MYOB calculates the amount of superannuation you need to pay on behalf of your employees.

This topic explains how the super is calculated and how you can adjust overpaid or underpaid superannuation amounts.

How is superannuation calculated?

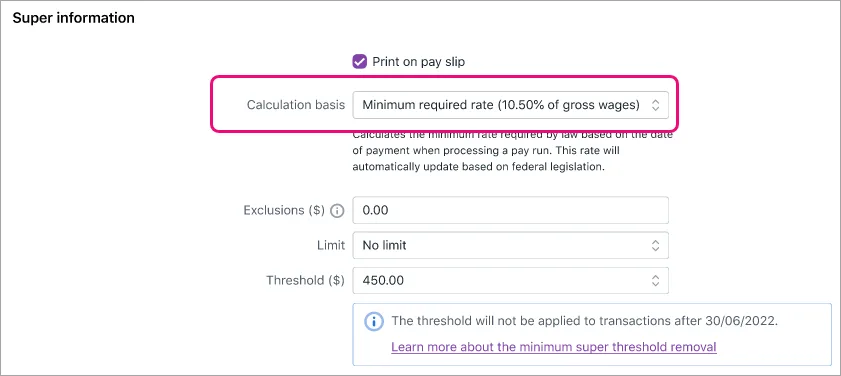

Superannuation guarantee contributions are calculated each pay run on the wage pay items that are not exempt from super calculations. It's calculated based on the Calculation basis set in the superannuation guarantee pay item (Payroll menu > Pay items > Superannuation tab > Superannuation guarantee). We recommend setting this to Minimum required rate so the correct rate will always be used – even when the government change the super rate. Tell me more...

Also see Paying super for employees aged under 18.

The ATO has a super guarantee calculator if you want to check how much super you should be paying.

Fixing super payments

If the incorrect super is from a previous payroll year, check with your accounting advisor before attempting to correct this in your software.

If you need to fix overpaid or underpaid superannuation, you can:

adjust the superannuation amount in a future pay, or

create a separate pay for the adjustment.

To make the super adjustment in an employee's next pay

The next time you pay the employee, click into the Superannuation Guarantee field and adjust the amount.

To make the super adjustment in a separate pay

If you want to process a super adjustment as a separate pay (with no other amounts in it), start a new pay for the employee and zero out all hours and amounts from the pay. Then enter the super adjustment amount in the Superannuation Guarantee field.

For example, if you've underpaid an employee's super, enter the underpaid amount as a positive number. If you've overpaid an employee's super, enter the overpaid amount as a negative value.

Here's an example to fix $100 of overpaid super: