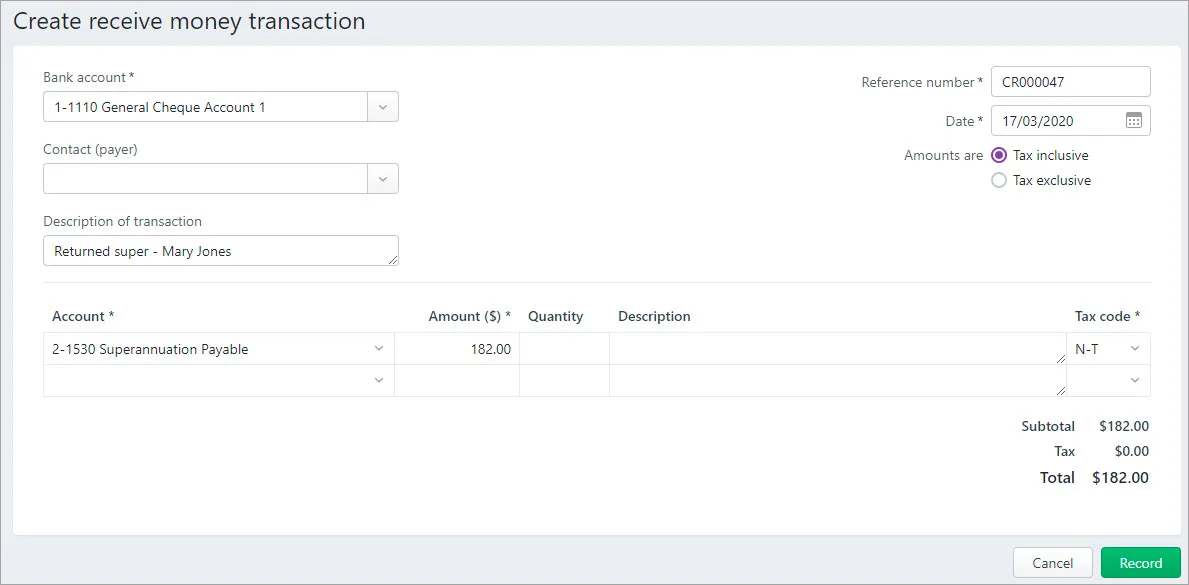

Go to the Banking menu and choose Receive money.

For the Bank account, choose the account the super contribution was returned into.

Enter a Description of transaction that best describes this entry.

For the Account, choose your Superannuation Payable account.

For the Amount ($), enter the amount of returned super.

When you're done, click Record.

Here's our example:

If the returned super contributions subsequently come into MYOB in a bank feed transaction, you can match it to this receive money transaction.

2. Record a pay to reverse the super

You now need to adjust the employee's pay to reflect the returned super. This will update the required superannuation accounts in MYOB, and send an update to the ATO for Single Touch Payroll reporting.

Here's what to do:

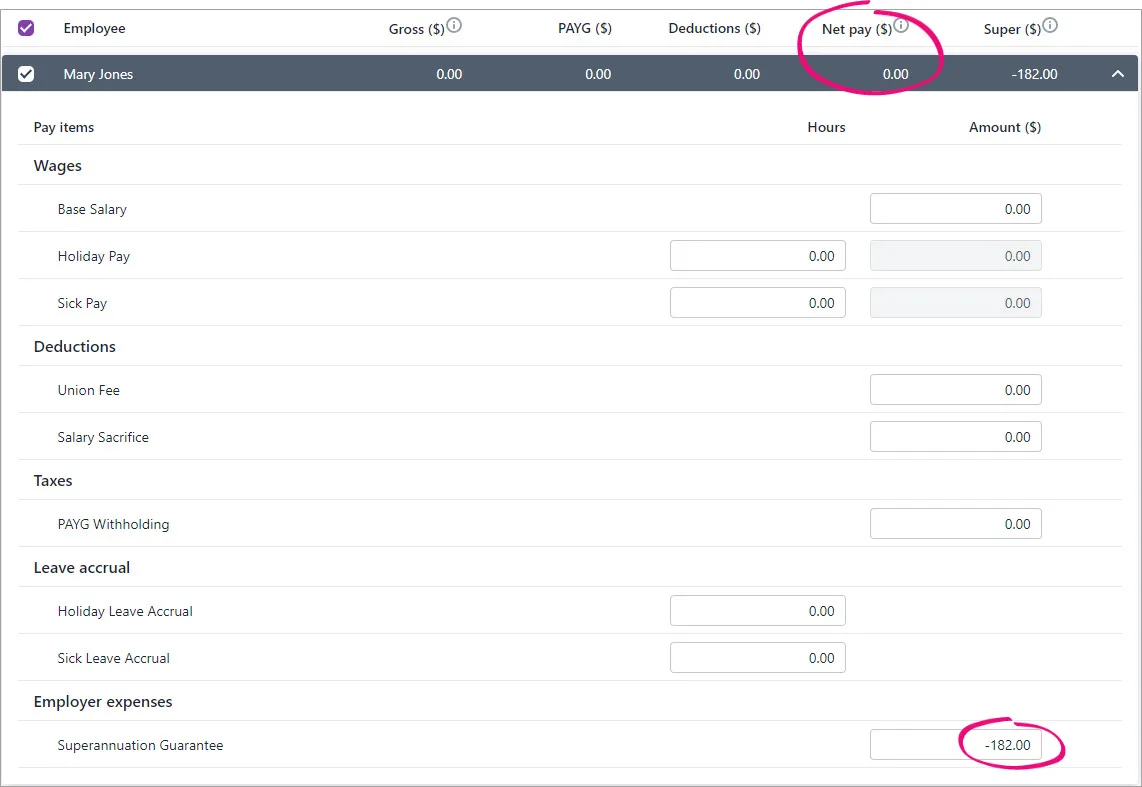

Go to the Payroll menu and choose Create pay run.

