AccountRight Plus and Premier only

When you finalise an employee, you're telling the ATO that your payroll reporting is complete for the payroll year and that the employee can now complete their tax return.

To change an employee's pay after finalising, you need to indicate this to the ATO by undoing the finalisation. Once you've made your changes – and updated the ATO about them – you can finalise again.

You might do this to:

fix a pay from a finalised payroll year

prevent an employee completing their tax return while you investigate an issue

update payroll or ATO reporting categories.

Am I reporting via STP Phase 2?

You can check in the STP reporting centre (Payroll command centre > Payroll reporting > Payroll Reporting Centre). If you don't see this label, you're on STP Phase 1. How do I get ready for STP Phase 2

To change a pay after finalising via STP Phase 1

Step 1: Remove the employee's finalisation

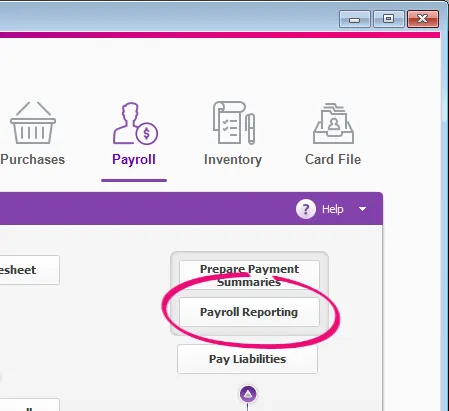

Go to the Payroll command centre and click Payroll Reporting.

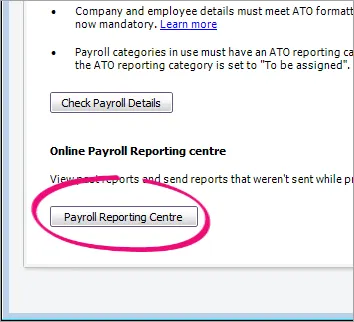

Click Payroll Reporting Centre.

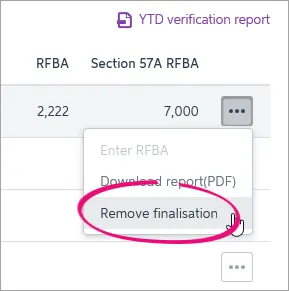

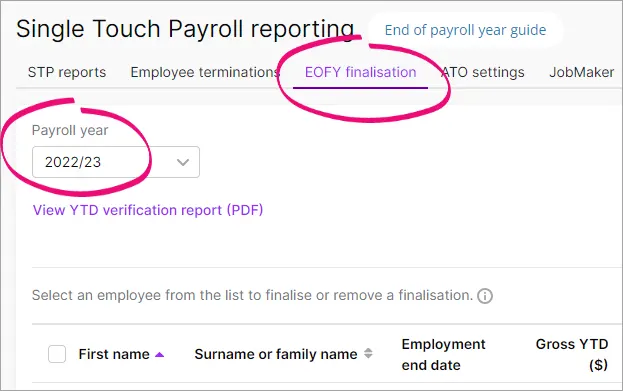

Click the EOFY Finalisation tab.

Click the ellipsis ( ) button for the employee to be unfinalised and choose Remove finalisation. This option is only available if the employee has been finalised.

Step 2: Enter an adjustment pay and update the ATO

Start a new pay run for the employee and enter the adjustment by increasing, entering negative amounts or zeroing out the relevant Amounts or Hours.

There's a lot that you may need to change depending on your scenario, such as pay amounts, payroll categories, superannuation and leave accruals. We can't cover all these specific situations, but see below for the basic steps to enter a pay adjustment.

By recording this pay, you'll be able to send the pay details to the ATO.

Go to the Payroll command centre and click Process Payroll. The Process Payroll window appears.

Select the option Process all employees paid.

Choose Bonus/Commission from the drop down.

In the Payment Date field, enter a date that falls within the payroll year you're adjusting.

Enter a pay date range in the Pay period start and Pay period end fields. This should be for the pay period you're adjusting.

Click Next. The Select and Edit Employees Pay window appears.

Select the employee that the adjustment is for.

Click the arrow in the Edit column next to the employee's name. The Pay Employee window appears.

