AccountRight Plus and Premier, Australia only

Deductions are the amounts withheld from employee pays (other than taxes), that are then forwarded on to an authority or other organisation.

For example, employees might pay a union fee out of their wage. The fees are then forwarded on to the union.

Here are some more specific scenarios which might help:

ETP payments where you need to track the amount of tax you withhold

Before or after tax deductions?

If you're not sure whether a deduction is pre-tax or post-tax, check with your accounting advisor or the ATO.

OK, let's step you through the basics of setting up a deduction.

To set up a deduction category

Go to the Payroll command centre and click Payroll Categories. The Payroll Category List window appears.

Click the Deductions tab.

If the deduction you want to set up already exists, open the category. Otherwise, click New and give the deduction a name.

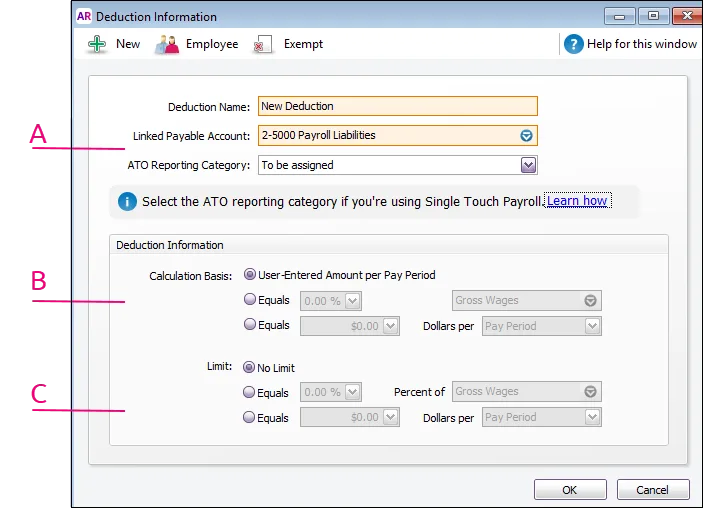

Make the required selections in the window.

A - Linked Payable Account - is the account (usually a liability account) in which all the deducted money will be accrued. The Default Tax/Deductions Payable Account you specified when setting up payroll appears as the default.

You can change this default if you want to track the deduction separately. For example, if you are deducting union fees, create a Union Fees Payable liability account. This way, the balance sheet will display the deductions separately from your PAYG Withholding and other deductions.

Select the ATO Reporting Category for each deduction category. If unsure, check with your accounting advisor or the ATO.

Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.B - Calculation Basis - can be one of the following choices:

User-Entered Amount per Pay Period - should be selected if you want to manually enter a specific amount for each employee, each pay period or if you want to use the amount you have entered in an employee’s standard pay details. Note that manually entered deductions should be entered as negative values.

Equals x Percent of - allows you to enter a percentage of any of the wage categories. This amount will be deducted until the deduction limit (see below) is reached.

Type or select a wage category upon which the calculation is to be based. Alternatively, you can select Gross Wages or Federal Wages, which totals all wage categories (hourly and salary) you pay an employee.Equals x Dollars per - allows you to deduct the specified amount per pay period, per month, per year or per hour. This amount will be deducted until the limit (see below) is reached.

C - Limit - may be one of the following choices:

No Limit - signifies no limit on the amount of money that can be deducted from the employee’s pay for this category.

Equals x Percent of - results in the maximum deduction amount being a percentage of a wage category. For example, a deduction might be $50 per pay period up to a maximum of 50% of the employee’s base salary. The special categories of Gross Wages and Federal Wages is also available here (refer to discussion in ‘Equals x Percent of’, above).

Equals x Dollars per - results in the maximum deduction being a fixed dollar amount per pay period, per month or per year. For example, a deduction might be 10% of the employee’s gross wages up to $1,500 per year.

Click Employee. The Linked Employees window appears.

Select the employees whose pay will include this category, then click OK.

If it's a pre-tax deduction (which means it'll be deducted from the employee's gross pay), click Exempt and select the PAYG Withholding category. If you're not sure if the deduction should be pre- or post-tax, check with your accounting advisor or the ATO.

Click OK.

Click OK to return to the Payroll Category List window.

The deduction category will now appear for the selected employees when you complete your next pay run. When you're ready to pay the authority (or whoever the payment was deducted for), you can record the transaction using Pay Liabiltiies.

To delete a deduction category

You can only delete a deduction category if it hasn't been used in an employee's pay.

Go to the Lists menu and choose Payroll Categories.

Click the Deductions tab.

Click the zoom arrow to open the deduction category to be deleted.

Go to the Edit menu and choose Delete Deduction.

Using Single Touch Payroll?

Don't forget to select the ATO Reporting Category for each deduction category. If unsure, check with your accounting advisor or the ATO.

Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

FAQs

Can I set up a deduction to pay additional HECS/HELP repayments?

You can set up a deduction (as described above) to deduct additional HECS (now called HELP) repayments from an employee's pay. These repayments will be in addition to compulsory HECS/HELP repayments (which are deducted automatically and included in an employee's PAYG Withholding when they are assigned a tax table with HELP in the description).

Use the Pay Liabilities feature in AccountRight to process deducted amounts, then pay them to the ATO using BPAY, credit card or direct credit.

See the ATO guidelines to learn more about voluntary repayments.

What are Federal Wages?

Federal wages are the total amount of all wage categories assigned to an employee, except those wage categories which are exempt from PAYG Withholding.

If you're not sure whether to use Gross Wages or Federal Wages in your deduction calculation, check with the ATO or your accounting advisor.