| HTML |

|---|

<span data-swiftype-index="true"> |

| HTML Wrap |

|---|

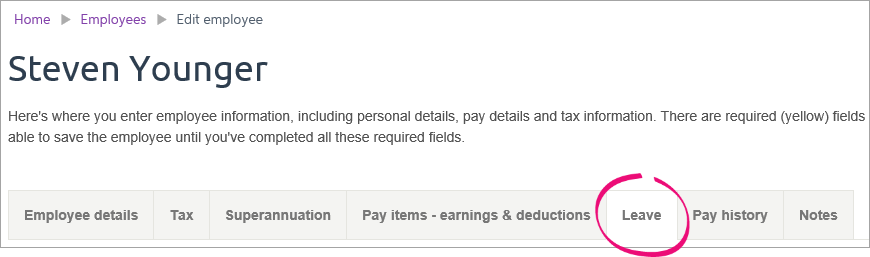

| When adding an employee into MYOB Essentials, you'll need to set up their annual leave and personal leave (sick leave) entitlements. You do this on the Leave tab of the employee's record (Payroll menu > Employees > click the employee > Leave tab).

The way you set up leave depends on your location. | UI Expand |

|---|

| For each employee entitled to leave, you need to: |

Enter - choose if the employee is entitled to leave

- enter opening leave balances (this is the leave already owing to an employee when you set them up in MYOB Essentials)

|

Enter - set up their annual and personal leave entitlements (this is how much leave the employee will accrue as they work).

Once you've set up an employee's leave, learn about managing their leave (this includes viewing leave balances, adjusting leave, showing leave on payslips, and paying unused leave). |

| Anchor |

|---|

| opening | opening | Enter opening leave balances | UI Expand |

|---|

| title | Choose whether the employee receives paid annual leave and personal leave |

|---|

|

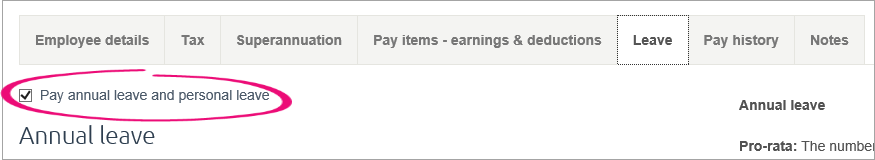

| (Australia) | Choose whether the employee receives paid annual leave and personal leave |

(Australia)When you start using MYOB Essentials for leave management, or when you create a new employee record, select whether you pay them annual leave and personal leave, by selecting or deselecting the option on the Leave tab of their employee record.  Image Modified Image Modified

If you select this option (for example, if the employee is part-time or full-time), they will begin accruing leave the next time you include them in a pay run. If you don’t select this option (for example, if the employee is a casual), you don’t need to enter leave entitlements and opening balances. |

| UI Expand |

|---|

| title | Enter opening leave balances |

|---|

|

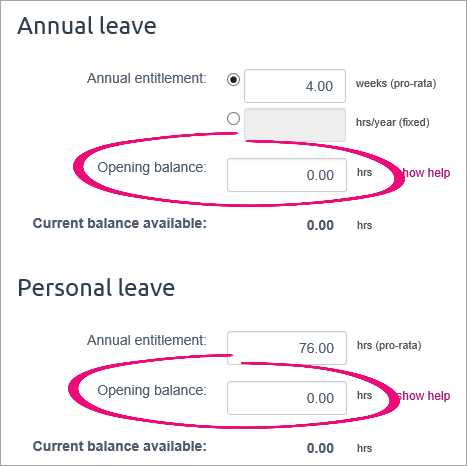

| (Australia) | Enter opening leave balances |

(Australia)New employeesWhen you add a new employee (Payroll menu > Employees > Add Employee), their annual leave and personal leave opening balance on the Leave tab will be zero. The employee will begin accruing leave after you have included them in a pay run.  Image Modified Image Modified

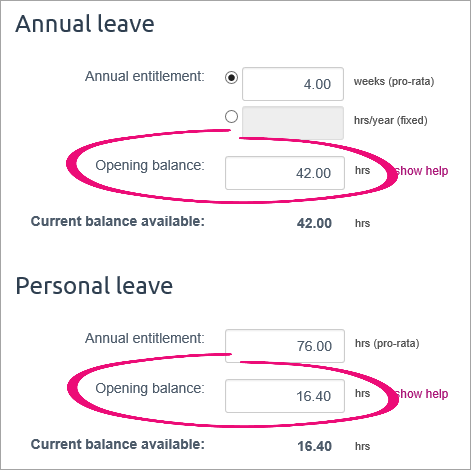

Existing employeesIf you’ve been manually tracking leave for an employee, enter their current leave balance. You should be keeping track of this for all existing employees, so simply copy over the amount of leave they are currently entitled to, into this field.  Image Modified Image Modified

|

Enter opening leave balances (New Zealand) | Enter opening leave balances (New Zealand) | | Set up annual leaveThere are two ways an employee can accrue annual leave: - Weeks—Enter how many weeks of annual leave the employee gets per year. Since accrued leave is tracked in hours, the actual number of hours accrued will depend on how much they work. However, it will normally result in the same number of weeks’ holidays, at each employee’s normal hours.

