Here you'll find answers to some common questions about activity statements, whether you're yet to move from lodging activity statements in MYOB AE/AO, or you're already preparing activity statements in MYOB Practice.

MYOB AE/AO activity statement support is ending

You can't use AE/AO to create new activity statements as of version 2024.0 available at the end of June 2024.

You can use AE/AO to work on and lodge existing activity statements and amend lodged activity statements, up to 30 September 2024.

After this time, you'll need to use MYOB Practice to create and lodge activity statements. But you don't have to wait! You can start using MYOB Practice for activity statements now.

For more on this change, see the FAQs below. Or learn about the benefits of, and get started with, activity statements in MYOB Practice.

Moving your activity statement workflow to MYOB Practice

Why do I need to move my activity statement workflow to MYOB Practice?

From June and September 2024, activity statement functionality will stop working in MYOB AE/AO (see the note at the top of this page).

Working with activity statements in MYOB Practice is fast and secure:

Auto-create activity statements using ATO reports.

Import from MYOB Business or AccountRight ledger.

Automatically add the assigned agent and client for new activity statements.

Send documents to clients and get signatures from my clients.

Easily find information in BAS forms.

Simple workflows make it easier to create, manage and lodge activity statements online.

What is MYOB Practice?

MYOB Practice is a smart set of collaboration tools that help you work closely with your clients. Learn more about MYOB Practice.

How do I move to MYOB Practice for activity statements?

If you've got access to MYOB Practice, you've got access to activity statements! Get started with activity statements in MYOB Practice.

Also check out the change management guide for tips on transitioning your practice from activity statements in MYOB AE/AO to MYOB Practice.

Will I still be able to create and lodge other tax return types in AE/AO?

Only activity statements are affected. Creating and lodging all other tax return types will continue to work as normal without disruption.

What happens to all my data in AE/AO Tax and activity statements?

Data related to previously lodged or in-progress BAS will remain in AE/AO, as will all tax data.

You can view and print out previously lodged activity statements in MYOB AE/AO.

What if I don’t move to activity statements in MYOB Practice or upgrade to 2024.0?

You won't be able to create new activity statements in AE/AO as of version 2024.0, available at the end of June 2024. You'll be able to amend previously lodged activity statements until 30 September 2024. After this date, you won't be able to create or lodge activity statements in AE/AO, regardless of whether you install 2024.0.

You'll need to install 2024.0 to get all the other tax updates. If you don’t install 2024.0, you won't be able to create or lodge 2024 income tax returns.

What if I lose internet connection?

Being browser based means MYOB Practice securely stores your work in the cloud.

While you're connected to the internet, your work is automatically saved as you make changes.

If your internet connection drops out, the data you entered while connected to the internet remains safe, and you'll be able to access it again once your connection's restored.

If you're not connected to the internet, your changes aren't being saved and you may need to make your changes again.

Where do I manage my clients contact details if I’m using MYOB Practice and MYOB AE/AO?

There's no change to how you manage your client contact details. Contact details are synced from AE/AO to MYOB Practice.

Where can I find out more about activity statements in MYOB Practice?

Working with activity statements in MYOB Practice

How do I create new activity statements?

You can create an activity statement in 2 ways:

Are new activity statements going to be pre-filled with underlying ledger data?

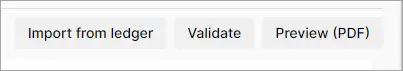

Yes, with activity statements in MYOB Practice, you have the option to import data from the underlying ledger into the activity statement form for MYOB Business and AccountRight Live files.

Can I delete an activity statement?

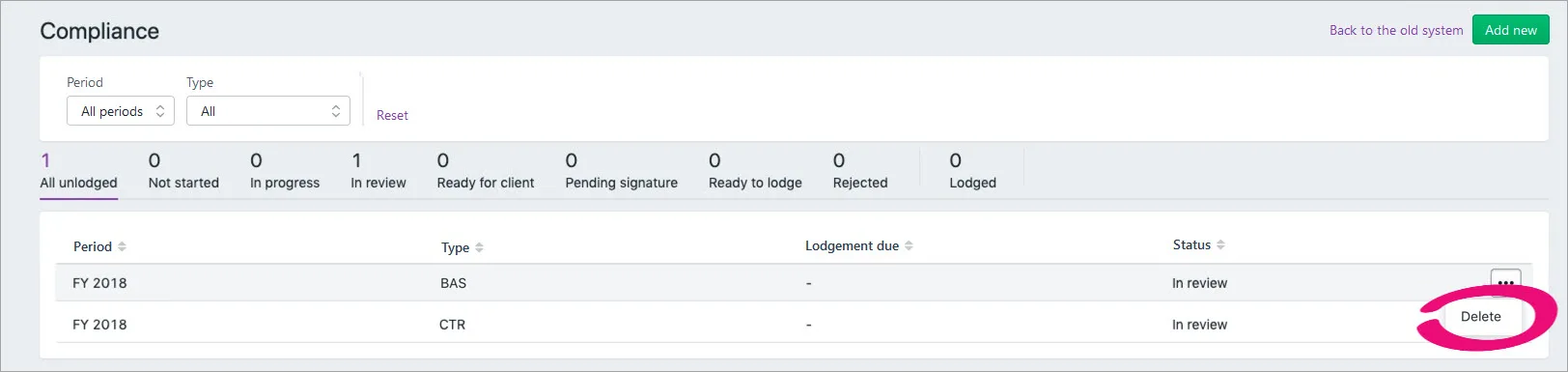

You can now delete In progress or In review activity statements from the Compliance listing (from the All Clients view or once you've selected the client). Find the BAS you’d like to delete in the list, click the ellipsis icon (...) and then select Delete.

Can I revise activity statements?

Yes, you can revise an activity statement in MYOB Practice.

If I complete an activity statement in MYOB Practice, does it integrate the status into AE/AO?

Activity statements prepared in MYOB Practice do not integrate into AE/AO.

There are additional advantages to preparing activity statements in MYOB Practice, with less data entry as it is pre-filled from ATO and you can also import GST return summary from an MYOB Business or AccountRight ledger.

Is there a report that shows the clients who don't have BAS agent assigned?

No, we don't have a report or filter that shows a list of clients who don't have a BAS agent attached.

Does it cost me extra to use the activity statements online?

No, there is no extra cost. Simply, start using the activity statements online and enjoy the benefits of a streamlined online experience.

Security

Can I restrict people in my practice from seeing certain activity statements?

MYOB Practice uses the client access permissions from MYOB AE/AO. If you've already set up these permissions in AE/AO, you don't need to do anything to enable them in MYOB Practice.

Where can I find out more about security of activity statements in MYOB Practice?

MYOB takes data security seriously. To learn more about our standards and practices, see the MYOB Trust Centre.

Need more help?

Can't find what you're looking for? You can also ask questions on the MYOB Community Forum or contact our support team.