Before filling out your inventory, it's important to know whether you'll be using a perpetual or periodical (also known as physical) inventory method. If you already know what you want to use, have a look below for more information on how AccountRight handles each method.

If you're not sure what method works best for your business, don't worry! It's a lot easier than it sounds. This information will help you choose the the best method for your business and give you greater control over managing your stock.

Perpetual and periodical inventory methods

Generally speaking, perpetual inventories, in which the inventory system is automatically updated for each sale and purchase, is used in businesses with high-volume sales where physical inventory counts are time-consuming and costly.

Periodical inventory is usually best for suited for businesses that sell low-volume products, such as cars or artwork, that can easily be tracked by a physical count, or by businesses that already use a third-party POS system to track inventory.

Check with your accounting advisor on whether perpetual or periodical is right for your business. But no matter which method you choose, you'll be able to tailor your AccountRight inventory to make your business life easier.

Perpetual inventory

When a business uses the perpetual inventory method, they're continually tracking the monetary and physical movement of their stock; so, their inventory balance will always be up-to-date and have less reliance on physical inventory counts.

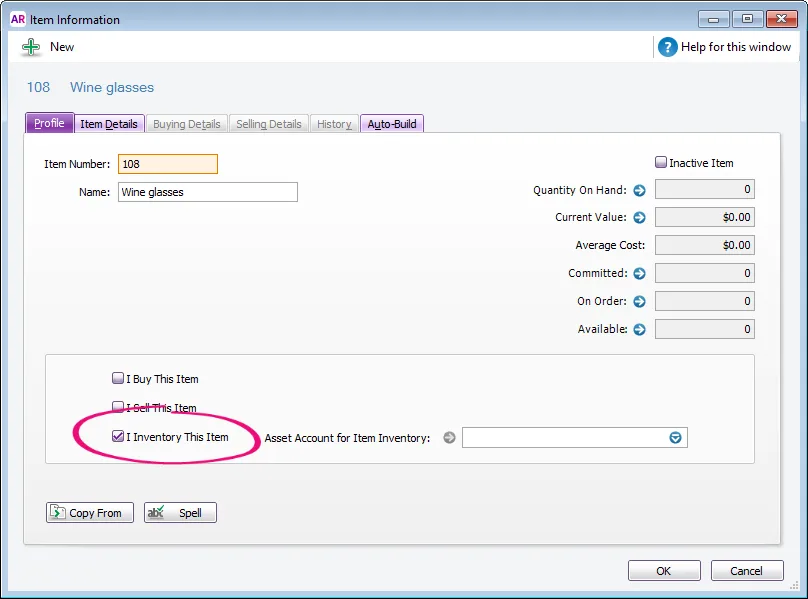

If you want to use the perpetual inventory method in your AccountRight, you need to make sure you check I Inventory This Item when creating an item.

For more information on this process, see Creating items.

When using a perpetual inventory in AccountRight, your inventory's monetary value is tracked using the average costing method.

Unlike other valuing methods, such as First in First Out (FIFO), the average costing method values your inventory by calculating its weighted average value, using the formula: Average Cost=Total Value of the item÷Total Quantity of items. Let's take a look at an example of how this would work in everyday business.

Example

Let's say you purchase 10 wine glasses for $10.00 each. This will result in an average cost of $10.00 per item. The following day, 10 more wine glasses are purchased, this time for $12.00 each. Your inventory looks like this:

-

Total Quantity of wine glasses: 20

-

Total Value of wine glasses: $220.00

-

Average Cost: $11.00 ($220.00÷20)

From this example, you'll notice your average cost rose by $1.00 after purchasing the second lot of glasses. This number will be automatically calculated and updated after each purchase. Another transaction that can impact the average cost is an inventory adjustment.

Periodical inventory

Under a periodical (or physical) inventory method, an inventory balance is recorded only after a physical inventory count.

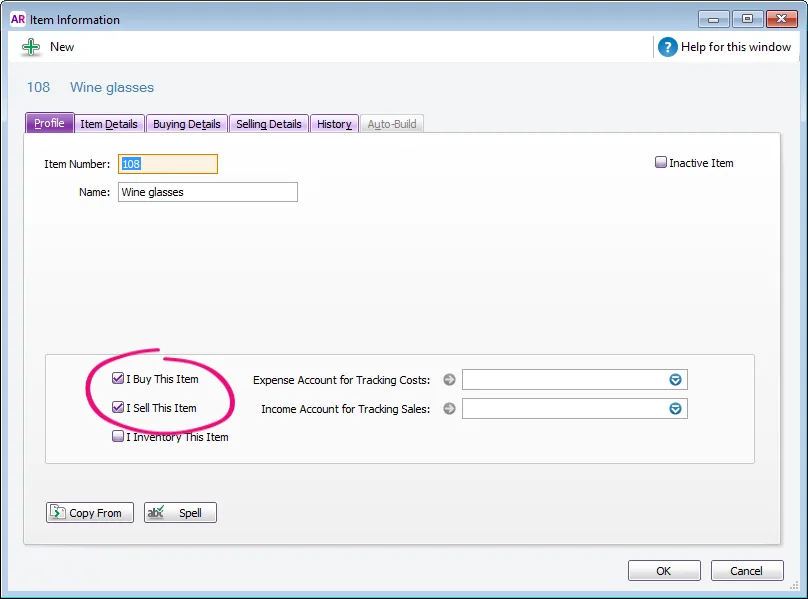

If you want to use the periodical inventory method in your AccountRight, you need to make sure you do not check I Inventory This Item, but rather I Buy This Item and I Sell This Item when creating an item.

Recording your inventory periodically requires just a few more steps each time a physical stocktake is conducted. For more information on recording a periodical inventory, see Periodical inventory. Before implementing periodical inventory, you should discuss its suitability with your accounting adviser.

What's next?

Once you've decided which inventory method to use, see our Inventory help topic to learn what else you can do and how to set up your inventory items.