AccountRight Plus and Premier, Australia only

If you're registered for Single Touch Payroll (STP), there's no need to prepare payment summaries so we've removed that option from the Payroll command centre. If an employee needs a copy of their income statement (payment summary), they can access these details through myGov. Visit the ATO for more information.

Stay compliant by using the latest AccountRight version, and see how we've simplifed your end of payroll year.

If you're registered for STP but you need to complete a payment summary (confirm with the ATO if you're not sure), you'll need to complete a manual payment summary for the employee using forms available from the ATO.

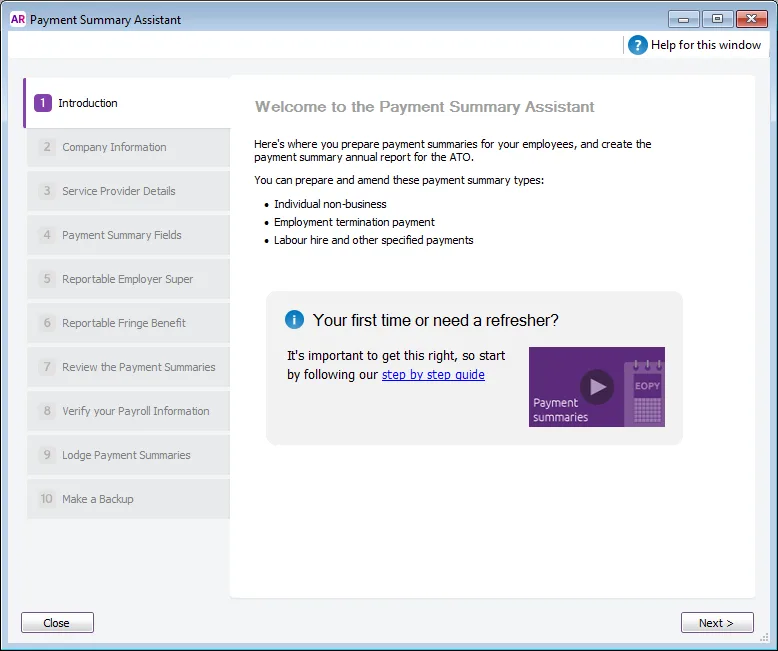

To access the Payment Summary Assistant, go to the Payroll command centre and click Prepare Payment Summaries.

There are three types of payment summaries you can complete using the assistant:

Individual Non-Business

This form is for payments to payees who:

are employees, company directors or office holders

are religious practitioners

receive compensation, sickness or accident payments

receive non-superannuation income streams

receive return to work payments

receive a non-super annuity or pension.

Labour Hire (or Business and personal services income)

This form provides details of amounts you have withheld from payments you made:

under a voluntary agreement

under a labour-hire arrangement

that are other specified payments

that are attributed personal services income.

Employment Termination Payment (ETP)

This form reports employment termination payments (ETP) you’ve made to:

an employee whose employment has been terminated

a non-dependant because of an employee's death

a dependant because of an employee's death, if the taxable component of the payment exceeds the ETP cap

a trustee of a deceased employee's estate.

You don’t need to select which ones you want to complete. AccountRight will select the right one for you, based on the information entered in your employees’ cards and the information you enter into the assistant. For example, if you have selected “Labour Hire” as the Employment Basis for some employees, the Labour Hire payment summary will be prepared for them. If you have terminated employees, and enter ETP amounts into the assistant, an ETP payment summary will be prepared for them.

Before preparing your payment summaries...

Make sure your employee cards contain a current address (including a city and postcode) and a tax file number.

Have available all details of any fringe benefit amounts and reportable superannuation amounts for your employees.

For workers paid under labour hire arrangements, make sure their employee card has the Employment Basis set to Labour Hire (Employee card > Payroll Details tab > Personal Details).

If you have everything you need, click Next in the Introduction step of the Payment Summary Assistant, and enter your company information.