If you're the company file administrator or your user role permits you to do so, you can transact in closed financial years. You might need to do this to make adjustments after closing the financial year.

Using AccountRight 2015.1 to 2020.1? You'll need to roll back the financial year to make your changes. Learn more

If a transaction you need to work with is in a locked period, you'll first need to unlock the period before making your changes. If you're changing a pay in a finalised payroll year, see Changing a pay after finalising with Single Touch Payroll.

Changes to prior year transactions will be logged in the journal and session audit reports.

You should speak to your accountant or bookkeeper before working in a closed financial year. Making changes to a period you have already prepared reports for could have compliance implications.

What changes can I make in previous financial years?

From AccountRight 2020.2, the Roll Back a Financial Year function was removed. Instead, you can make these adjustments in other financial years:

For new company files created in 2020.2 and later you can create, reverse, edit and delete transactions in any prior year.

For company files which are upgraded to 2020.2 or later, you can create and reverse transactions in any prior year. Additionally, you can edit and delete transactions in the previous year.

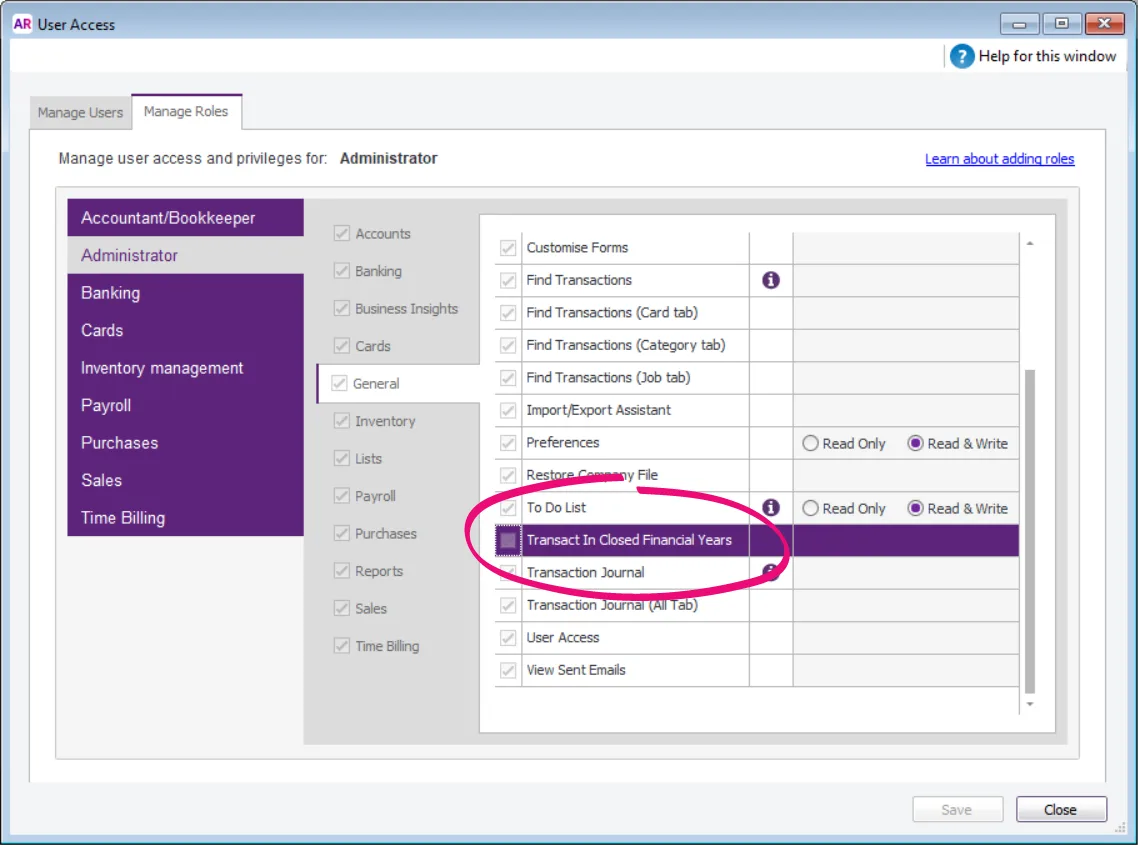

User access

A user must be assigned the role Transact in Closed Financial Years to be able to transact in previous financial years. Find out more about Assigning roles.

Rolling back the financial year

AccountRight 2015.1 to 2020.1 only

In older AccountRight versions, the only way you could change transactions in closed years was to roll back the financial year. In the latest AccountRight versions there's no need to do this (see the details above).

For example, say your current financial year is 2020. If you need to enter an adjustment for the 2019 financial year, you will need to roll back the year. Once you've recorded the adjustment, you can close the 2019 financial year again.

By rolling back the financial year, you can add and reverse transactions for the previous year, but you can't edit or delete transactions. When you roll back, any transactions you've recorded for the current financial year won't be affected.

To roll back the last financial year, go to the File menu > Close a Year > Roll Back a Financial Year. An assistant appears that will step you through the process.

Can't see the roll back option? This feature is only available in AccountRight 2015.1 to 2020.1.

If the option is in the File menu, but you can't click it, it means that you've already rolled back the financial year, you've never closed a financial year in this company file or you don't have the required user access.

FAQs

How do I know what my current financial year is?

Go to the Setup menu > Company Information. This window shows you the year that’s considered to be the current financial year in AccountRight. You can only roll back to the year prior to the current financial year, also known as “Last Year” in AccountRight.