Do you see Tax or Activity statements in the top menu bar?

-

Tax: You're on the Early Access Program (EAP) and can prepare tax returns (including activity statements) in MYOB Practice.

-

Activity statements: You're not in the EAP or you're an MYOB Partner.

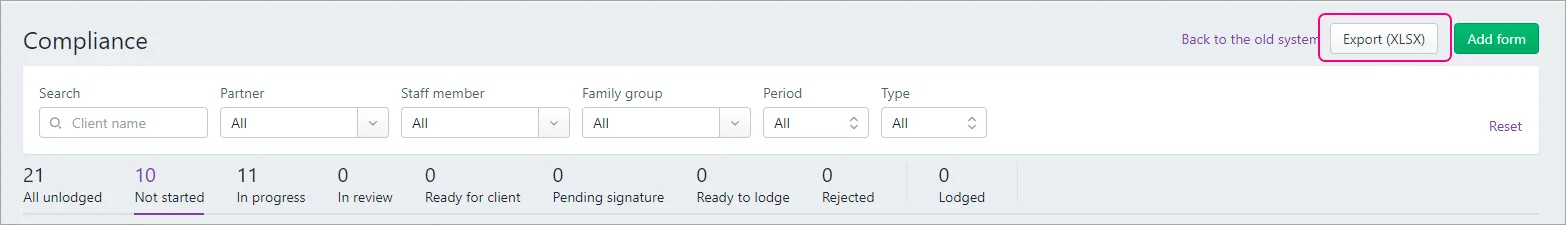

This page lists all the activity statements and tax returns for your clients, letting you manage all your forms in a single place.

Here's what you can do:

View the forms for one client or all your clients.

Filter to restrict the forms listed and find forms quickly.

Check the status of the forms to track your work

Add or delete activity statements and tax returns.

Export the list in to Excel to help with reviewing.

View all clients or a single client

To view tax returns and activity statements, click Tax or Activity statements on the top menu bar.

For all your clients, select All clients on the sidebar

For one client only, select a client name on the sidebar.

Filter the list of forms

The filtering options are slightly different when selecting a single client or all your clients.

From the single client view, you can filter the forms by Period and Type.

From the All clients view, you can use filters to search by a particular client, Office, Partner, Manager, Staff member, Family group, Period, and Type.

-

The Office filter option is useful if you applied multiple office categories to your clients in MYOB AE/AO.

-

Filtering Office by None will include listing clients that have the default office value of UNSPECIFIED in AE/AO.

-

To see the Offices in the MYOB Practice Compliance filters, you need AE or AO version 5.4.50 (2023.3) released April 2024.

-

To clear all filters, click Reset.

If you use AE/AO, you'll need to manage partners, staff , and family groups in AE/AO.

Check statuses

The status column shows the different statuses of your tax return or activity statement. This is a good way to keep track of their progress through the workflow.

Status | Description |

|---|---|

All unlodged | Lists all tax returns or activity statements |

Not started | Tax returns or activity statements you haven't started working on. |

In progress | Tax returns or activity statements that you're currently working on. |

In review | Tax returns or activity statements to be reviewed by yourself or someone in your practice. |

Ready for client | Tax returns or activity statements reviewed, approved, and ready to send to clients |

Pending signature | Tax returns or activity statements sent to the client and awaiting their signature. |

Ready for lodge | Tax returns or activity statements are all approved, signed, and ready to lodge to ATO. |

Rejected | Tax returns or activity statements have been lodged to ATO and were rejected. |

Lodged | Tax returns or activity statements are lodged successfully to ATO |

Add and delete forms

Click Add form to add a new activity statement or a tax return.

Click the ellipses at the end of the line and select Delete to delete a tax return or activity statement.

Click Back to the old system if you want to complete any FBT returns.

Export to a spreadsheet

Want a handy way to make and share notes and comments while reviewing? You can export tax return and contacts data together into an XLSX file to open it in Microsoft Excel.

Exporting is done from the Compliance page, so you can filter which compliance data is exported. For example, filter and export tax returns or activity statements for each partner or staff member to check their work.

