Once you have completed your activity statement (BAS or IAS) you'll need to record the ATO payment or refund.

Recording a payment to the ATO

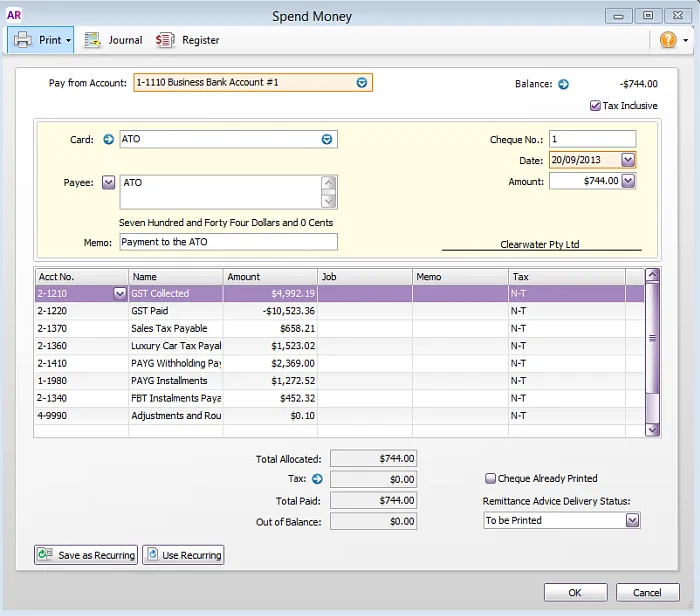

Enter your ATO payment using a Spend Money transaction with a separate line to represent each of your BAS fields (Banking command centre > Spend Money). These fields will typically have an associated account in AccountRight, but check with your accounting advisor if you're unsure which accounts to use.

For example, your GST payable (BAS field 1A) is typically allocated to a liability account (2-XXXX) called GST Collected.

Use this table to work out what to enter in your transaction and whether the amount should be positive or negative.

BAS field | Field name | Description | Account number example | In Spend Money, the entry is |

1A | Goods and Services tax payable | This is the GST that you have collected. | 2-XXXX | + (Positive) |

1B | Goods and services tax paid | This is the GST that you have paid. | 2-XXXX | - (Negative) |

1C | Wine Equalisation tax payable | This is the amount of Wine Equalisation tax that you will need to pay if applicable to you. | 2-XXXX | + (Positive) |

1E | Luxury car tax payable | This is to record the Luxury car tax that you will need to pay if applicable to you. | 2-XXXX | + (Positive) |

4 | PAYG withholding payable | This is the total amount of PAYG that is withheld from employees and subcontractor. This field also includes amounts withheld for No ABN and also No Tax File Number. | 2-XXXX | + (Positive) |

5A | PAYG Instalments | This is the prepayment of PAYG, which is based on total Income and the instalment rate that is set on your BAS/IAS form, or an instalment amount. | 1-XXXX | + (Positive) |

6A | Fringe Benefits Tax Instalments | This is a prepayment of Fringe Benefits Tax based on a projection for the year. | 2-XXXX | + (Positive) |

7 | Deferred Company funds Instalments | This field relates to those who are liable to pay deferred instalments under the company or fund instalment system. | 1-XXXX | + (Positive) |

N/A | Adjustments and Rounding Account | The BAS requires that whole dollars be reported, so some manual rounding of cents will be required. We suggest that you create an adjustments and rounding account to record the manual rounding of these adjustments. | Expense or Income Account | + (Positive) or - (Negative) |

Here's our example Spend Money transaction for a payment to the ATO.A tax code of N-T is usually given to the allocation accounts in the transaction, but you should always check with your accounting advisor or the ATO for the applicable tax codes to use in your circumstances.

Recording a refund from the ATO

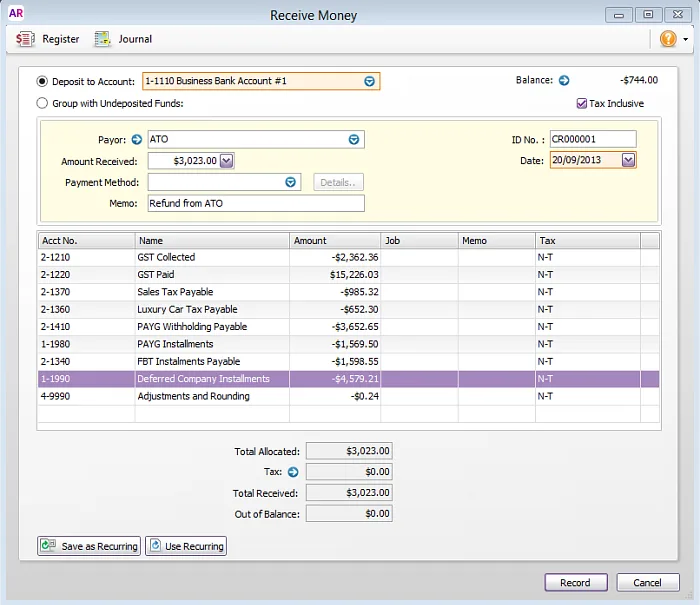

Enter your ATO refund using a Receive Money transaction with a separate line for each of your BAS fields (Banking command centre > Receive Money). These fields will typically have an associated account in AccountRight, but check with your accounting advisor if you're unsure which accounts to use.

For example, your GST paid (BAS field 1B) is typically allocated to a liability account (2-XXXX) called GST Paid.

Use this table to work out what to enter in your transaction and whether the amount should be positive or negative.

BAS field | Field name | Description | Account number example | In Receive Money, the entry is |

1A | Goods and Services tax payable | This is the GST that you have collected. | 2-XXXX | - (Negative) |

1B | Goods and services tax paid | This is the GST that you have paid. | 2-XXXX | + (Positive) |

1C | Wine Equalisation tax payable | This is the amount of Wine Equalisation tax that you will need to pay if applicable to you. | 2-XXXX | - (Negative) |

1E | Luxury car tax payable | This is to record the Luxury car tax that you will need to pay if applicable to you. | 2-XXXX | - (Negative) |

4 | PAYG withholding payable | This is the total amount of PAYG that is withheld from employees and subcontractor. This field also includes amounts withheld for No ABN and also No Tax File Number. | 2-XXXX | - (Negative) |

5A | PAYG Instalments | This is the prepayment of PAYG, which is based on total Income and the instalment rate that is set on your BAS/IAS form, or an instalment amount. | 1-XXXX | - (Negative) |

6A | Fringe Benefits Tax Instalments | This is a prepayment of Fringe Benefits Tax based on a projection for the year. | 2-XXXX | - (Negative) |

7 | Deferred Company funds Instalments | This field relates to those who are liable to pay deferred instalments under the company or fund instalment system. | 1-XXXX | - (Negative) |

N/A | Adjustments and Rounding Account | The BAS requires that whole dollars be reported, so some manual rounding of cents will be required. We suggest that you create an adjustments and rounding account to record the manual rounding of these adjustments. | Expense or Income Account | + (Positive) or - (Negative) |

Here's our example Receive Money transaction for a refund from the ATO.

A tax code of N-T is usually given to the allocation accounts in the transaction, but you should always check with your accounting advisor or the ATO for the applicable tax codes to use in your circumstances.

Using bank feeds?

If your ATO payment or refund appears as a bank transaction in your bank feeds you can match it to an existing Receive money or Spend money transaction, if you've already entered it, or create a transaction from the bank transaction, with separate transaction lines for each of your BAS fields, as we showed in the examples above. If you need a refresher on using bank feeds, see Approving a bank feed.