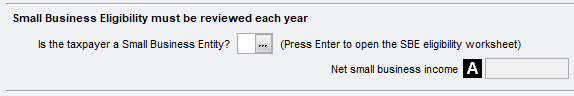

This question must be answered and eligibility re-affirmed each year to be eligible for the Small business income tax offset (SBITO), and to use the simplified depreciation rules. Press Enter at this question to open the Small Business Entity worksheet (sbe). The answer to both eligibility questions in the worksheet must be Y. Press Alt+S at question 2 to open the Small business entity aggregated turnover worksheet (sat). You can also open the sbe worksheet from the depreciation worksheet (d). If you have done that the eligibility question will be Y or N. Aggregated turnover for small business has been increased from $10 million to $50 million and for the SBITO, $5 million with the rate of offset 8% applied to the small business income capped at $1,000. |