Australia only Some industries, including building and construction, cleaning or courier services, or government entities, are required to report to the ATO the amount of payments made to contractors for services (such as labour). Payments need to be reported to the Australian Taxation Office (ATO) on the Taxable Payments Annual Report, or electronically. Do I need to report payments?There's a growing list of businesses which may need to report payments. To check the list, visit the ATO website. What transactions do I need to report?You need to report the total payments you make to each applicable contractor or supplier for building and construction services each year. This doesn’t include payments for materials, but you should report any transactions that include a service component. For example, you would be required to report a transaction involving the purchase of paint alongside painting services. For more information , see the ATO on the payments you need to report, visit the ATO website. What do I need to do?At the end of the financial year, you need to produce the Taxable payments annual report to declare all of your taxable payments to the ATO. To be able to produce the report, you need to follow the setup steps below. In order to report taxable payments, you just need to select which suppliers and transactions are reportable. | UI Expand |

|---|

| title | To mark a supplier as reportable |

|---|

| To mark a supplier as reportableIf most of your transactions with a particular supplier are reportable, you can save time by marking them as reportable. When you do this, all transactions involving this supplier will be automatically marked as reportable. If you need to, you’ll be able to change whether an individual transaction is reportable (see To mark transactions as reportable or not reportable below). - Go to the Contacts menu and choose All contacts.

- For the Contact type, choose Supplier.

- Click the supplier you want to mark as reportable.

- In the Details section of the contact, select the option Report payments to ATO via TPAR.

- Click Save.

- Repeat for each supplier you want to mark as reportable.

|

| UI Expand |

|---|

| title | To mark transactions as reportable or not reportable |

|---|

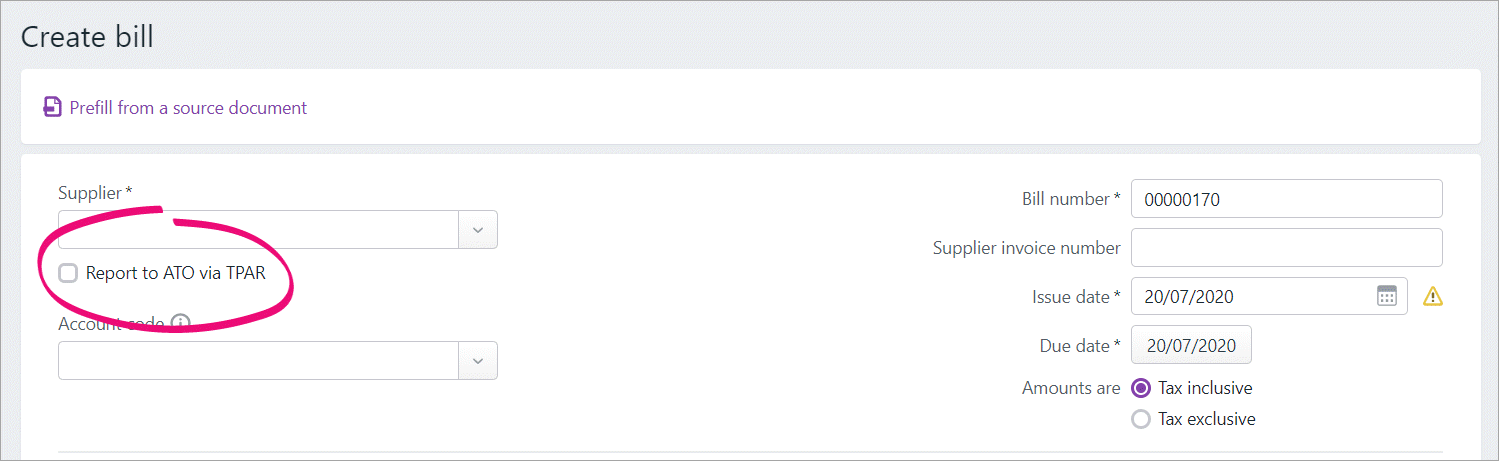

| To mark transactions as reportable or not reportableWhen you're entering a bill or creating a spend money transaction, if the option, Report to ATO via TPAR, is selected it means the transaction is reportable. Deselect this option of the transaction isn't reportable.

|

What now?When you're ready, you can produce the Taxable payments annual report. |