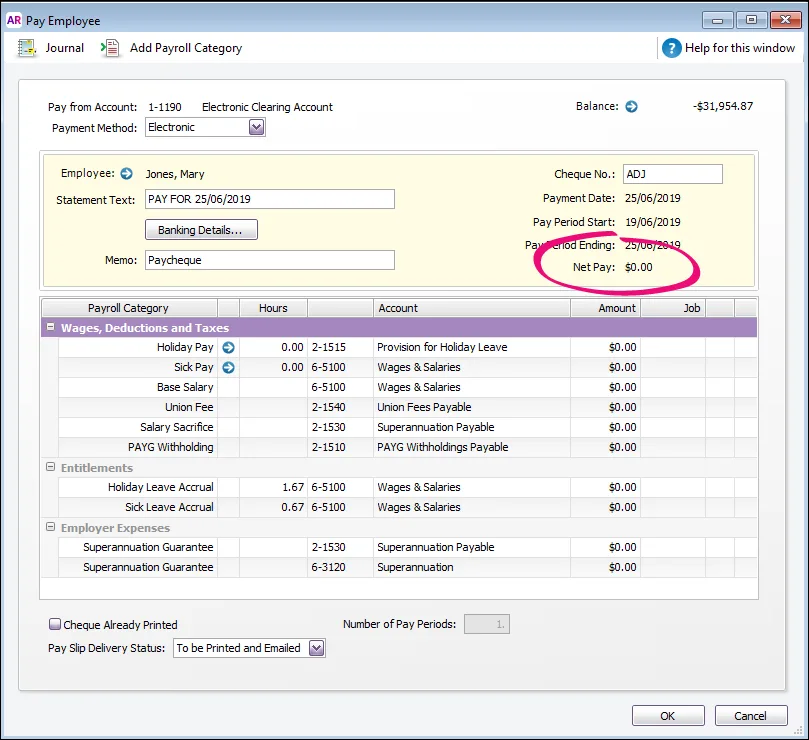

Type a reference in the Cheque number field to show it is an adjustment, for example ADJ.

If you want to provide additional information, enter a description of the adjustment in the Memo field.

The next step depends on the nature of the adjustment. If you're:

Not changing the dollar amount that has been reported to the ATO, delete all amounts shown in the window. You need to do this so you don't re-record any pay amounts for the period, other than the adjustment.

Correcting an overpayment, enter a negative (-) amount in the Hours or Amount column of the category that was overpaid:

Correcting an underpayment, increase the Amount or Hours of the wage category that was underpaid:

For more examples of pay adjustments, see Fixing a payroll overpayment or underpayment.

Continue to follow the onscreen instructions to record the pay. When prompted to send your payroll information to the ATO, enter your details and click Send.

Click Next.

Click Finish to close the Process Payroll Assistant.

Step 3: Re-finalise the employee

When you're done, you need to finalise your employee again.

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

Click the EOFY Finalisation tab and choose the Payroll year you're finalising.

If you need to report fringe benefits for an employee (what is this?):

Click the ellipsis ( ) button for the employee and choose Enter RFBA.

Enter in both the:

Reportable fringe benefits amount $

Reportable fringe benefits amount exempt from FBT under section 57A $

The combined value of these must be above the thresholds set by the ATO.

Click Add amounts.

Select the employee you want to finalise, then click Set as Final.

Enter the name of the Authorised sender and click Send.

The employee is now finalised again.

To change a pay after finalising via STP Phase 2

Step 1: Remove the employee's finalisation

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in using MYOB account details (email address and password).

Click the EOFY finalisation tab.

Choose the Payroll year.

Select the employee whose finalsation you want to undo.

Click Remove finalisation and notify the ATO.

When prompted to send your payroll information to the ATO, enter your details and click Send. The Final indicator tick is removed for the employee. If it's still there, click a different tab then return to the EOFY finalisation tab.

When you're ready, you can finalise the employee again.

Step 2: Enter an adjustment pay and update the ATO

There's a lot that you may need to change depending on your scenario, such as pay amounts, payroll categories, superannuation and leave accruals. We can't cover all these specific situations, but for details see Changing a recorded pay or Fixing a payroll overpayment or underpayment.

If you need to reverse an employee's pay, you'll be prompted to report that reversal to the ATO. But if the change you make doesn't affect the amounts you've paid an employee, you can send an update event to the ATO. This is a way of ensuring the ATO has the latest year to dat payroll information for the employee.

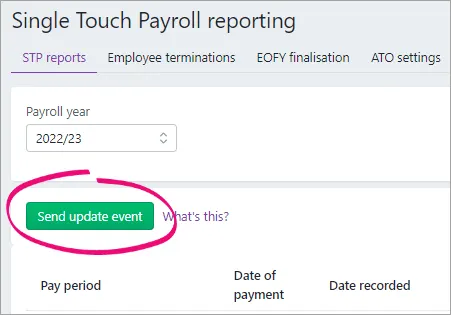

To send an update event

Go to the Payroll command centre > Payroll Reporting > Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password).

Click the STP reports tab.

Choose the applicable Payroll year.

Click Send update event.

When prompted, enter your details and click Send. The latest year to date payroll amounts for all employees you've paid in the chosen payroll year are sent to the ATO.

This update event will be listed with your other STP reports where you can check its status.

Step 3: Re-finalise the employee

When you're done, you need to finalise your employee again.

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password)

Click the EOFY finalisation tab and choose the Payroll year you're finalising.

If you need to report fringe benefits for an employee (what is this?):

Select the option Enable RFBA.

For each applicable employee, enter values for both:

RFBA ($)

Section 57A $

The combined value of these must be above the thresholds set by the ATO.

Select each employee you want to finalise, then click Finalise and notify the ATO.

When prompted to send your payroll information to the ATO, enter your details and click Send.

The employee is now finalised again.