You'll get this error if you haven't notified the ATO you're using MYOB for payroll reporting.

If you haven't notified the ATO...

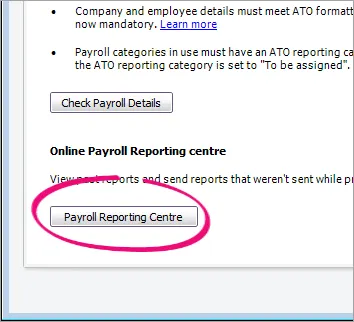

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password).

Click the ATO settings tab.

Note down your Software ID.

Notify the ATO you're using MYOB for payroll reporting by either:

phoning the ATO on 1300 852 232, or

using Access Manager to notify the ATO of a hosted SBR software service.

If you have notified the ATO...

Check your ATO settings and update Single Touch Payroll details if necessary.

Go to the Payroll command centre and click Payroll reporting.

Click Payroll Reporting Centre.

If prompted, sign in with your MYOB account details.

Click the ATO settings tab.

Check the ABN.

If the ABN is incorrect click Edit STP business details (near the bottom of the screen).

Follow the prompts to set up Single Touch Payroll again.

Once the error is fixed, the latest payroll information will be sent to the ATO when you report your next pay run to the ATO, or you can send an update event as described in the FAQs below.

If the issue persists, get in touch with our support team.

FAQs

How do I send an update event to the ATO?

An update event is where you send your employees' latest year to date payroll totals to the ATO. This ensures your payroll totals in MYOB sync with the figures held by the ATO.

If you're reporting via STP Phase 2, you can send an update event from the STP reporting centre. Otherwise you'll need to record a zero dollar ($0) pay for each employee whose year to data payroll totals you want to send to the ATO.

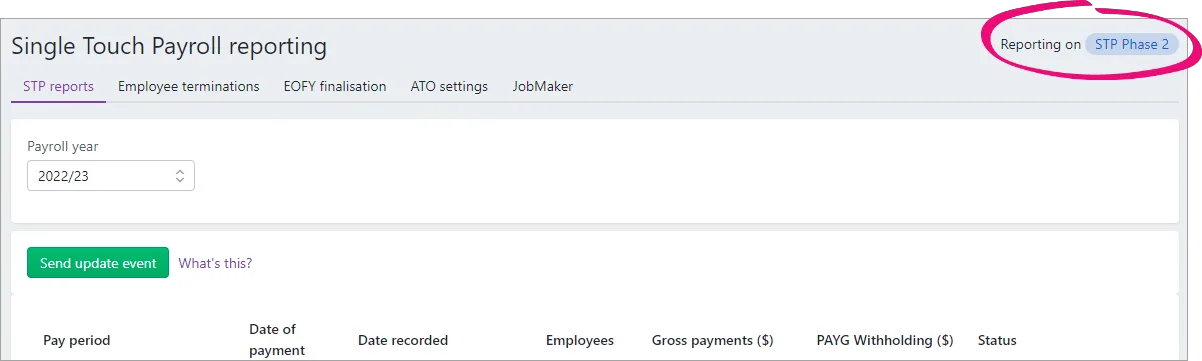

Am I reporting via STP Phase 2?

You can check in the STP reporting centre (Payroll command centre > Payroll reporting > Payroll Reporting Centre). If you don't see this label, you're on STP Phase 1. How do I get ready for STP Phase 2?

Sending an update event for STP Phase 2

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password).

