You can create a file of your business’s transactions and account balances, which you can send to your accountant. They'll be able to import the file into compatible MYOB software. Check with your accounting advisor about which export format they prefer.

Invite your accounting advisor

Inviting your accounting advisor to access your MYOB business means you'll no longer need to send them anything. See Invite your accountant or bookkeeper .MYOB Business - Importing and exporting data - Export for accountants (Browser)

To export data for your accounting advisor

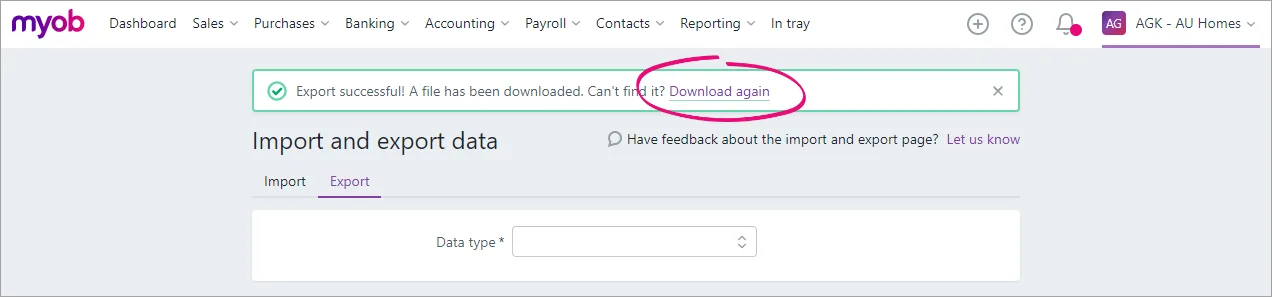

In MYOB, click the settings menu (⚙️) and choose Import and export data. The Import and export data page appears.

Click the Export tab.

From the Data type dropdown list, choose Data for your accountant. Additional fields appear.

To specify the date range for the transactions to be exported, choose a Period or select dates in the Date from and Date to fields.

Choose the Export file type. Check with your accountant if you're not sure which one to choose. See the table below for guidance.

If exporting for Reckon APS or Sage Handiledger, map the MYOB tax codes to the corresponding APS or Handiledger tax codes. Tax codes can be letters or numbers, up to 3 digits, with no special characters.

Click Export to save the file. By default it'll save in your Downloads folder. If you can't find it, you can click Download again.

When you're ready, send the file to your accounting advisor to import into their software. Check with your accounting advisor about how they want you to send the file.

Export file type | Compatible software | File format |

|---|---|---|

CeeData | MYOB AE Accounts | .txt |

Mye | MYOB AE MAS | .mye |

MYOB AE MAS | MYOB AE MAS | .txt |

MYOB AO | MYOB AO | .txt |

Reckon APS | Reckon APS | .txt |

Sage Handiledger | Sage HandiLedger | .csv |