If you have a customer who is also a supplier, set up two contact records for them: one as a supplier and one as a customer. You can then record payments and receipts as you usually do.

However, another way you can manage your payments is to offset your outstanding customer and supplier invoices by recording a contra payment. This topic explains how to do this.

First, you need to create a separate customer and supplier contact in MYOB. You then record invoices and bills against these contacts. This is the same process as you usually do.

When it comes time to pay, you record a contra payment that offsets the sale and purchase amounts. To record the payment, you'll need to set up a contra payment account. This account works like a bank account, but it's simply a clearing account which doesn't record actual cash.

OK, let's take you through it.

To create a contra payment account

Go to the Accounting menu and choose Chart of accounts.

Click Create account.

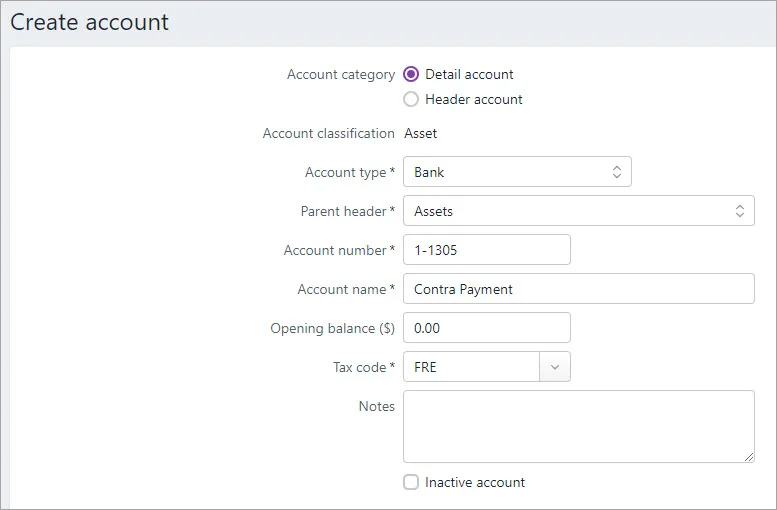

Leave the Account category set to Detail account.

For the Account type, choose Bank.

For the Parent header, choose the header account under which this new account will sit. If you're unsure which to choose, check with your accounting advisor.

Enter an Account number that suits your account list.

For the Account name, enter "Contra Payment".

Choose the applicable Tax/GST code. If you're unsure which to choose, check with your accounting advisor. Here's our example:

Click Save.

To record a contra payment

Record your invoices and bills as you usually do (including assigning the correct tax code). When you're ready to offset sales against your purchases, record a contra payment. It's a two-step process.

Record a payment for your sales.

Go to the Sales menu and choose In the Create invoice payment.

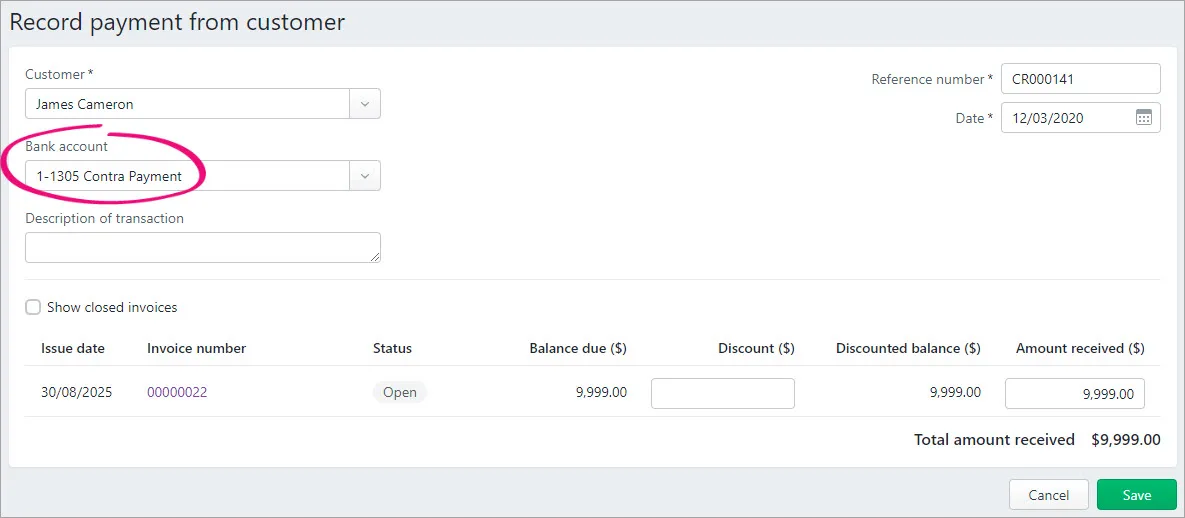

Choose the Customer.

In the Bank account field, choose the Contra Payment account.

Enter the amount that you need to offset against your outstanding invoices. Here's our example:

Record a payment for your purchases.

Go to the Purchases menu and choose Create bill payment.

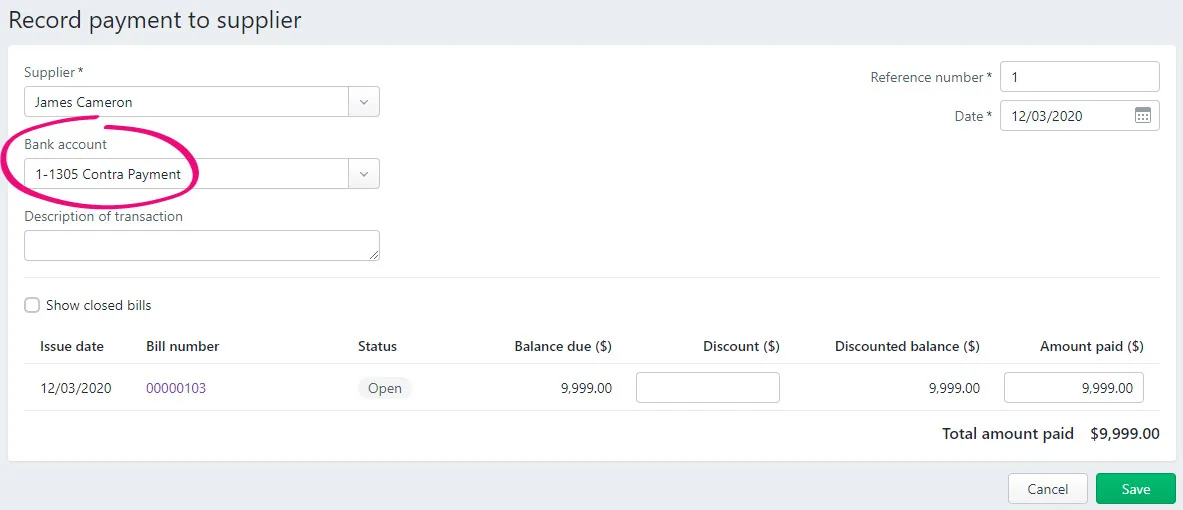

In the Supplier field, choose the supplier contact.

In the Bank account field, choose the Contra Payment account.

Enter the amount that you need to offset against your outstanding bills. Here's our example:

After recording these payments, your bank accounts are not affected; but your receivable and payable accounts have been reduced. Also, the Contra Payment account balance will be zero.