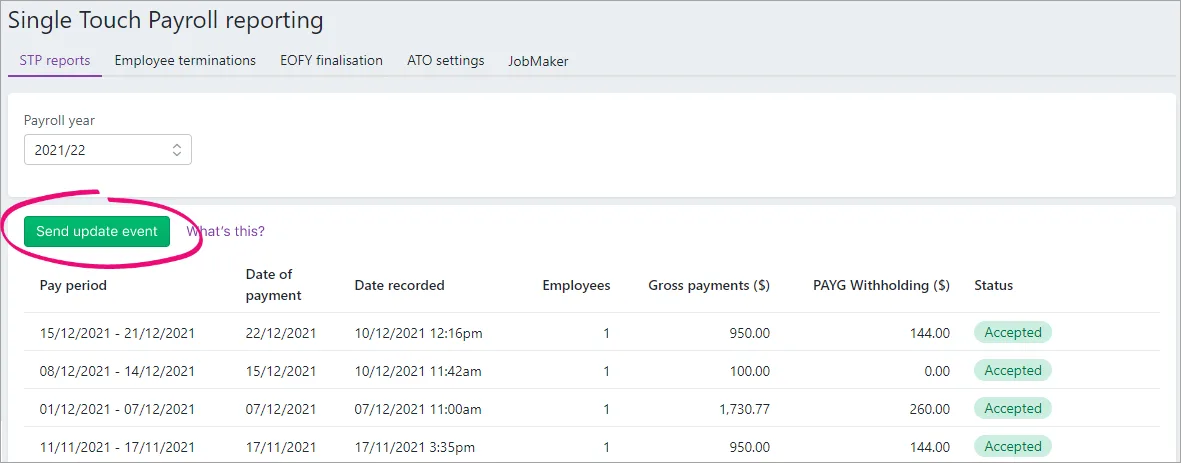

Click the STP reports tab.

Choose the applicable Payroll year.

Click Send update event.

When prompted, enter your details and click Send.

Update events are listed in the Single Touch Payroll reporting centre with your other payroll submissions, but with zero (0.00) amounts.

Sending an update event for STP Phase 1

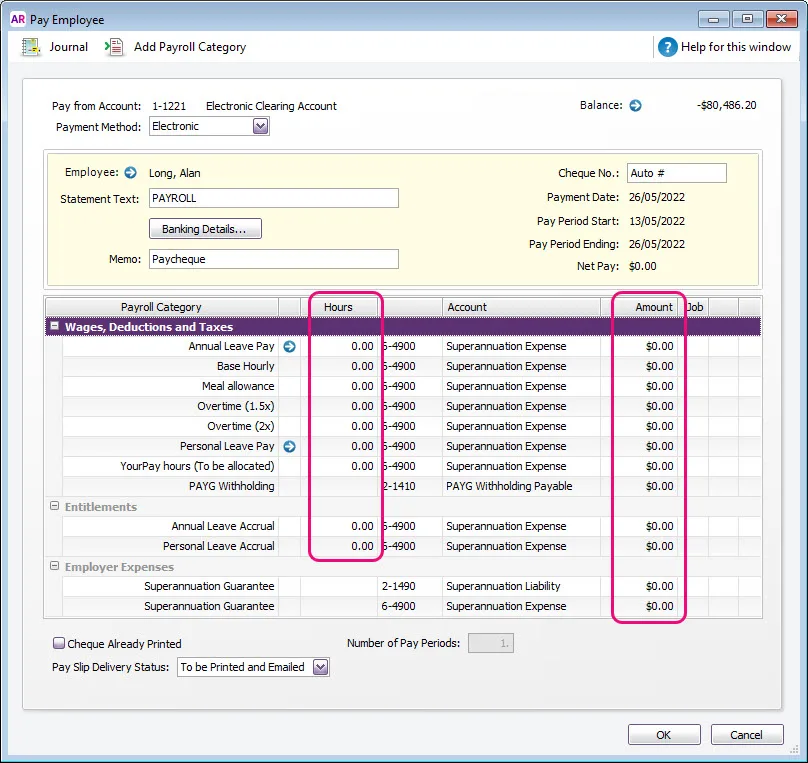

You can send an update event for your employees by recording a $0 pay for them. This type of pay is also called a void pay and it's like any other pay, but all hours and amounts will be zero.

When you record a $0 pay, the employee's latest year to date payroll totals will be sent to the ATO.

Start a new pay run (Payroll > Process Payroll). Need a refresher?

Select the option Process all employees paid and choose Bonus/Commission. Ignore the displayed warning – we're choosing this option to ensure all hours and amounts are removed from the pays.

Ensure the Payment Date is in the payroll year you're sending the update event for.

Select the employees you want to send the update for. If unsure, select them all.

Because you chose Bonus/Commission at step 2, you'll notice all hours and amounts are removed from each employee's pay (which is just what we want). Here's an example.

Complete the pay run as you normally do and declare it to the ATO. Need a refresher?

Update events are listed in the Single Touch Payroll reporting centre with your other payroll submissions, but with zero (0.00) amounts.