For example, say your employees are entitled to four weeks of annual leave each year. A full-time employee (working 38 hours per week) will accrue 152 hours per year (that is, four weeks, at 38 hours per week). A part-time employee who works 19 hours per week will accrue 76 hours each year (that is, four weeks at 19 hours per week). In both cases, this is equivalent to four weeks of leave at their normal hours. - Hours—Enter a fixed number of hours. The employee will accrue this number of hours each year, regardless of how much they work.

For example, say all of your employees are entitled to 152 hours of annual leave per year. A full time employee will be able to take four weeks of annual leave (at their normal 38 hours per week). However, a part time employee who works 19 hours per week will be able to take four weeks of leave at their normal hours.

|

| UI Expand |

|---|

| title | Set up personal leave |

|---|

| Set up personal leaveThe personal leave entitlement that you enter on this screen is the number of hours of personal leave that the employee will accrue if they work full-time (that is, 38 hours per week as per the Fair Work Australia guidelines). By default, this is set to 76 hours (equivalent to 10 days). If the employee works less than 38 hours per week, the amount of leave they accrue will be automatically scaled. For example, an employee working 19 hours per week (that is, half of full-time hours) will accrue half of the entitlement shown. For more information see Managing your employees’ leave. |

|

| UI Expand |

|---|

| For each employee entitled to leave, you need to: - Enter opening leave balances (this is the leave already owing to an employee when you set them up in MYOB Essentials)

- Set up their leave entitlements (this is how much leave the employee will accrue as they work)

Once you've set up an employee's leave, learn about managing their leave (this includes viewing leave balances, adjusting leave, showing leave on payslips, and paying unused leave). | UI Expand |

|---|

| title | Enter opening leave balances |

|---|

| Enter opening leave balancesNew employees When you add a new employee (Payroll menu > Employees > Add Employee), their annual leave, alternative holiday and sick leave opening balance on the Leave tab will probably be zero. The employee will begin accruing leave after you have included them in a pay run. | UI Text Box |

|---|

| Under the Holidays Act 2003, an 'accrual' is considered to be an estimate of entitlements. For more information, see the Employment New Zealand website. |

|

Image Removed Image Removed Image Added Image Added

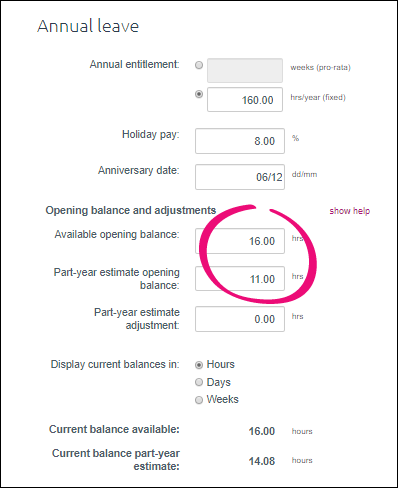

Existing employeesIf you’ve been tracking annual leave for an employee in another system, enter the opening balance for both available and Part-year estimate leave. Note that you can only edit the Part-year estimate opening balance before the employee's first-anniversary date in MYOB Essentials. These balances will be reflected in their respective current balance fields. Note that you can choose whether to display current balances in hours, days or weeks. With each pay run, the current balance will increase, while the opening balances will remain the same. |

Image Removed Image Removed Image Added Image Added

After the pay run which includes the employee’s anniversary date in Essentials has occurred, the opening balance is rolled into the current balance available, and the part-year estimate opening balance field becomes uneditable. If you need to enter a Part-year estimate adjustment, see Managing your employees’ leave. The opening balance available field can be edited at any time, but remember that any change will be reflected in the employee’s current balance available. You might need to do this to adjust an employee's leave balance. | UI Text Box |

|---|

| If you delete the employee’s pay run which includes their anniversary date, the part-year estimate opening balance field will become editable again until another pay run is done. |

When you finish entering annual leave opening balances, enter opening balances for both alternative holidays and sick leave. |

|

| Anchor |

|---|

enterentitlements | enterentitlements | Enter leave entitlements| UI Expand |

|---|

| Annual leaveThere are two |

ways an employee can accrue methods of managing annual leave ( |

note that in New Zealand, employees must be permanent or part-time to accrue annual leave):- Weeks—Enter how many weeks of annual leave the employee gets per year. Since accrued leave is tracked in hours, the actual number of hours accrued will depend on how much they work. However, it will normally result in the same number of weeks’ holidays, at each employee’s normal hours.

