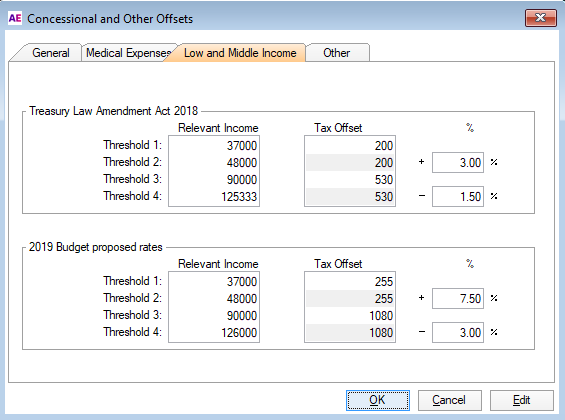

A new low and middle income tax offset applies for 2018–19, 2019–20, 2020–21 and 2021–22 income years. You can't claim this offset at any label in the individual return. The ATO and MYOB Tax will calculate it where applicable and include it in the Estimate of tax payable. Australian resident individuals (and certain trustees) whose income does not exceed $125,333 are entitled to the new low and middle income tax offset. Entitlement to the new offset is in addition to the existing low income tax offset, and is available on assessment after you lodge your income tax return. If your income: does not exceed $37,000 you are entitled to $200

exceeds $37,000 but does not exceed $48,000, you are entitled to $200 plus 3% of the amount of the income that exceeds $37,000

exceeds $48,000 but not $90,000, you are entitled to $530

exceeds $90,000 you are entitled to $530 less 1.5% of the amount of the income that exceeds $90,000.  Image Added Image Added

Offset: This is the maximum available rebate. Threshold: This is the figure above which the rebate is reduced by $1 for every $4 of income in excess of this amount. Reduction: This is the reduction rate expressed as a percentage. |