To enter an employee tax code click Employee > Modify Employee Details > Taxation. Select your employee from the drop-down menu, then click Tax Code. The Tax Code Selection window opens.  Image Modified Image Modified

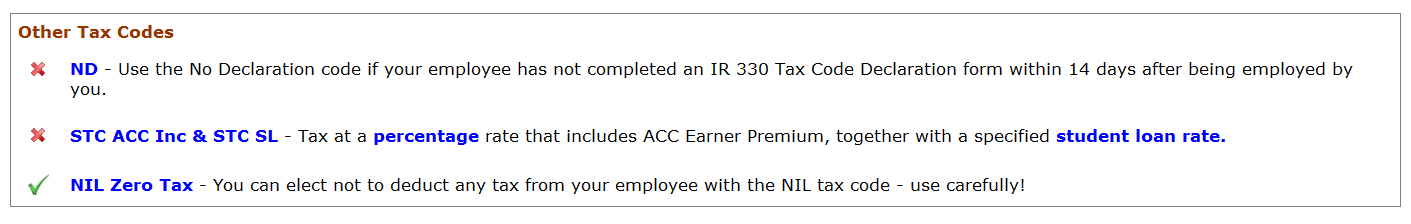

The most commonly used codes are shown towards the top of the screen. All tax codes are available by scrolling down. Click a code to select it. A tick appears next to your selection. At the top of the screen is a link to Download an IR330 Tax Code Declaration, which you need all new employees to complete for your records. Tax codes can also be entered from the Tax Ready Reckoner, in the Utilities menu on the front screen.

Percentage Tax DeductionInland Revenue may send you an IR23 Special Tax Code Certificate asking you to deduct tax at a specified percentage rate. The rate specified by the IRD may be inclusive of ACC Earner Premium, or plus ACC Earner Premium. The certificate will specify whether the rate is plus ACC Earner Premium, or inclusive of ACC Earner Premium.

Inclusive of ACCIf the rate is inclusive of ACC Earner Premium, the rate will be a whole number such as 11 cents in the dollar (11%). Tick STC ACC Incl as shown above, then enter the percentage value and ensure you select the code to be inclusive of ACC Earner Premium.

Plus ACCIf the rate is plus ACC Earner Premium the rate will a strange number, such as 29.39% If the rate is 29.39% inclusive, the breakdown of that number is 28% tax, plus earner premium of $1.39 per $100. Set this by ticking STC ACC Plus, then click percentage and enter 28 as the percentage. Not only does this produce the correct tax deduction, but when the earner premium changes in the future it is automatically adjusted by Ace Payroll without any additional input.

Student Loan Special Tax CodesInland Revenue may send you an IR23 Special Tax Code Certificate asking you to deduct student loan repayments at a set rate. You do this using the SL STC tax code. When producing printed and electronic employer monthly schedules this code is shown as STC but internally Ace Payroll shows it as SL STC to provide a little more information about the tax code. After entering the Tax Code Selection window, scroll down to the student loan tax codes. Tick the SL STC code, click the student loan rate link, and enter the specified rate.

Withholding Tax at Zero PercentIf Inland Revenue has asked you to deduct withholding tax for a contractor at zero percent with no earner premium, set the employee tax code to 'NIL Zero Tax'. In the Tax Code Selection window, scroll down - it is the last tax code shown. No tax will be deducted from the employee wages, and the gross payment will still be returned on your monthly schedule showing the tax code as STC - special tax code.

|