For example, say your employees are entitled to four weeks of annual leave each year. A full-time employee (working 38 hours per week) will accrue 152 hours per year (that is, four weeks, at 38 hours per week). A part-time employee who works 19 hours per week will accrue 76 hours each year (that is, four weeks at 19 hours per week). In both cases, this is equivalent to four weeks of leave at their normal hours. - Hours—Enter a fixed number of hours. The employee will accrue this number of hours each year, regardless of how much they work.

For example, say all of your employees are entitled to 152 hours of annual leave per year. A full time employee will be able to take four weeks of annual leave (at their normal 38 hours per week). However, a part time employee who works 19 hours per week will be able to take four weeks of leave at their normal hours.

|

| UI Expand |

|---|

| title | Personal leave (Australia) |

|---|

| Personal leave (Australia)The personal leave entitlement that you enter on this screen is the number of hours of personal leave that the employee will accrue if they work full-time (that is, 38 hours per week as per the Fair Work Australia guidelines). By default, this is set to 76 hours (equivalent to 10 days). If the employee works less than 38 hours per week, the amount of leave they accrue will be automatically scaled. For example, an employee working 19 hours per week (that is, half of full-time hours) will accrue half of the entitlement shown. For more information see Managing your employees’ leave. |

also known as annual holidays) entitlements in MYOB Essentials: fixed and pro-rata. It's important to consider these carefully. All employees are entitled to a minimum of four weeks’ annual holidays each year after 12 months of continuous service. MYOB Essentials manages leave in hours, so you need to work out what an employee’s four week leave entitlement is in hours. When employees work the same, or a similar number of hours each week, this process is simple. For example, an employee who works 40 hours a week would receive 160 hours per year. With employees who work variable hours or a have a pattern that changes weekly, determining a four-week entitlement may not be as easy. When unclear, employers and employees can agree on what genuinely constitutes a working week, and then multiply this by four to arrive at an annual entitlement. One option is to use the longest working week as this will ensure the employee can take four weeks paid leave regardless of the weeks taken. Decisions on entitlements should always be made in accordance with good faith obligations and via engagement and agreement with employees. FixedWe recommend using this method which accrues the same amount of leave each pay period regardless of the hours worked. Work out the annual entitlement in hours and enter this in the hrs/year (fixed) field.  Image Added Image Added

Each pay, a portion of the entitlement is added to the employees estimated leave accrued since anniversary and on the next leave anniversary date, the estimated accrued leave is given to the employee as available leave and the estimated leave accrued since anniversary resets to zero. It's important to check the employees receive their full entitlements. If required, you can update their balance using the available balance adjustment field. Pro-rataPro-rata is a leave accrual method which calculates an employee’s four weeks of leave based on the hours worked each pay. Historically, this method has been used when an employee’s hours varied across pay periods, so it was difficult to determine what a working week was for the purpose of annual leave. It’s important to note that this method isn’t defined within the Holidays Act and MBIE’s guidance cautions about its use, as there’s a risk that an employee may not receive their full four weeks of leave. While MYOB Essentials continues to support this method of leave calculation, we caution that it should only to be used when an agreement exists to use it and that its use should be reviewed regularly in case a work pattern has changed or becomes predictable. |

| (New Zealand) (New Zealand)The sick leave entitlement is the number of Most employees are entitled to five days of sick leave |

that the employee will accrue each year. By default, this is set to 10 days, regardless of how many hours the employee works each week. You can use the Maximum accrual is field to set the maximum number of sick leave days the employee can have accrued. |

| UI Expand |

|---|

| title | Holiday pay percentage (New Zealand) |

|---|

| Holiday pay percentage (New Zealand)For casual and contract workers, this percentage is added to their gross salary each pay period, instead of accruing annual leave. For example, if their gross pay one week is $1000, they will receive an additional $80 in holiday pay. For permanent and part-time employees, this percentage is used to calculate payment of accrued holidays when leaving employment. The accrued holiday payment is the holiday pay percentage of the gross pay they’ve earned since their last anniversary date. For example, if they’ve earned $10,000 since their last anniversary date, and their holiday pay percentage is 8.00%, then their accrued holiday payment will be $800. Note that the minimum legal rate for holiday pay is 8%. For more information, see the Department of Labour websitee. |

