Refer to See Item 15 - Net income or loss from business on the ATO website for more information.

You cannot enter values at labels B, C, A, D, W, E or FThe amounts at item 15: labels: - B: Primary production income/loss and C: Non-primary production income are entered at item P8.

- D: W: E: and F: Tax withheld amounts are entered in the Payment summary schedule (PS)

- A is for sole trader small business entity income which is used to calculate the taxpayer's Small business income tax offset (SBITO).

| UI Expand |

|---|

| title | Label B - Net primary production income/loss |

|---|

| This amount defaults from label Y at item P8. | Click label B to move to item P8 to complete the primary production income and expenses. The result of these entries is the net income or loss at item P8: label Y. Use the Primary production income worksheet (Schedule C) to assist with completing this label. See Schedule C (primary production worksheet). |

| UI Expand |

|---|

| title | Label C - Net non-primary production income/loss |

|---|

| This amount defaults from label Z at item P8. | Click label C to move to item P8 to complete the Non-primary production income and expenses. The result of these entries is the net income or loss at item P8: label Z. Use the Non-primary production income worksheet (Schedule B) to assist with completing this label. See Schedule B (business income worksheet). |

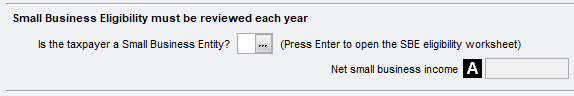

Small Business - Eligibility| UI Expand |

|---|

| title | Is the taxpayer a Small Business Entity? |

|---|

|  Image Added Image Added

This question must be answered and eligibility re-affirmed each year to be eligible for the Net small Small business income tax offset (SBTOSBITO), and to use the simplified depreciation rules. Press [Enter] at this question to open the Small Business Entity worksheet (sbe). The answer to both eligibility questions in the worksheet must be Y. Press [Alt+S] at question two 2 to open the Small business entity aggregated turnover worksheet (sat). You may can also access open the sbe worksheet from the depreciation worksheet (d) and if . If you have done so that the eligibility question will already be answeredY or N. Aggregated turnover for small business has been increased from $2 $10 million to $10 $50 million and for the SBITO, $5 million with an increase in the percentage applied to SBI up from 5% to 8% the rate of offset 8% applied to the small business income capped at $1,000. |

| UI Expand |

|---|

| title | Label A - Net small business income |

|---|

| If you have 've indicated that the taxpayer is a small business entity, values amounts will be defaulted from labels B and C to the fields in the Small business income worksheet (for SBTO) (sbc). Any offset calculated will be included in the taxpayer’s [F4] Estimate. |

Small Business - Tax Withheld| ui-text-box |

|---|

| | If the taxpayer received income from carrying on a business as an artist, composer, inventor, performer, production associate, active sportsperson or writer, the net business income/loss must be included at item 15: label C and the Taxable professional income (eligible income for averaging purposes) must be entered at item 24, label Z. For full details on calculating Professional eligible income, refer to Item 24 Label Z - Taxable professional income. |

| ui-expand |

|---|

| title | Integration from the Payment Summary schedule |

|---|

| Press [Enter] Click the label or press Enter at the labels D, W, E and F fields to open the Payment Summary summary schedule. Refer to Payment summary schedule (PS).The Payment Summary schedule the entries returned at the relevant labels in the return:The income amounts integrate filter through to item P8: labels C, A, E and N. The Tax withheld amounts integrate are totalled and filter through to item 15 labels D, W, E and F at item 15.

|

| UI Expand |

|---|

| title | Label D - Tax withheld - voluntary agreement |

|---|

| This amount will be is the sum of entries from the Payment Summary (PS) where the Income type is B and the payment type is V. The ATO will accept accepts dollars and cents at label D. |

| UI Expand |

|---|

| title | Label W - Tax withheld where Australian Business Number not quoted |

|---|

| This amount will be is the sum of entries from the Payment Summary (PS) where the Income type is B and the payment type is N. The ATO will only accept accepts whole dollar amounts at this label, so . To avoid rejection don't enter cents at label W. |

| UI Expand |

|---|

| title | Label E - Tax withheld - foreign resident withholding (excluding capital gains) |

|---|

| This amount will be is the sum of entries from the Payment Summary (PS) where the Income type is B and the payment type is F. The ATO will only accept accepts whole dollar amounts at this label, so . To avoid rejection don't enter cents at label E. |

| UI Expand |

|---|

| title | Label F - Tax withheld - labour hire or other specified payments |

|---|

| This amount will be is the sum of entries from the Payment Summary (PS) where the Income type is B and the payment type is S. | UI Text Box |

|---|

| | If the taxpayer received income from carrying on a business as an artist, composer, inventor, performer, production associate, active sportsperson or writer, the net business income/loss is shown at label C of item 15 but the Taxable professional income (eligible income for averaging purposes) must be entered at item 24, label Z. For full details on calculating Professional eligible income, refer to Item 24 Label Z - Taxable professional income.The ATO accepts dollars and cents at label D

CCH References 7-001 Concessions and tools for small business entities 7-200 Concessional corporate tax rate 10-110 Business income 16-015 Expenses necessarily incurred in carrying on a business 18-030 What is income from primary production? 26-100 PAYG withholding: introduction |