| HTML Tablestyle |

|---|

| cellpadding | 5 |

|---|

| cellspacing | 0 |

|---|

| align | right |

|---|

|

...

| HTML Table |

|---|

| summary |

|---|

| cellspacing | 0 |

|---|

| class | tn_TableNarrow |

|---|

| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: #E6E6E6; border-top-color: #C8C8C8; border-top-style: solid; border-top-width: 1pt; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: middle; width: 234.666141732283pt; |

|---|

|

| Anchor |

|---|

1106523 | 1106523 | Task| Table Cell (td) |

|---|

| style | background-color: #E6E6E6; border-top-color: #C8C8C8; border-top-style: solid; border-top-width: 1pt; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: middle; width: 134.268377952756pt; |

|---|

|

| Anchor |

|---|

1106525 | 1106525 | See| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: White; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106527 | 1106527 | Reconcile transactions| Table Cell (td) |

|---|

| style | background-color: White; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106531 | 1106531 | Reconcile transactions| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: #F7F7F7; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106534 | 1106534 | Review reports| Table Cell (td) |

|---|

| style | background-color: #F7F7F7; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106539 | 1106539 | Reports| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: White; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106541 | 1106541 | Send customer statements| Table Cell (td) |

|---|

| style | background-color: White; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106545 | 1106545 | Customer statements| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: #F7F7F7; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106548 | 1106548 | Record depreciation| Table Cell (td) |

|---|

| style | background-color: #F7F7F7; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106552 | 1106552 | About depreciation accounts| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: White; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106555 | 1106555 | Lodge your activity statement| Table Cell (td) |

|---|

| style | background-color: White; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106559 | 1106559 | Lodge your activity statement| Table Row (tr) |

|---|

| Table Cell (td) |

|---|

| style | background-color: #F7F7F7; border-bottom-color: #595959; border-bottom-style: solid; border-bottom-width: 1px; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106562 | 1106562 | Lock periods| Table Cell (td) |

|---|

| style | background-color: #F7F7F7; border-bottom-color: #595959; border-bottom-style: solid; border-bottom-width: 1px; padding-bottom: 4pt; padding-left: 6pt; padding-right: 10pt; padding-top: 4pt; vertical-align: top; |

|---|

|

| Anchor |

|---|

1106567 | 1106567 | Locking periods| import | https://maxcdn.bootstrapcdn.com/bootstrap/3.3.7/css/bootstrap.min.css |

|---|

| |

| CSS Stylesheet |

|---|

.container {

width:100%;

padding-left:0px;

padding-right:0px;

}

.container>p, .row {

padding-left:10.5%;

}

.row{

width:100%;

padding-bottom:100px;

margin-left:0px;

margin-right:0px;

padding-top:50px;

}

.col-md-6.col-sm-12, .col-lg-12, .col-md-12 {

margin-top:50px;

}

.row h2 {

font-size:28px!important;

font-family:NeutroMYOB-Medium,Arial,sans-serif;

color:#2e3e4f!important;

margin-bottom:0.6667em;

line-height:1.166;

padding-bottom:15px;

}

.brikit-content-layers .brikit-content-layer-backdrop, .brikit-container-backdrop .brikit-content-layer-backdrop .brikit-content-layer {

margin-left:0px;

margin-right:0px;

}

#content-layer-0 {

margin-left:0px;

margin-right:0px;

}

.row:nth-of-type(even) {

background:#f3f4f5!important;

}

#content-block-0 {

padding-left:0px;

padding-right:0px;

margin-left:0px;

margin-right:0px;

}

iframe {

margin-top:5px;

}

.col-lg-6 {

padding-right: calc(50% - 640px);

padding-right:-moz-calc(50% - 640px);

padding-right:-webkit-calc(50% - 640px);

padding-right:-webkit-calc(50% - 640px);

padding-right:-o-calc(50% - 640px);

}

/*.col-lg-6.col-md-4:first-child {

padding-right:50px;

}*/

.col-lg-6.col-md-4 {

padding-right:50px;

