From 1 July 2022, the Australian Government removed the $450 per month threshold for super guarantee eligibility (that's the amount an employee can earn in a calendar month before you have to pay them super). This means you need to pay super guarantee contributions on all ordinary time earnings.

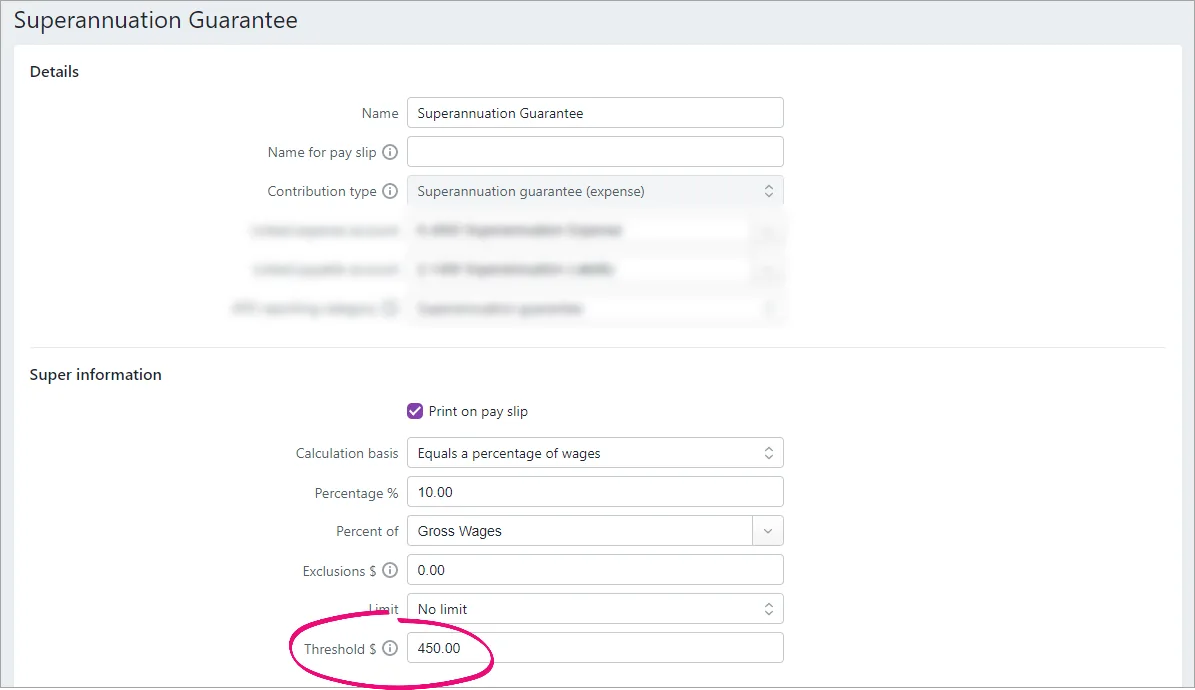

As such, we've removed the Threshold $ field from superannuation pay items where the Contribution type is set to Superannuation guarantee (expense).

Here's what it used to look like:

What do I need to do?

Nothing.

The right amount of super will be calculated each pay.

Do you employ under 18s? If they work 30 hours or less in a week you don't need to pay them super for that week. Learn more about paying super for employees aged under 18.