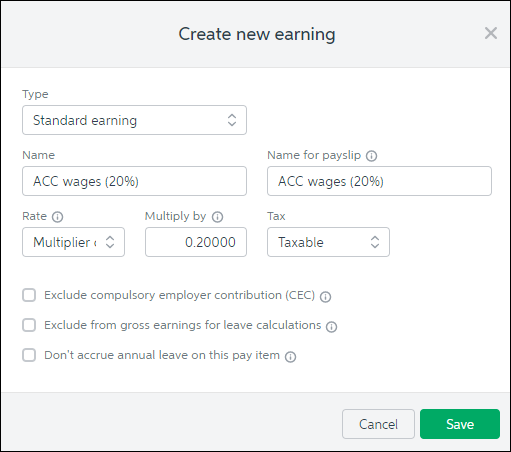

(New Zealand) How do I set up a pay item for ACC payments?There's a few variables when it comes to ACC payments, so you should start by asking an accounting advisor for the best solution for your needs. For example, if your employee needs time off work and ACC are covering their injury, ACC will usually pay 80% of their standard wage after the first week. If the injury occurred at work then you would usually need to pay them for the first calendar week (or part week) at 80% of what they would have earned. To cater for these various pay rates, you can set up earning pay items (Payroll > Pay items > Create earning). Here's an example pay item to pay 20% of the employee's normal pay:

Holiday pay for an employee is calculated at 8% of gross earnings. So, if the employee is getting paid 20% through the new earning pay item, holiday pay will be calculated on that value (this assumes you haven't selected the option Exclude from gross earnings for leave calculations for the pay item). As mentioned above, there's a few variables so check with an expert for help with your scenario—the community forum is a great place to start. Learn more about creating pay items |