A declarer is someone who can send your business's payroll information to the ATO after each pay run. This might be a payroll officer or a tax or BAS agent.

Whoever set up Single Touch Payroll (STP) for your business will be able to send payroll information to the ATO, but additional people who need to send payroll information must add themselves as declarers.

Before adding a declarer

-

Set up STP for your MYOB business

-

Add the declarer to your MYOB business (see Invite a user or Invite your accountant or bookkeeper)

To add a declarer for STP reporting

The following steps need to be completed by the new declarer.

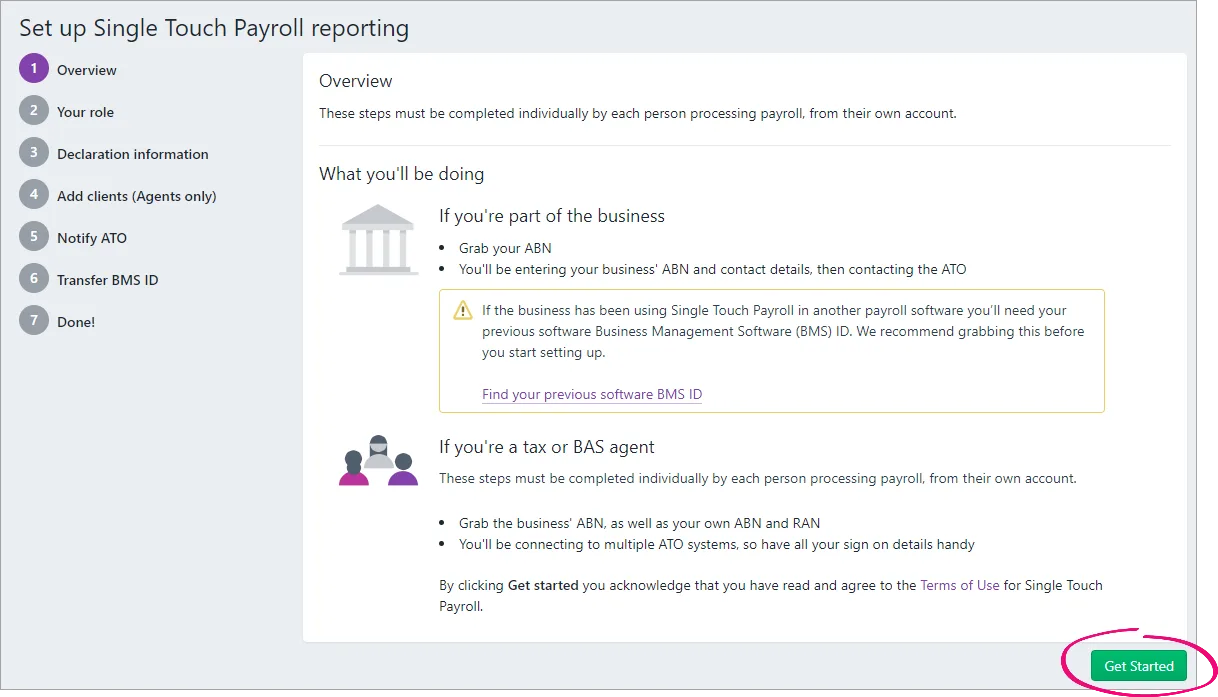

Go to the Payroll menu and choose Single Touch Payroll reporting. You'll be prompted to set up payroll reporting.

Click Get started.

If you're prompted to fix some errors first, it means STP hasn't been set up for your business. See Setting up Single Touch Payroll reporting.

At the Overview step, click Get Started. If you don't see the Overview step, it means you're signed in as a user who is already an STP declarer.

Select your role:

Someone from the business

Select Someone from the business.

Click Next.

If prompted, at the Declaration information step, enter the company’s ABN and your personal details. This is sent to the ATO with the payroll information. Then click Next.

At the Notify the ATO step, click I’ve notified the ATO. When prompted, click Confirm.

Only one person from the business needs to notify the ATO. If your company is already using STP, additional declarers don't need to do this step.

What you do at the Transferring BMS ID step depends on whether Yes or No was selected by the person who set up STP for the business.

If No is selected

Click Next.

If Yes is selected

Click Report previous BMS ID.

When prompted to send your payroll information to the ATO, enter your details and click Send.

And that's it — you're done! You're now able to submit information to the ATO after doing a pay run.

A Tax / BAS Agent

Select either A tax agent or A BAS agent

Enter your Agent ABN and Registered agent number (RAN).

Click Search to find your contact details – if you can't find these, you'll need to add them. Click Continue.

Enter your declarer information, including the business's ABN, your name and contact details and click Continue.

At the Add clients step, add this business to your client list in the Online Services for Agents (skip this step if they're already on your client list).

Click I've added this client.

At the Declaration information step, you need to let the ATO you're using MYOB for payroll reporting.

Get the Software ID. This is unique to you and you can't share it – each client and agent will have their own . If you use the wrong Software ID, the ATO will reject your reports.

Choose how you want to notify the ATO that you're using MYOB for payroll reporting:

Option 1. Phone the ATO on 1300 85 22 32

This only takes a few minutes. You'll need your own TFN, ABN or RAN (for agents) handy, to verify your identity.Follow the prompts and provide your unique Software ID and MYOB details when requested. This information is generated in MYOB and displayed in the page for this step.

Once confirmed, click I've notified the ATO.

Option 2. Create notification in Access Manager

If you have an Access Manager you can notify the ATO online. You can also create an Access Manager account.Detailed instructions: Notifying us of a hosted SBR software service (ATO website).

Log into Access Manager.

Click My hosted SBR software services from the left hand menu.

Click Notify the ATO of your hosted service.

Complete all steps with the unique Software ID and MYOB details.

Once confirmed, click I've notified the ATO.

Once you've notified the ATO that you're using MYOB software, click I've notified the ATO and in the message that appears, click Confirm.

What you do at the Transferring BMS ID step depends on whether Yes or No was selected by the person who set up STP for the business:

If No was selected, click Next.

If Yes was selected, click Report previous BMS ID, then, when prompted to send your payroll information to the ATO, enter your details and click Send.

And that's it — you're done! You're now able to submit information to the ATO after doing a pay run.