New Zealand only The Accounting Income Method (AIM) is a new way of calculating provisional tax for small businesses in New Zealand. Businesses choosing to use AIM will make more frequent provisional tax payments based on their actual current earnings rather than calculations on last year's income. This makes AIM a great 'pay as you go' option for growing businesses or businesses with fluctuating, seasonal income. Jump ahead to: How does AIM work?When it comes time to pay provisional tax, MYOB Essentials will use AIM to calculate what you owe straight from your chart of accounts and gather the info into your statement of activity. This is then sent to Inland Revenue. Note that a statement of activity isn't an income tax return and isn't processed as one. This means if you make a mistake you can simply fix it in the next statement. More of a visual learner? Check out this short video on how AIM works with MYOB Essentials. | HTML |

|---|

<div class="wistia_responsive_padding" style="padding:56.25% 0 0 0;position:relative;"><div class="wistia_responsive_wrapper" style="height:100%;left:0;position:absolute;top:0;width:100%;"><iframe src="https://fast.wistia.net/embed/iframe/j62ncbhwu0?videoFoam=true" title="Wistia video player" allowtransparency="true" frameborder="0" scrolling="no" class="wistia_embed" name="wistia_embed" allowfullscreen mozallowfullscreen webkitallowfullscreen oallowfullscreen msallowfullscreen width="100%" height="100%"></iframe></div></div>

<script src="https://fast.wistia.net/assets/external/E-v1.js" async></script> |

Sounds great! Where do I start?You first need to check that your business is eligible to use AIM. See the table below for the AIM requirements. If you have any questions, please see the Inland Revenue website or speak with your accountant. | If you... | then... |

|---|

| have turnover under $5 million, and | You can use AIM | | opt in before your first provisional tax date for the year | | have investments in foreign investment funds (FIF) or controlled foreign companies (CFC) for the income year, or | Sorry, you can't use AIM | | are in a transitional year (a year in which you've changed your balance date), or | are any of the following:

partnership

trust

Māori authority

superannuation fund

portfolio investment entity (PIE) |

Setting up AIM in your MYOB Essentials business After confirming your eligibility, you need to map each account in your ledger to the AIM statement of activity. This is done from within your GST & provisional return filing report. | UI Expand |

|---|

| title | Mapping your accounts |

|---|

| Mapping your accounts- Click Reports in the MYOB Essentials menu bar, then choose All reports.

- In the Business reports sections, click GST & provisional tax filing.

- The GST & provisional tax filing page appears.

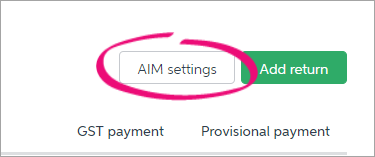

- Click AIM settings.

The AIM settings page lists every field on the AIM statement of activity. You need to map all of your ledger accounts to a field.

Note that not every field will be mapped to an account, but all of your accounts must be mapped before lodging your provisional tax return using AIM. Starting from the topmost field (Gross income from sales and/or services) and working your way down, click +Map account(s) and select all applicable accounts for each field.

Image Modified Image Modified | UI Text Box |

|---|

| If you're unsure about where to map your accounts, please speak with your accountant. |

- When you've finished mapping your accounts, click Save & Exit. You can come back tothis page to finish mapping your accounts or to map a newly created account.

Image Modified Image Modified

|

When you're ready, learn about filing an AIM statement of activity. |