COVID-19 wage subsidy payments

The New Zealand Government has some business support payments to help pay staff during the COVID-19 pandemic.

For details of available payments and eligibility criteria, visit business.govt.nz

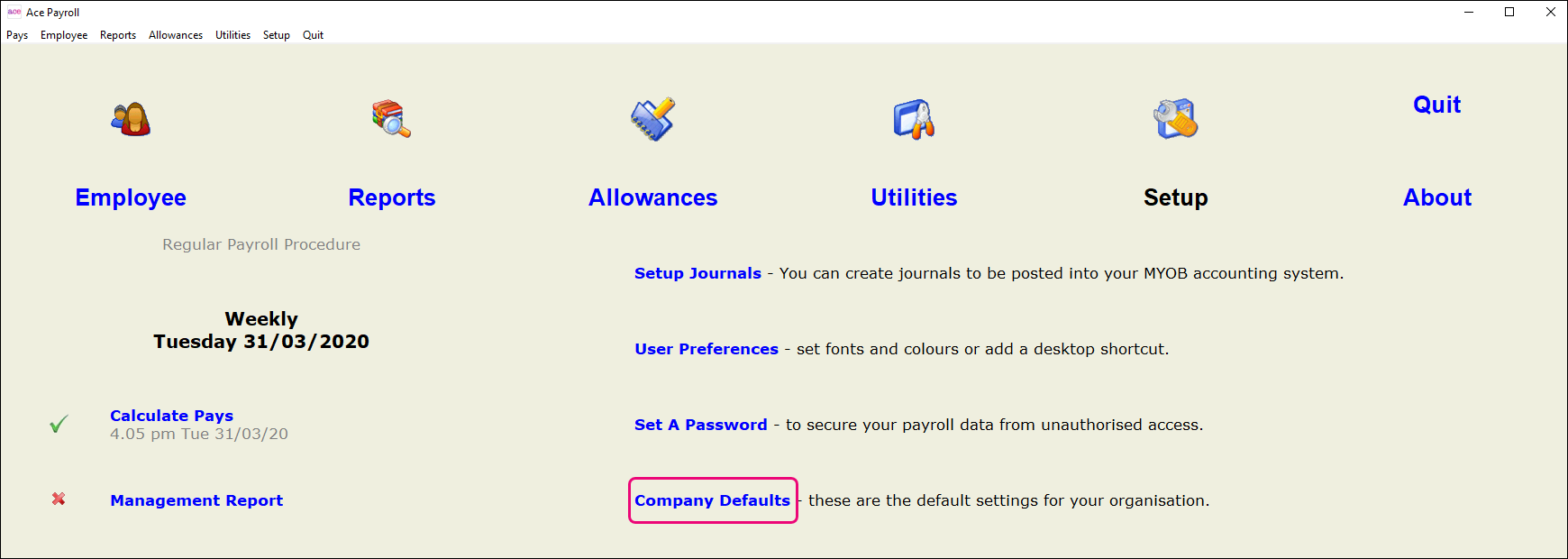

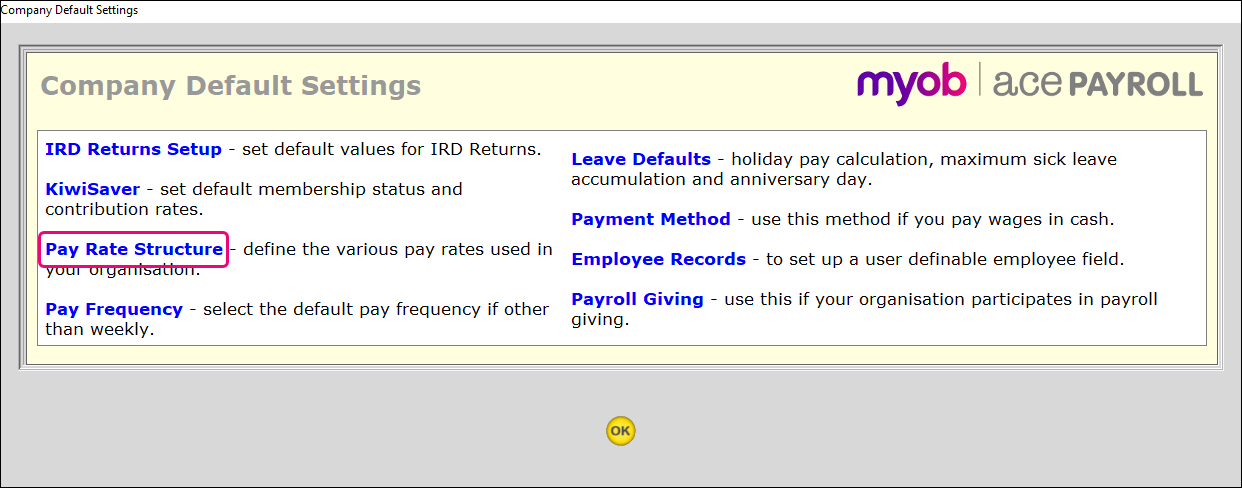

