If you're in AustraliaTax file number declarationBefore filling in this tab, make sure the employee has provided you with a completed Tax file number declaration form (which you'll need to lodge online (not through MYOB Essentials) or post to the ATO). If they’re claiming any other variations or exemptions, they need to get the appropriate forms from the ATO, fill them in and give them to you. These forms will contain all the information you need when filling in details on this screen. The Tax file number declaration form can be obtained from the ATO. See the ATO website for more information. To complete this section, simply copy the employee’s answers from the numbered questions on the Tax file number declaration form into the matching numbered fields on this page. | UI Text Box |

|---|

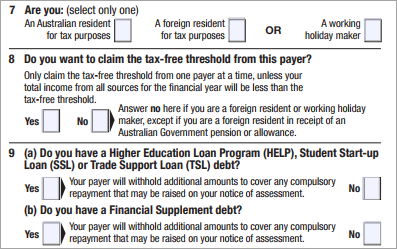

| Tax file number declaration form changes The ATO has recently updated the Tax file number declaration form and we're updating the question numbers in MYOB Essentials to match. You'll still be able to complete the details in MYOB Essentials using the information provided on the form—which now looks like this:  Image Removed Image Removed

|

Withholding variations (Miscellaneous)If the employee is eligible for a withholding variation, they’ll have arranged this previously with the ATO. To claim the variation, they need to give you a Withholding variation declaration form, available from the ATO website. The form needed will depend on the type of variation. Enter the variation in MYOB Essentials as a flat rate of tax to be applied to the employee's gross pay.  Image Removed Image Removed

|