When an employee leaves your business, you need to let the ATO know the details of the employee's departure. You'll also need to "finalise" the employee which lets the ATO know you won't be paying that employee again.

1. Process all final pays and ETP (if required)

When an employee finishes working for you, you need to pay them all amounts they're owed. This might include their regular pay and any leave they're owed.

If the final pay includes an employment termination payment (ETP), such as a payment in lieu of notice, redundancy, or a 'golden handshake", this is handled differently to other final payments.

For all the details, see Processing a final pay and Processing an employment termination payment (ETP).

2. Notify the ATO

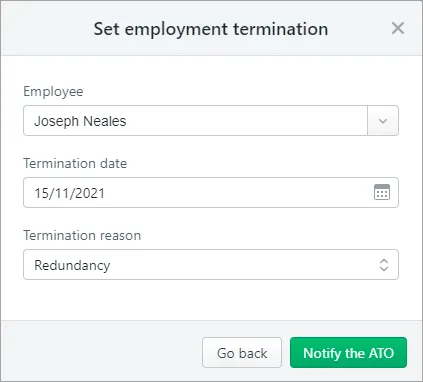

As part of your Single Touch Payroll (STP) reporting, you need to notify the ATO of the termination. This lets the ATO know the employee's termination date, the reason, and any ETP components in their final pay.

Here's how:

Go to the Payroll menu > Single Touch Payroll reporting.

Click the Employee terminations tab.

Choose the applicable Payroll year and click Add Termination.

Enter the termination details and click Notify the ATO.

When prompted to send your payroll information to the ATO, enter your details and click Send.

This declaration is processed in the same way other STP reports, and it can take up to 72 hours to be accepted by the ATO. You can check the status of the report in the STP reporting centre.

3. Finalise the employee

This step lets the ATO know that you won't be paying the employee again this payroll year. You can finalise the terminated employee now, or when you complete your STP finalisation at the end of the payroll year.

Go to the Payroll menu and choose Single Touch Payroll reporting.

Click the EOFY finalisation tab.

Choose the applicable Payroll year.

If you need to report fringe benefits for the terminated employee (what is this?):

Select the option Enable RFBA.

For each applicable employee, enter values for both:

RFBA ($)

Section 57A $

The combined value of these must be above the thresholds set by the ATO.

Select the terminated employee.

Click Finalise and notify the ATO.

When prompted to send your payroll information to the ATO, enter your details and click Send.

Need to undo a termination? See Removing an employee termination