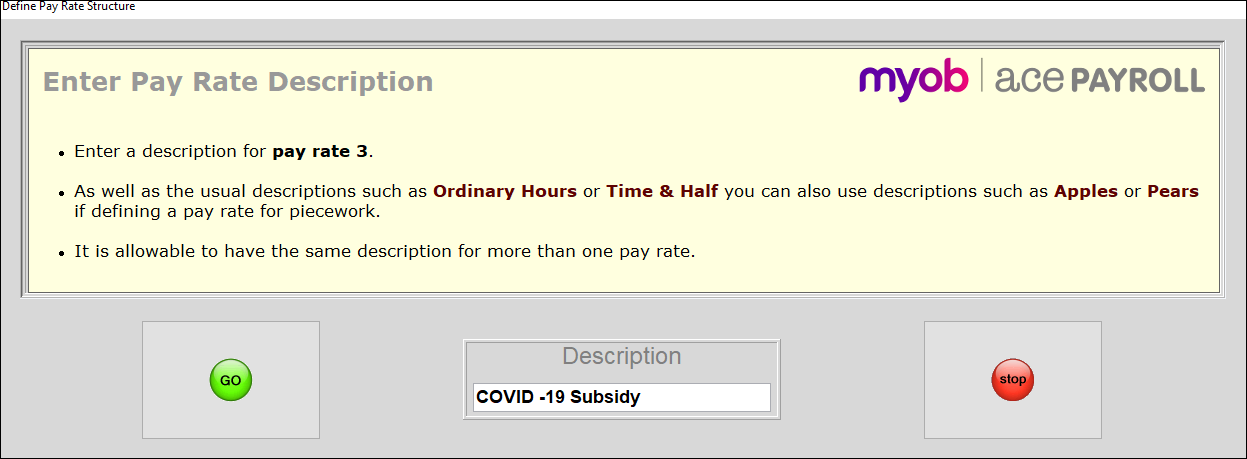

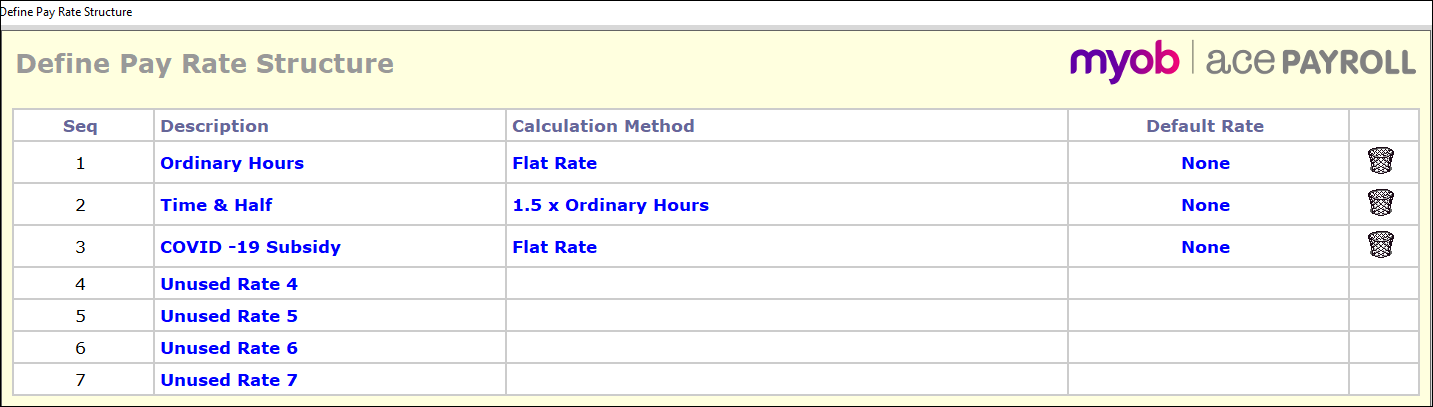

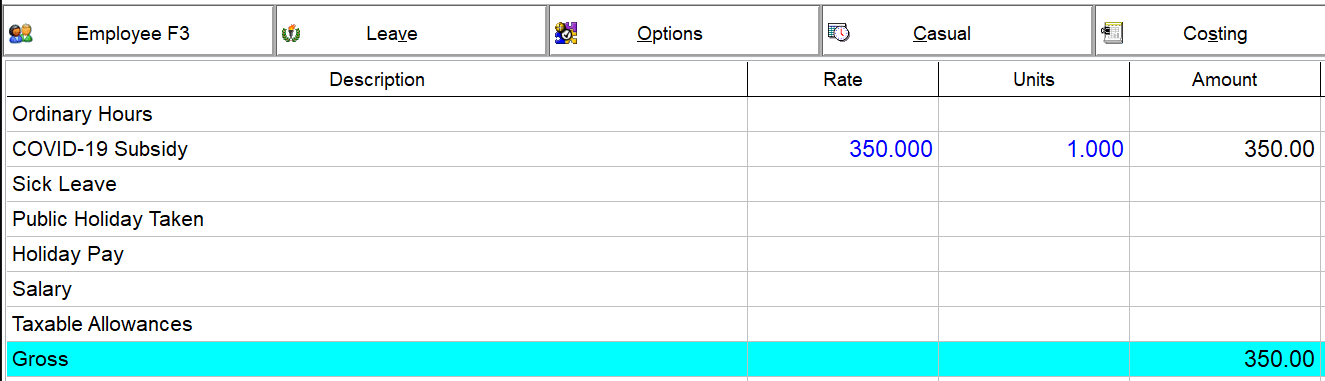

If your business is eligible for any wage subsidy payments, we recommend setting up a COVID-19 pay rate structure to make those payments to the affected employees.