See Item 24 - Other income on the ATO website for further information. E - Tax withheld - lump sum in arrearsThese payments relate to an earlier income year or years and would normally be shown at E on your PAYG payment summary – individual non-business, or at E on your PAYG payment summary – foreign employment. See Item 24 - Other income on the ATO website for further information. Z - Taxable Professional IncomeMYOB Tax (and the ATO) need the eligible Taxable professional income (PFI) to calculate any averaging offset. The Estimate Tab in the Return properties for the client store and control the 4 years of PFI from year-to-year. See Div 405 Averaging for further information. The amount to be entered at Taxable professional income at label Z is calculated as the amount remaining after deducting from the assessable professional income the total of deductions that reasonably relate to this income. | UI Text Box |

|---|

| Do NOT deduct from the amount at label Z any apportionable deductions - for example gifts to charity that have been shown at item D9 as both the ATO and Tax will perform that calculation during the preparation of their Assessment/Estimate of tax payable. |

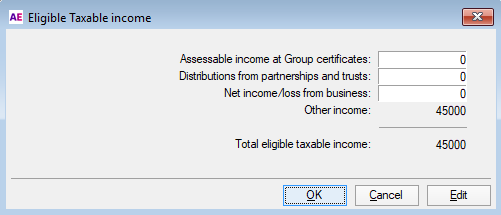

When you enter the Eligible income amount at label Z, the dissection dialog is opened and the amount you entered has defaulted to the Other income field. To assist with the correct calculation of the income for averaging, you need to dissect that amount. If the income is from Salary or wages, then the relevant amount should be keyed in that field - likewise for the other types of income.

Eligible income from the previous 4 years is stored and managed in the Return properties > Estimate tab. The 5th year's PFI is calculated from the current year amounts entered in the return. If it is not to the taxpayer's advantage to average this year, then tick the checkbox ‘Averaging NOT required this year for Eligible professional income’.

Label S - Tax withheld - Assessable FHSS released amountSee First home super saver scheme If you requested a release of an amount under the FHSS scheme during 2018–19, you must include in your 2019 tax return: - any such FHSS amount

- the tax withheld amount.

You'll have received a payment summary from the ATO showing the assessable FHSS amount and the tax withheld. If you requested the release of an FHSS amount during 2018–19, even if you did not receive the amount until after 30 June 2019, you must still include it in your 2019 tax return. If you use ATO-pre-fill then the amounts will be pre-populated. See Pre-fill manager. CCH References 13-790 First home savers superannuation scheme |