On 1 July 2023, the superannuation guarantee contribution rate increased from 10.5% to 11%. This is the minimum super amount you must pay all eligible employees from 1 July 2023. Learn more about your super obligations.

Set and forget the super guarantee rate

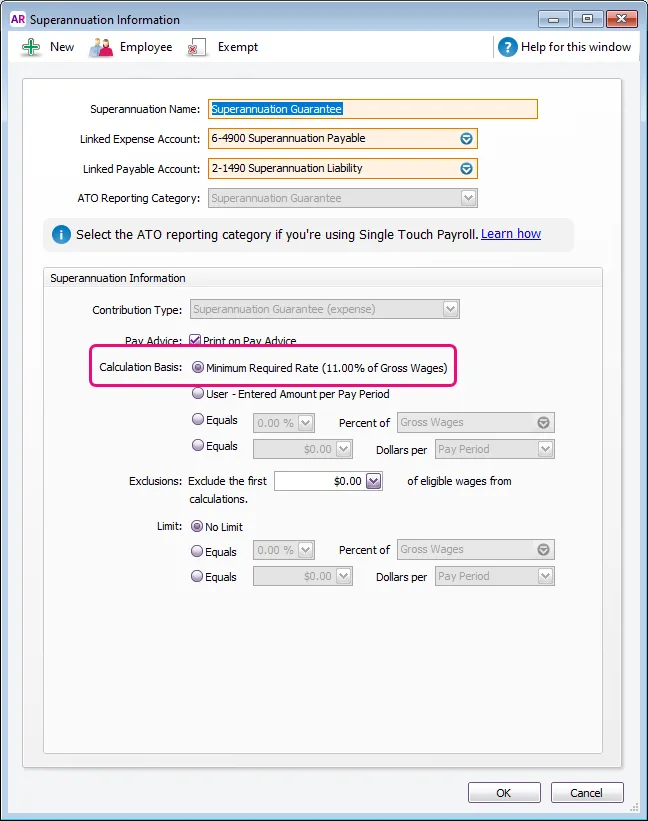

There's a calculation basis in your superannuation guarantee payroll category called Minimum Required Rate. This option caters for the 1 July rate increase and any future rate increases.

You'll see this new option in all super payroll categories where the Contribution Type is set to Superannuation Guarantee (expense). For example, you'll see it in your default super guarantee payroll category (Payroll > Payroll Categories > Superannuation tab > Superannuation Guarantee).

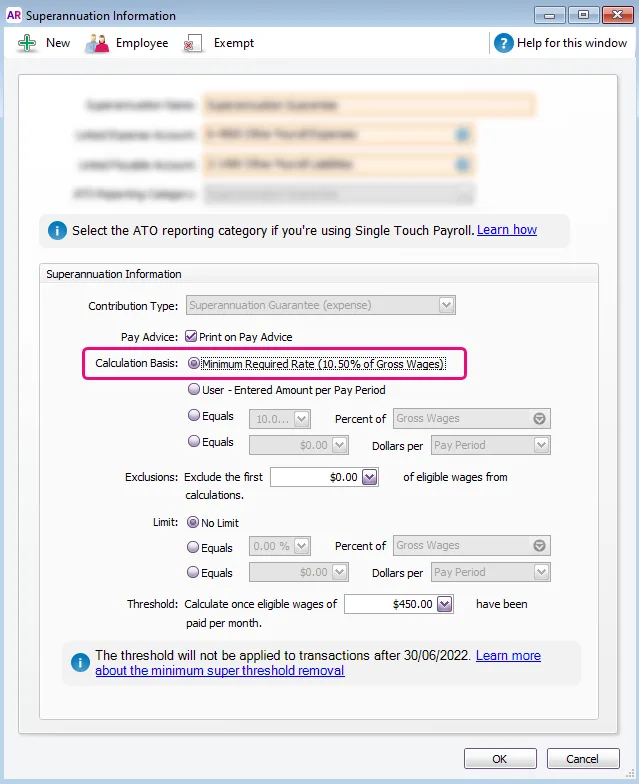

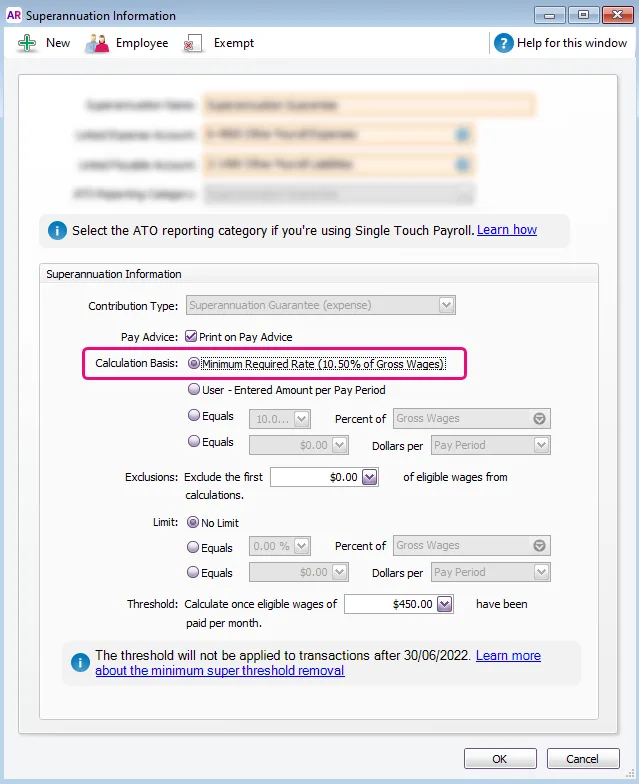

This option will display as Minimum Required Rate (10.50% of Gross Wages) before 1 July, but from 1 July onwards it'll display as Minimum Required Rate (11.00% of Gross Wages).