}

.col-lg-6.col-md-4:last-child {

padding-left:50px;

}

.tab-pane {

padding-top: 20px;

width:80%;

margin-left:auto;

margin-right:auto;

}

.videoContainer {

width: calc(100% - 50px);

width: -moz-calc(100% - 50px);

width: -webkit-calc(100% - 50px);

width: -o-calc(100% - 50px);

}

.nav-tabs {

width: 80%;

margin-left: auto;

margin-right: auto;

border-bottom:0;

}

.nav-tabs li, .nav-tabs.active li {

width: 25%;

text-align:center;

}

.nav-tabs>li.active>a, .nav-tabs>li.active>a:focus, .nav-tabs>li.active>a:hover {

border-top: 0;

border-left: 0;

border-right: 0;

border-bottom: purple 3px solid;

}

li[role=presentation] {

border-bottom: #ddd 1px solid;

}

.tab-pane .row {

padding-left: 0px;

}

.col-lg-6 p, .col-lg-6 li {

max-width: calc(100% - 50px);

max-width: -webkit-calc(100% - 50px);

max-width: -moz-calc(100% - 50px);

max-width: -o-calc(100% - 50px);

}

.tabSection {

padding-top:40px;

}

.yes img, .no img {

height: 60px!important;

} |

| HTML |

|---|

<span data-swiftype-index="true">

<script src="https://maxcdn.bootstrapcdn.com/bootstrap/3.2.0/js/bootstrap.min.js"></script> |