The export displays data in the columns as they appear in MYOB Practice (and any filters you've applied). You may also see some data displayed differently. For example, the Period field in MYOB Practice will display as Period start and Period end columns in Excel.

Go to the Compliance page. This can be for one client or all clients view.

You can export all the data from this page or use filters to customise the data you want.

To use filters when exporting data:

Select All unlodged if you want to export all the compliance forms. To export the forms for certain statuses, select the one you want. For example, Ready to lodge, Lodged.

Select the name of the Partner or Staff member from the drop-down.

Select the Export (XLSX) button located on the top right of the Compliance page.

The XLSX spreadsheet file is downloaded to your browser's download location, using the file name format YYYY-MM-DD_MYOB_ComplianceList.xlsx.

Disclaimer

Please note that the data you’re exporting may include individuals’ personal information. You should take steps to keep that information secure.

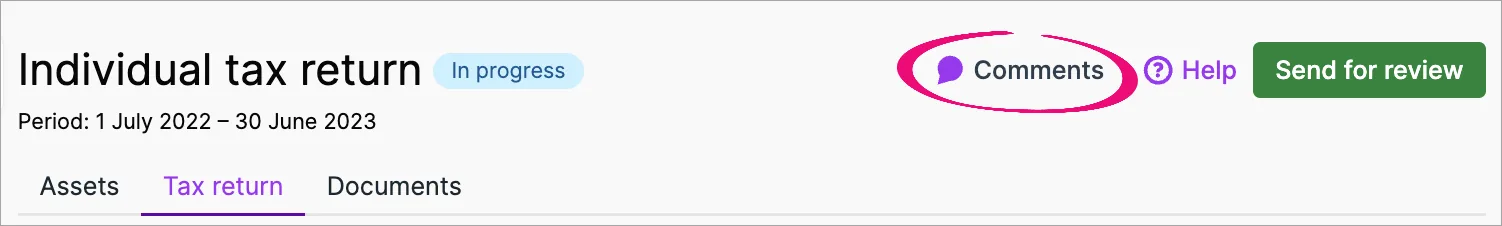

Add, view or delete comments on tax returns or activity statements

You can add comments about tax returns or activity statements for other users to view. For example, if you want to flag something for review.

You can add and view comments from a couple of places on the Compliance page, and the comments are synced between these places:

on the Compliance page, from the overview list of all tax returns and activity statements

by opening a tax return or activity statement from the Compliance page. You can add and view the comment from the Assets, Tax returns or Documents sub tabs.

Comments aren't synced between different tax periods.

An icon indicates whether a tax return or activity statement has any comments:

No comments: a speech bubble outlined in purple.

Comments: a solid purple speech bubble.

If you're on the Compliance page, the icon will be in the Comment column. If you've opened the tax return or activity statement, the icon will be on the top right of the page.

Information about the time, date and author of the comment is included with each comment, and you can also add text formatting. There’s no limit to the number of comments you can add.

Adding and deleting a comment

Adding a comment:

Open the Compliance page and, optionally, open a tax return or activity statement from the list.

Click the comment icon (a solid purple speech bubble or a speech bubble outlined in purple).

On the Compliance page, the icon will be in the Comment column. If you've opened the tax return, the icon will be on the top right of the page.

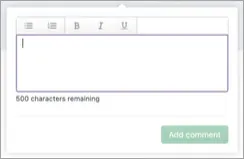

The comment window appears.

Enter your comment in the text field.

Don’t click out of the comment window before you’re finished making your changes. If you click out of the comment window, the window closes without saving the content.

You can use the toolbar above the text field to add formatting. The amount of characters remaining for your comment is displayed below the text field.Click Add comment.

Viewing and deleting a comment:

To view a comment:

Open the Compliance page and, optionally, open a tax return or activity statement from the list.

Click the icon indicating comments (a solid purple speech bubble).

If you're on the Compliance page, the icon will be in the Comment column. If you've opened the tax return or activity statement, the icon will be on the top right of the page.

All the comments that have been added are listed.

To delete a comment:

Hover over the comment. An ellipsis appears to the right of the comment.

Click the ellipsis. A Delete option appears.

Click Delete.