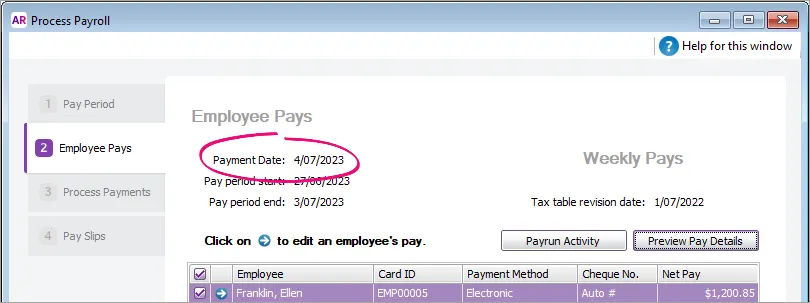

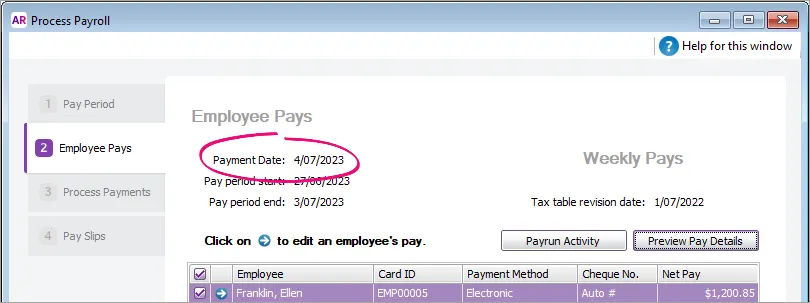

The Minimum Required Rate option means AccountRight will automatically calculate the correct amount of super for your employees based on the Payment Date in the pay run.

For example:

If the payment date is 30 June 2023 or earlier, a super guarantee rate of 10.5% is used.

If the payment date is 1 July 2023 or later, a super guarantee rate of 11% is used.

What do I need to do?

If you already have the calculation basis in your super guarantee payroll category set to Minimum Required Rate as shown above, there's nothing you need to do. The right amount of super will calculate in your employees' pays.

But if the calculation basis is set to anything else, it might mean you're paying a non-standard amount for your super guarantee contributions and you should check to make sure it's correct.

To check or change your super calculation basis

Go to the Payroll command centre and click Payroll Categories.

Click the Superannuation tab.

Click the blue zoom arrow to open the Superannuation Guarantee payroll category.

(Recommended) For the Calculation Basis, select the option Minimum Required Rate to pay the mandatory minimum super guarantee contributions for the current, and future, payroll years.

If you're not paying the minimum super guarantee contributions for your employees, choose a different Calculation Basis. If unsure, check with your accounting advisor or the ATO. Check your super obligations.

Select User-Entered Amount per Pay Period if you want to enter the super amount each time you do a pay run.

Select Equals x Percent of and enter the super rate to be calculated and what it should be calculated on, e.g. Gross Wages.

Select Equals x Dollars per if you want to pay a set amount of super per pay period, per hour, per month or per year.

Using one of the above 3 options means you'll need to manually manage any future super guarantee rate increases.

Click OK to save your changes.

If you use multiple superannuation payroll categories, we recommend checking each of them to see if the Calculation Basis is set correctly. If you're not sure about the impacts of any super rate changes on your business, check with your accounting advisor or the ATO.

FAQs

What super rate is used for pays that span payroll years?

If you've selected the new option in your super guarantee payroll category, the applicable rate will be used based on the Payment Date in the pay run.

For example:

If the payment date is June 30 or earlier, a super guarantee rate of 10.5% will apply.

If the payment date is July 1 or later, a super guarantee rate of 11% will apply.

This means if the pay period includes dates in June and July, the Payment Date will determine which super rate will be applied.

If you don't use the calculation basis Minimum Required Rate, make sure you're paying the correct amount of super for your employees. What are my super obligations?

What super rate is used if I process a pay in June with a July date of payment?

If you've selected the new option in your super guarantee payroll category, the applicable rate will be used based on the Payment Date in the pay run.

For example:

If the payment date is June 30 or earlier, a super guarantee rate of 10.5% will apply.

If the payment date is July 1 or later, a super guarantee rate of 11% will apply.

This means if the pay period includes dates in June and July, the Payment Date will determine which super rate will be applied.

If you don't use the calculation basis Minimum Required Rate, make sure you're paying the correct amount of super for your employees. What are my super obligations?

What if my business chooses to pay a higher rate of super?

If you pay your employees more than the minimum super guarantee rate, you can either:

select the option Equals x Percent of in the super guarantee payroll category and enter the super rate you're paying, or

use 2 super guarantee payroll categories to clearly show the additional super on your employees' pay slips:

In the first super guarantee payroll category, select the option Minimum Required Rate.

Create a separate super guarantee payroll category for the additional percentage. For example, if you pay 3% above the minimum super rate, set up the additional super payroll category with the Calculation Basis set to Equals 3% Percent of Gross Wages. Both super payroll categories will show on your employees' pay slips making it clear they're receiving a higher contribution. Learn more about Additional superannuation contributions.

Why can't I see the OK button when I try to save changes to a super payroll category?

If you can't see the OK button in the Superannuation Information window, it could be because of your monitor's display settings. For more information, see Fixing display issues.