| div |

|---|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

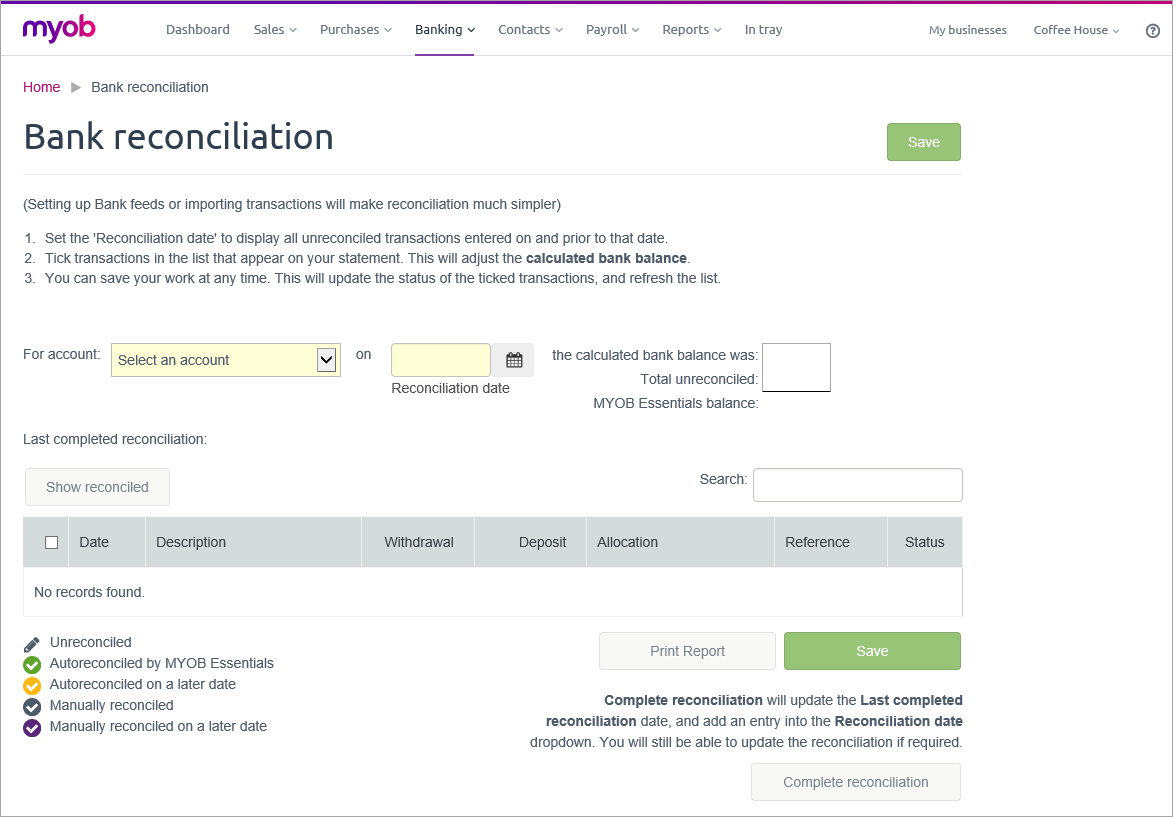

| Where to beginThe following is a list of tasks we suggest you complete at the end of each period (month, quarter, etc.). Depending on the nature of your business, some of these tasks may not apply to you. Consult an accounting advisor (such as your accountant) if you require help with your end of period tasks. |

