Key points

-

You can pre-fill from the tax year 2020 onwards for an individual tax return.

-

Tax returns that are created after 1 December 2023 can prefilled multiple times. The Pre-fill from ATO button will always be active. For returns created before 1 December 2023, you can enable pre-filling multiple times by deleting and adding the tax return again.

-

During the pre-fill, the schedules will be auto-created. The pre-fill data will be populated in the income details schedule and then into the respective tax return items.

-

You can edit the pre-fill data if required.

What data pre-fills into the tax return?

Label | Item numbers |

|---|---|

Salary and wages | Item 1 |

Employment Termination Payment (ETP) | Item 4 - Income Details schedule (INCDTLS) |

Government Payments | Item 1, Item 5, Item 6, Item 24 Label V, Item IT3 depending on the benefit description |

Superannuation lump sum | Item 9 - Income Details schedule (INCDTLS) |

Bank Interest | Item 10 |

ATO interest | Item 10 - Item 24X |

Dividends | Item 11 |

Employee Share Scheme | Item 12 - Income details schedule - INCDTLS |

First home super saver (FHSS) | Items 24R, Item 24S |

Private health insurance | PHI labels |

Personal Superannuation contributions deduction | Item D12 - Deductions schedule - DDCTNS |

PAYGW - Union / Professional Association Fees | Item D5 - Deductions schedule - DDCTNS |

PAYGW - Workplace Giving | Item D9 - Deductions schedule - DDCTNS |

ATO Interest: Interest Charge Debit | Item D10 - Deductions schedule - DDCTNS |

PAYGW - Deductible amount of UPP of the annuity to INCDTLS Annuity deductible amount of undeducted purchase price |

|

Early Stage Innovation Companies (ESIC) | Item T8 - Early stage investor (ESIC) workpaper. |

Foreign Employment payments | Item 1 - Salary or wages and Foreign employment income in INCDTLS schedule |

To pre-fill the data into the tax return

On the Compliance page, click to open the return you want to pre-fill.

On the right side of the tax return, click Pre-fill from ATO.

For a successful pre-fill, you'll see the Pre-fill successful! message and date/time of pre-fill.

You can pre-fill the tax return as many times as you need. But if you have manually edited the previously pre-filled data, it will be over-written.

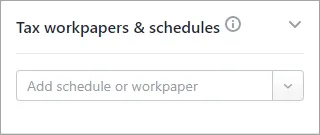

To view the pre-fill data, open the Income details schedule from Tax workpapers & schedules on the right panel.

If you need to pre-fill again, select the Pre-fill from ATO button. This will overwrite any previously edited ATO pre-fill amounts. Confirm the details and then select Pre-fill from ATO again.

You can edit or delete the pre-fill data if required.

After you've checked all the details, the return is ready to validate.

Pre-filling multiple times

You can pre-fill ATO data multiple times for any tax returns created after 1 December 2023. Returns created before this date can be deleted and recreated to enable pre-filling multiple times.

When you pre-fill for the first time, the pre-fill data will be available in the schedules and integrated into the tax return labels.

If you pre-fill for the second time, it will overwrite any previously ATO pre-filled data that you've changed. Any new pre-fill data will be added as a new record. Manually entered data in the schedule will be retained.

Auto creation of schedules

After the pre-fill data is downloaded, the relevant schedules are created automatically and pre-filled with the data from the ATO.

For example, if there's interest income from the ATO pre-fill report, the Income details schedule will be created and the data will be populated in the label in the tax return.

FAQs

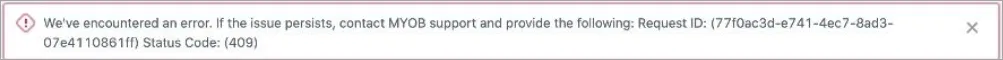

What if the pre-fill fails?

If the pre-fill fails, you'll see an error and need to contact MYOB support.

Can I view the pre-filled fields and the ATO pre-fill report?

No, you can't view the pre-fill report or the pre-filled fields, yet. If you want to check the data from the ATO, download the pre-fill report from ATO online services.