per year. The first entitlement becomes available after 6 months service of continuous service, then every 12 months. The minimum annual entitlement must be five days and cannot be pro-rated based on hours or days worked. Unused sick leave is carried over up to the maximum amount defined, which must be at least 20. For new employees, minimum sick leave entitlements are set up by default. For migrating employees, enter their sick leave anniversary date and then any existing balances in the opening balance field. Continuous service typically means having a regular work pattern and expectation of ongoing work. Employees who work irregularly, such as casuals, can still be entitled to sick leave if during a six-month period they have worked for the employer an average of at least 10 hours per week, including at least one hour per week, or 40 hours a month.  Image Added Image Added

|

| (New Zealand) (New Zealand)Anniversary dates determine when employees are |

used determine when an employee’s becomes available can will typically have a different anniversary date for annual |

leave personal leave (for example, if they started as a casual employee with no annual leave entitlement, and then became full time), but usually these dates will both be the same as the employee’s start date.| UI Expand |

|---|

| Holiday payAll employees must have their holiday pay rate set to 8% (or higher, if specified in the employment agreement). For employees who receive annual leave entitlements, the holiday pay rate is used as part of the final pay calculation. It is also used for employees who are eligible to be paid holiday pay with each pay instead of receiving annual holiday entitlements. Employees who have their status in the employee details set to Casual or Fixed-term will have holiday pay added to each pay by default. However, there are instances where this is not correct: - Employees on a fixed term contract of 12 months or greater should have their status set to Full-time to receive annual leave entitlements. Only employees on genuine fixed-term agreements of less than 12 months are eligible to be paid holiday pay with each pay.

- Employees on casual employment agreements are not automatically eligible to be paid holiday pay with each pay. Depending on their work pattern it’s possible that they should be set up as a part time employee and receive annual leave entitlements. We recommend checking with MBIE if you’re unsure.

Image Added Image Added

|

| UI Expand |

|---|

| title | Available and accruing annual leave |

|---|

|

| (New Zealand) | Available and accruing annual leave |

(New Zealand)Employees accrue the specified amount of annual leave over the course of the year. On their anniversary date, it becomes available, and moves from their accruing balance to their available balance. It’s possible for employees to negotiate to take leave that is accrued but not yet available, but this will result in a negative available balance until the next anniversary date, when the accruing leave (already taken by the employee in this case) becomes available. For more information about managing your employees’ leave in MYOB Essentials, see Managing your employees’ leave.The Holidays Act 2003 states that an employee isn’t entitled to annual holidays until 12 months of continuous employment has passed. However, it’s common practice for employers to allow employees to take leave in advance of it becoming entitled. This will result in a negative available balance until the next anniversary date. The Estimated accrued leave since anniversary field tracks an estimate of the leave accrued since the last anniversary (or start date within the first year). While the concept of leave accruing is not described in the Holidays Act 2003, it is provided in MYOB Essentials to show how much leave an employee can take in advance. The accrual estimate increases each pay. On the annual leave anniversary date: - the accrued hours are added to the Available balance, and

- the estimate accrual resets to zero.

The amount added to their available leave on the anniversary date must be four weeks (in hours) based on their agreed definition of a week. For both the available and estimated accrued leave, adjustment fields are provided to update leave balances when work patterns change. For more details see Updating leave balances. |

|

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | How do I pay rostered days off (RDOs)? |

|---|

| How do I pay rostered days off (RDOs)?While MYOB Essentials can't track the accrual of RDOs, you can set up a new earning to cater for RDO payments. For all the details see Rostered days off (RDOs). |

| UI Expand |

|---|

| title | How do I pay long service leave? |

|---|

| How do I pay long service leave?While MYOB Essentials can't track the accrual of long service leave, you can set up a new earning to cater for long service leave payments. For all the details see Long service leave. |

| UI Expand |

|---|

| title | How do I pay time off in lieu? |

|---|

| How do I pay time off in lieu?While MYOB Essentials can't track the accrual of time off in lieu, you can set up a new earning to cater for time in lieu payments. For all the details see Time off in lieu. |

| HTML Wrap |

|---|

| width | 15% |

|---|

| class | col span_1_of_5 |

|---|

| | |

| HTML Wrap |

|---|

| float | left |

|---|

| class | col span_1_of_5 |

|---|

| | Panelbox |

|---|

| name | magenta |

|---|

| title | Related topics |

|---|

| |

| Panelbox |

|---|

| name | yellow |

|---|

| title | From the community |

|---|

| | RSS Feed |

|---|

| titleBar | false |

|---|

| max | 5 |

|---|

| showTitlesOnly | true |

|---|

| url | http://community.myob.com/myob/rss/search?q=leave&filter=labels%2Clocation%2CsolvedThreads&location=forum-board%3AEssentialsAccounting&nospellcheck=true&search_type=thread&solved=true |

|---|

|

|

|

|