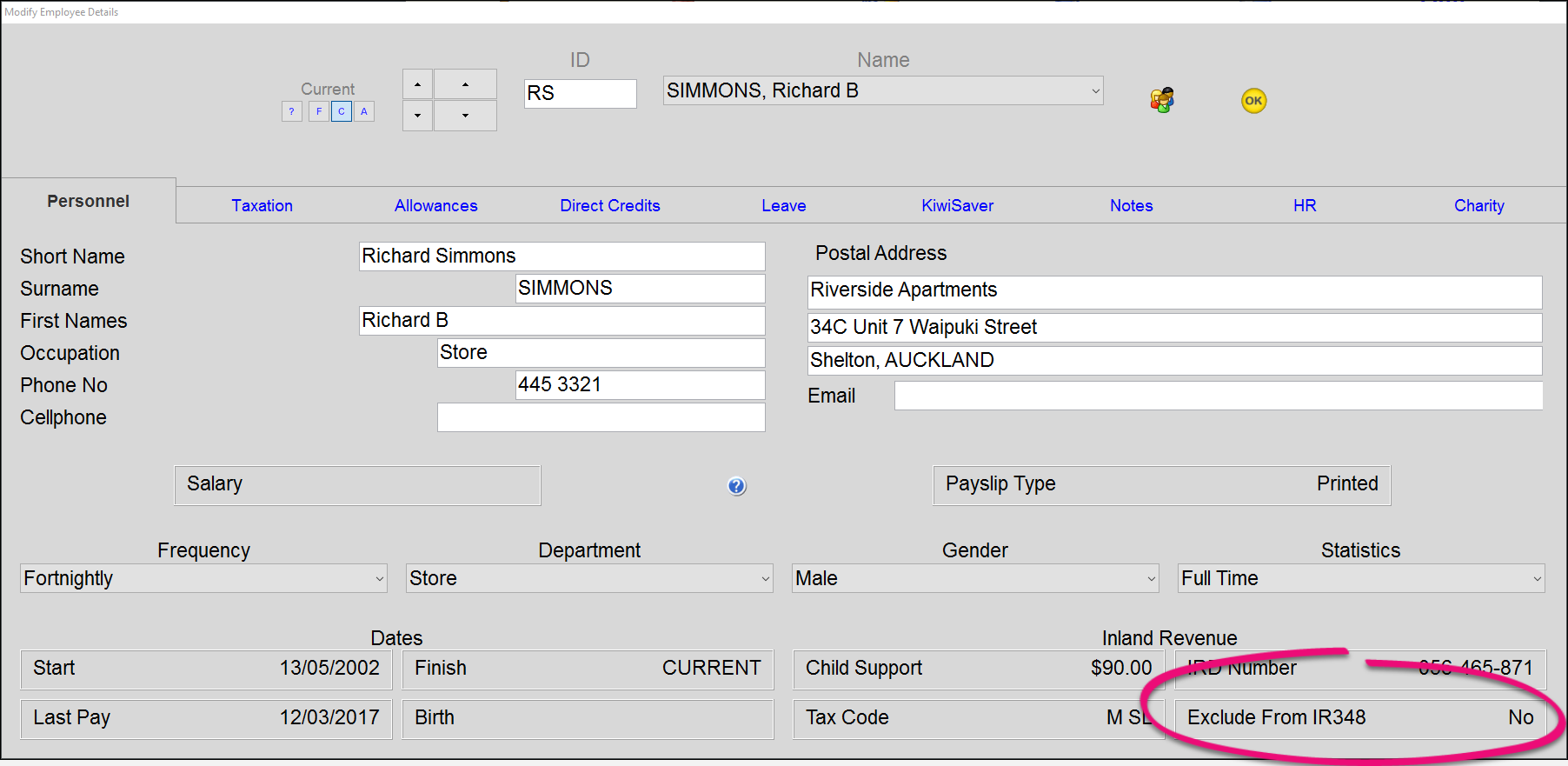

Exclude an employee from the IR348 Employer Monthly Schedule

From 1 April 2019, employers must report employee info to the IRD every payday via payday filing, instead of filing an IR348. The information on this page only applies before 1 April 2019.

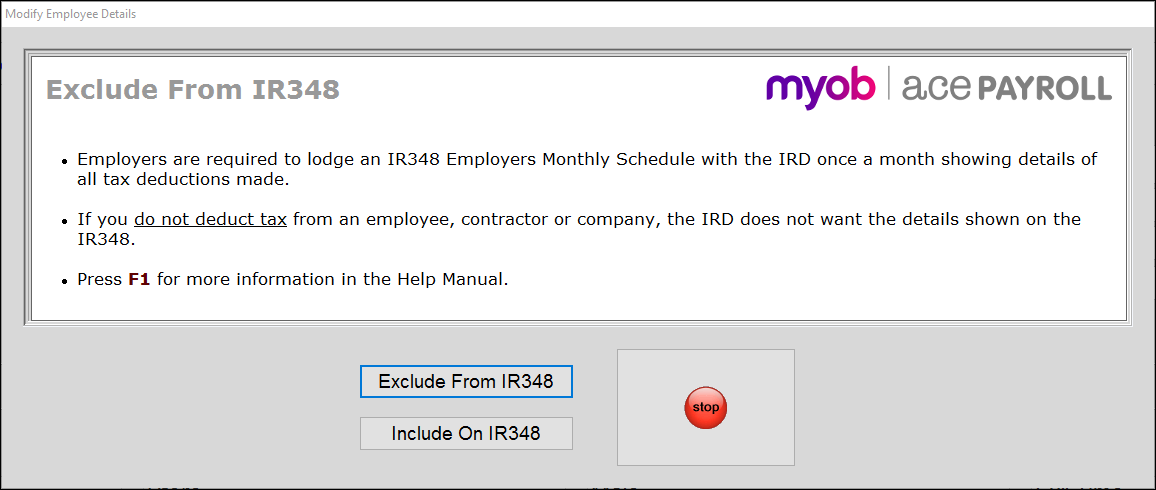

Employers are required to lodge an IR348 Employers Monthly Schedule with Inland Revenue once a month, showing details of all tax deductions made.

If you do not deduct tax from an employee, contractor or company, the IRD does not want their details shown on the IR348.

Contractors or Companies

If you deduct withholding tax from a contractor or company, then the contractor or company must be shown on the IR348. If no withholding tax is deducted, the contractor or company is to be excluded from the IR348.

Directors Drawings

Some clients use Ace Payroll to regularly transfer money to a director by way of drawings, with no tax deducted. In these cases the director takes responsibility for paying their own tax using the provisional tax system. If no tax is deducted, then the director's drawings are not to be shown on the IR348.

Note that some company directors prefer their drawings to be taxed at the source, using the PAYE system. If tax is deducted in this manner, then the payments to the director are required to be shown on the IR348.