When you're setting up leave you might be prompted to link a wage pay item or check your exemptions.

Let's take a look at what these mean.

Linking a wage pay item

To ensure leave is paid and accrued correctly, you need:

a wage pay item – this is used to pay the leave

a leave pay item – this is used to work out how the leave accrues and updates leave balances when leave is taken.

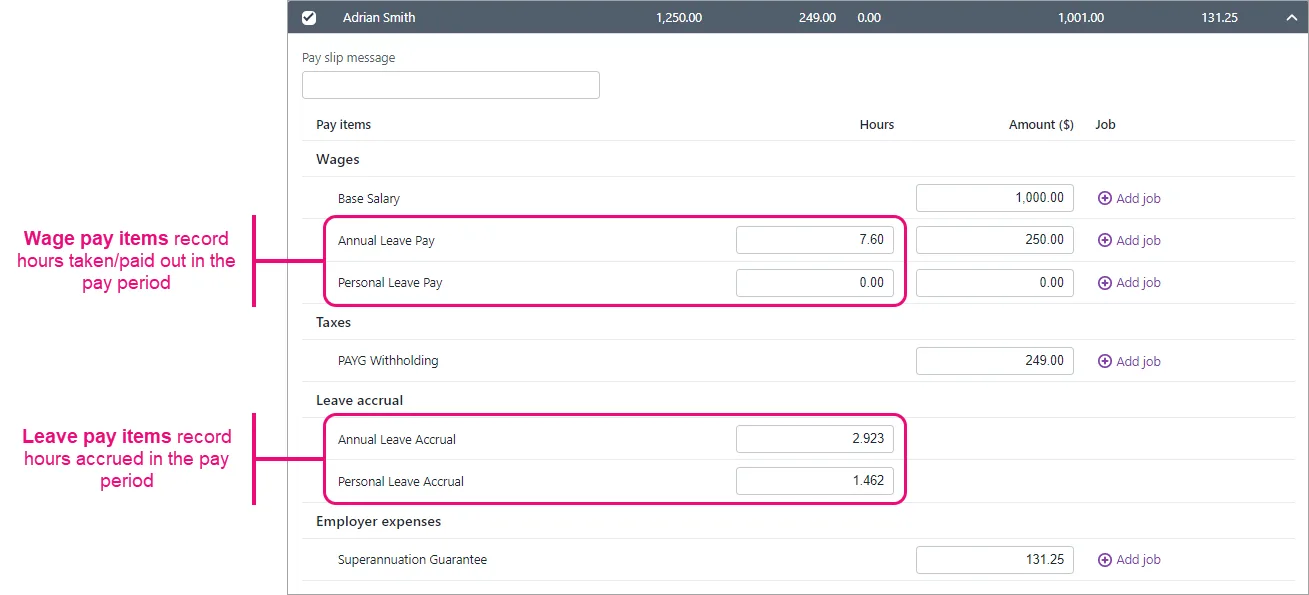

Here's an example pay that shows the wage pay item being used to pay 7.6 hours of annual leave. It also shows how the leave pay item automatically calculates how much annual leave is being accrued on this pay.