Choose the Pay cycle for the employee(s) whose super has been returned.

For the pay period dates, choose dates that include the date the super was returned.

Click Next.

Click the dropdown arrow for the employee whose super contribution has been returned.

Enter 0.00 for all hours and amounts in the pay. This ensures no amounts are paid and no leave is accrued.

In the Superannuation Guarantee field, enter the value of this employee's returned super as a negative number. The Net pay will be zero.

Here's our example:

Repeat steps 5-7 for any other employees whose super contribution has been returned.

Finish processing the pays as normal, including sending the payroll information to the ATO (for Single Touch Payroll reporting).

You can now reprocess the super payment as described in the next task.

3. Record a pay to reprocess the super

Before reprocessing any super payments, fix whatever it was that caused the contribution to be returned. This might mean updating employee details or updating super fund details.

You'll then be able to record a pay to reprocess the super payment. This will make it available to send to the super fund.

Here's how:

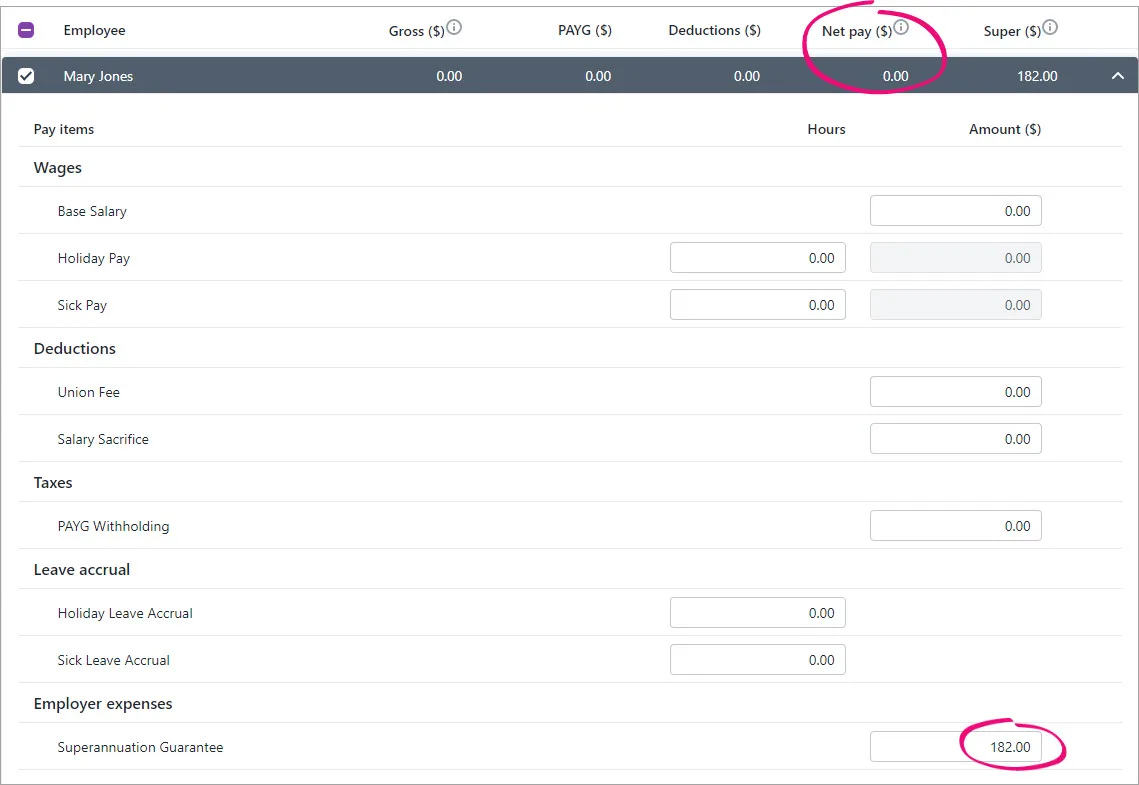

Go to the Payroll menu and choose Create pay run.

Choose the Pay cycle for the employee(s) whose super has been returned.

Choose the pay period dates to include the date the super was returned.

Click Next.

Click the dropdown arrow for the employee whose super contribution is to be reprocessed.

Enter 0.00 for all hours and amounts in the pay. This ensures no amounts are paid and no leave is accrued.

In the Superannuation Guarantee field, enter the superannuation amount to be reprocessed (as a positive number). The Net pay will be zero.

Here's our example:

Repeat steps 5-7 for any other employees whose super contribution needs to be reprocessed.

Finish processing the pays as normal, including sending the payroll information to the ATO (for Single Touch Payroll reporting).

You can now pay and authorise these reprocessed super contributions, including the negative ones from the previous task, through Pay Super (Payroll menu > Super payments). Need a refresher?

Still need help?

Contact our support team and we'll be happy to help.