| div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

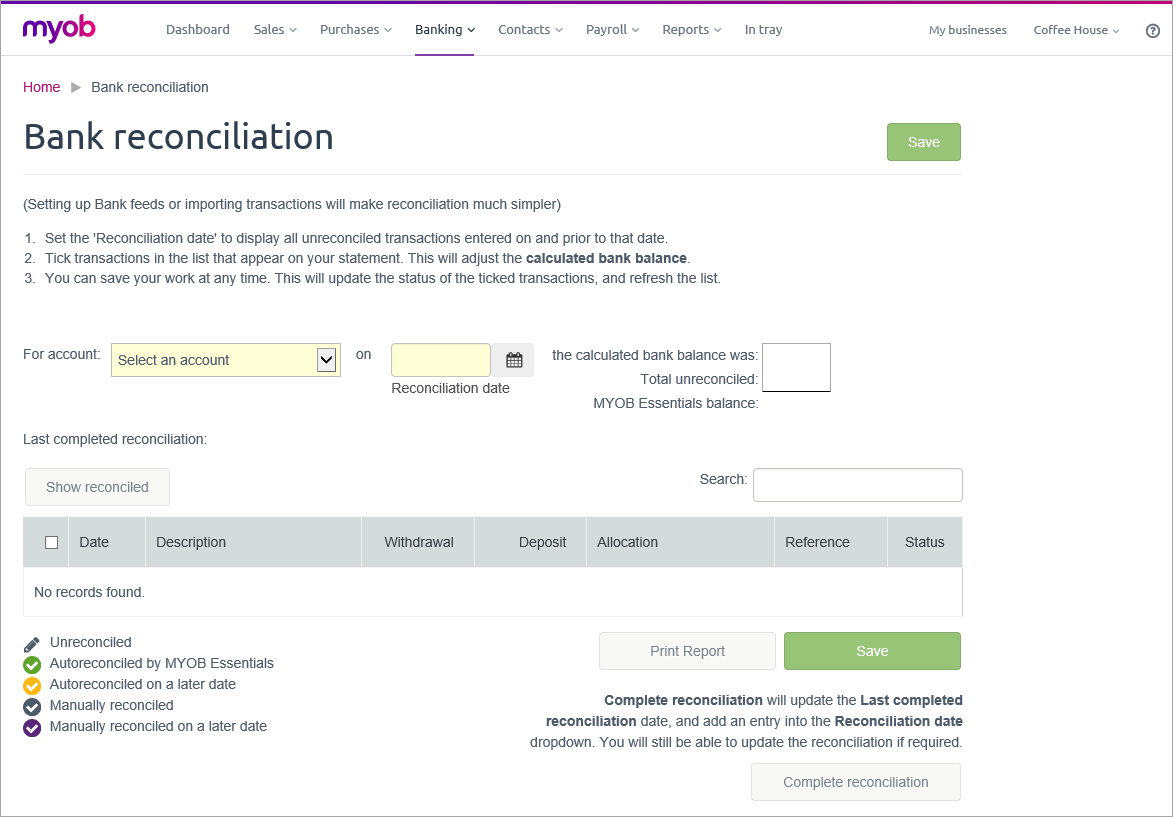

|  Image Added Image Added

|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

|  Image Added Image Added

|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

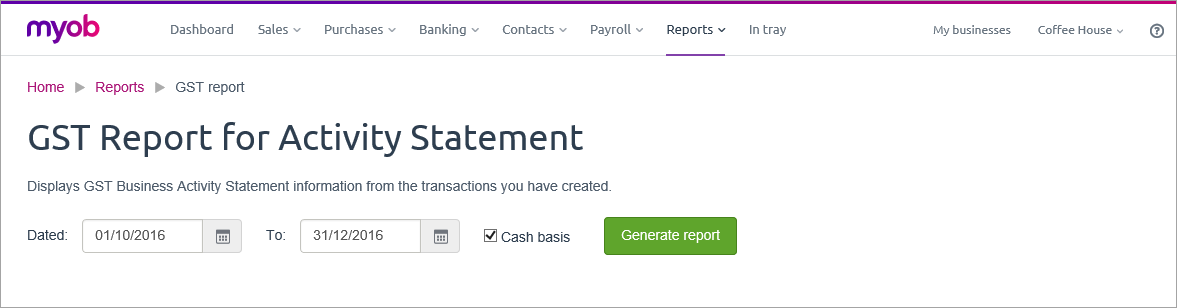

| Review reportsMYOB Essentials allows you to create detailed reports about any area of your business. You can use these reports to gain valuable insight into customers, stock items or even employee pay. You can produce these reports to view for yourself on your computer, print them or even save them as PDFs for safekeeping. Depending on the type of report you create, you'll be able to specify the details you want such as a range of dates or type of contact. Reports are grouped into five categories: business, banking, payroll, sales and bills. |

