- Created by admin, last modified by RonT on Jun 08, 2023

https://help.myob.com/wiki/x/1oER

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

New Zealand only

For Australian help, click here.

When adding an employee, enter their tax details on the Tax tab of their employee record. This ensures MYOB Essentials withholds the correct amount of tax from their pay.

You can access an employee's tax details via the Payroll menu > Employees > click the employee > Tax tab.

To add employee tax details

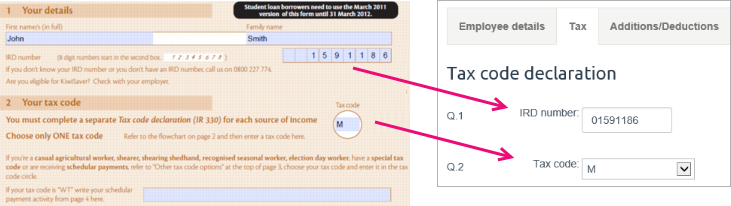

Before filling in this tab, make sure the employee has completed and given you an IR 330 Tax code declaration form. They can download this form from the IRD website.

If they’ve got a special tax code or are required to make student loan repayments, they may also give you a Special tax code or student loan repayment certificate (IR23). These forms will contain all the information you need when filling in the details on this screen.

To complete this section, simply copy the employee’s answers from the numbered questions on the Tax code declaration (IR330) form into the matching numbered fields on this page.

There are different tax rules for primary and secondary school students. Select this option if the employee is currently a student in primary or secondary school.

For more information about tax rules for primary and secondary school students, see the IRD website.

Your employee might give you a Special tax code or student loan repayment (IR 23) certificate, which authorises you to deduct tax at a different rate, or not at all. Copy the information about the deduction rates from the form into the matching fields on this screen.

Note that you must see this certificate before you can change the rate at which PAYE is deducted from your employee’s pay.

To set up a special tax code

- On the Tax tab, select the option Employee or schedular payee has given a tailored tax code or student loan repayment - IR23 Certificate.

- Select the option PAYE at the tax rate of and enter the information from the certificate the employee has supplied.

- In the first field, enter the rate at which tax is to be deducted excluding the ACC Levy.

- In the second field, enter the ACC Levy deduction.

- Click Save.

If your employee hasn't had the right amount of student loan repayments deducted from their pay, you may be required by the IRD to make compulsory extra deductions. See the IRD website for more details.

If an employee's tax code is set to a student loan code (e.g., S SL, ME SL), an SLCIR deduction checkbox will appear below.

Check the box and enter the required percentage deduction in the Percentage (%) field.

FAQs

How can I deduct extra tax for an employee each pay?

To deduct extra tax for an employee, overwrite the PAYE figure when processing their pay. For example, to deduct an extra $20 tax from a pay, click into the PAYE field and overtype the amount to include the additional $20.

The tax should be the last thing you change on a pay as any other changes will force a recalculation of the PAYG/PAYE figure.

See it in action:

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.