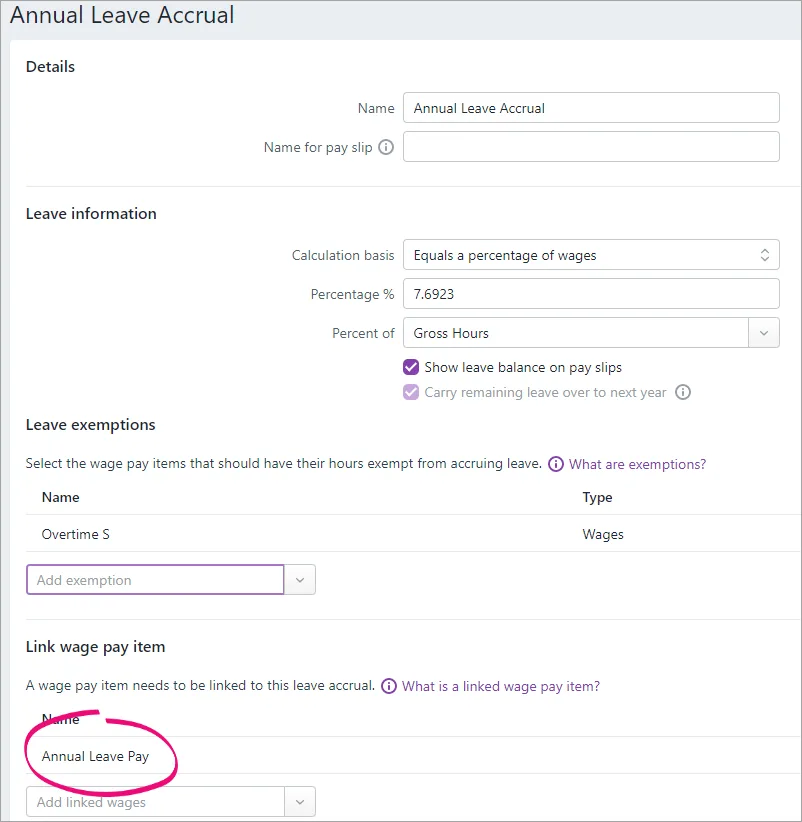

To ensure the wage and leave pay items work together, you need to link them when you set up the leave pay item. This tells MYOB that when you use that linked wage pay item, for example to pay annual leave, the employee's leave balance will be adjusted accordingly.

Here's an example of the Annual Leave Accrual leave pay item that's linked to the Annual Leave Pay wage pay item.

Link at least one wage pay item

There might be cases where you need to link more than one wage pay item to a leave pay item. For example if you have separate wage pay items for "Personal Leave - With Certificate" and "Personal Leave - Without Certificate", these would both be linked to the personal leave pay item.

Adding exemptions

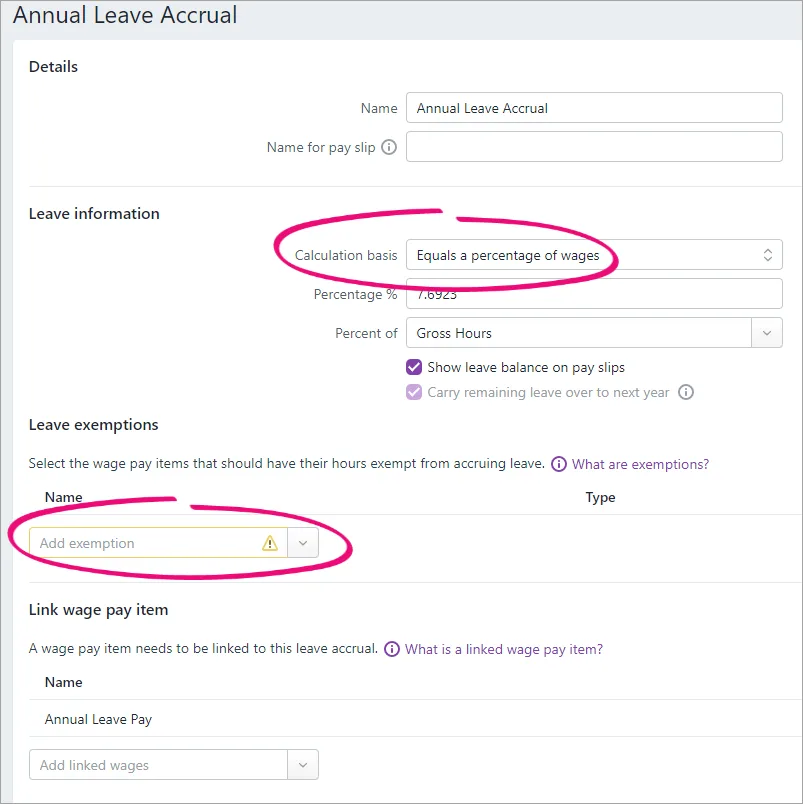

If the Calculation basis in a leave pay item is set to Equals a percentage of wages, the Add exemption dropdown button is enabled.

This allows you to choose any hourly-based wage pay items that should be exempt (not included) in the leave accrual calculation.

For example, to prevent annual leave from accruing on overtime hours, you'd click the Add exemption dropdown arrow in the annual leave pay item and choose the overtime wage pay items.

Similarly, to prevent annual leave from accruing on holiday leave loading hours, you'd click the Add exemption dropdown arrow in the annual leave pay item and choose the holiday leave loading wage pay item.

If you're not sure what (if anything) should be exempted from leave calculations, check with your accounting advisor.

If you don't exempt any wage pay items, that type of leave will calculate (accrue) on all hourly wage pay items that you use.