Not available in Series 6 & 8 A wizard is available on the Tax Returns tab to assist with creating activity statements. If the client does not have an income tax return for the lodging tax year selected, a return will be created. | UI Text Box |

|---|

| (Accountants Enterprise) If a return exists for a client, but the return code does not match the client code, you must create the activity statement by opening the income tax return and selecting the activity statement from Preparation > Schedules. | UI Text Box |

|---|

| | Warning: The Create Activity Stmt wizard will create a new tax return if the tax return code does not match the client code.

| UI Expand |

|---|

| expanded | true |

|---|

| title | To create an activity statement |

|---|

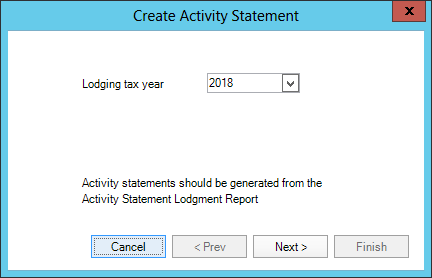

| - Select Create Activity Stmt from the Tasks bar.

Select Lodging tax year from the drop-down and click Next. | Note |

|---|

| The earliest year you can select is 2017. |

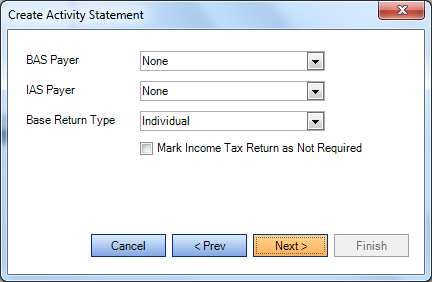

If the client does not have an income tax return for the lodging year selected, the following screen displays:

- Select the relevant BAS Payer, IAS Payer and Base Return Type from the drop-downs. The selections for BAS Payer and IAS Payer will update fields in the Return Properties > General tab.

- Select Mark Income Tax Return as Not Required if the base tax return will not be lodged.

This will save Return required to "T – Not this year" in the Return Properties > Lodgment tab. The base return will appear in the Tax Returns tab for the client only. - Click Next.

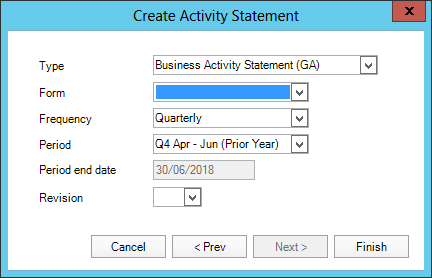

The final Create Activity Statement screen displays.

Type and Frequency are derived from the BAS Payer and IAS Payer settings on the main tax return, or from the selections on the previous screen for statement created without an existing return.

If no values are set for the BAS Payer or IAS Payer, the wizard defaults to quarterly BAS.

If a BAS exists for the lodging tax year selected, the wizard takes the period from that BAS and defaults the next period in this screen. Select Type, Frequency and Period as required. | UI Text Box |

|---|

| Revision defaults to blank if a statement does not exist for the period. If you select a period which already has an activity statement, the revision will increment by 1. |

- Click Finish.

The activity statement opens.

|

|