| div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

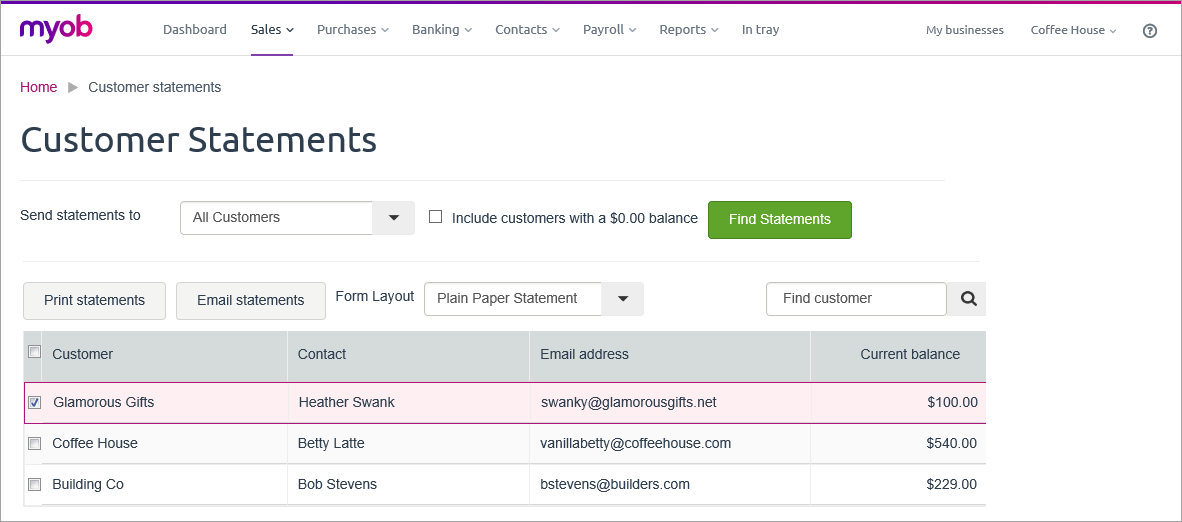

|  Image Added Image Added

|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

|  Image Added Image Added

|

| div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

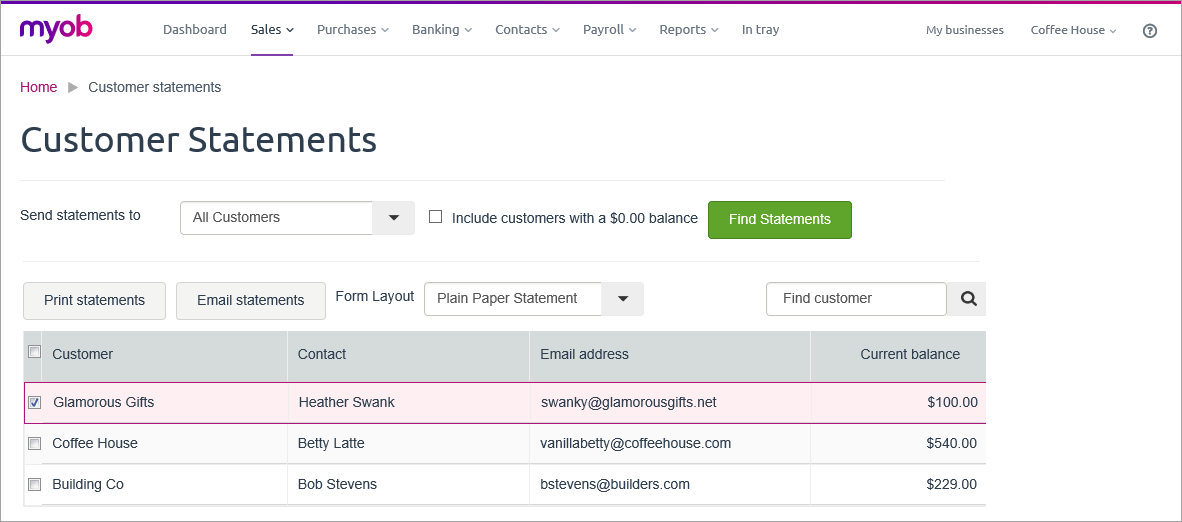

| Send customer statementsMake sure your customers are kept in the loop by providing them with up to date customer statements. You can view each customer's balance and see all the invoices they have—or haven't—paid for. If you've updated their contact details with their email address, you can send them their statement right from MYOB Essentials. If not, you can still print a physical copy of any statement to deliver to them however you like. |

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

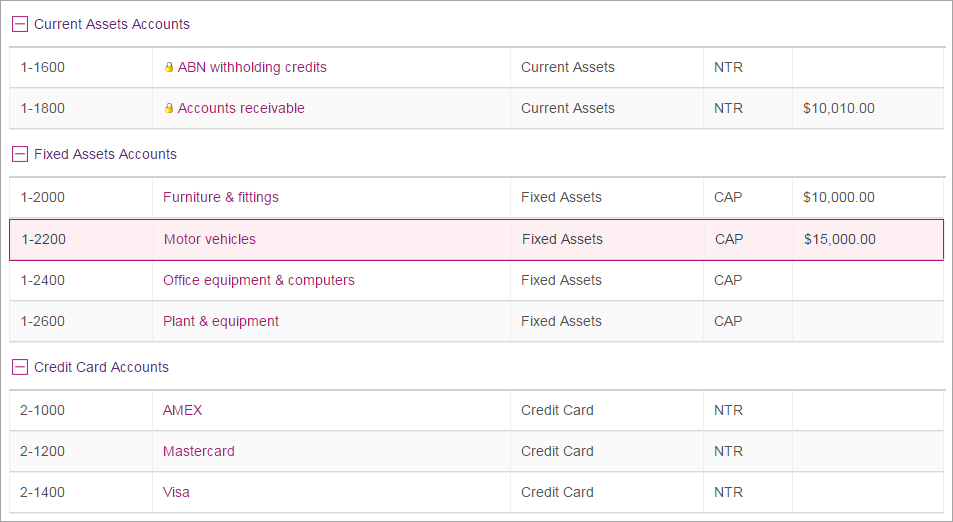

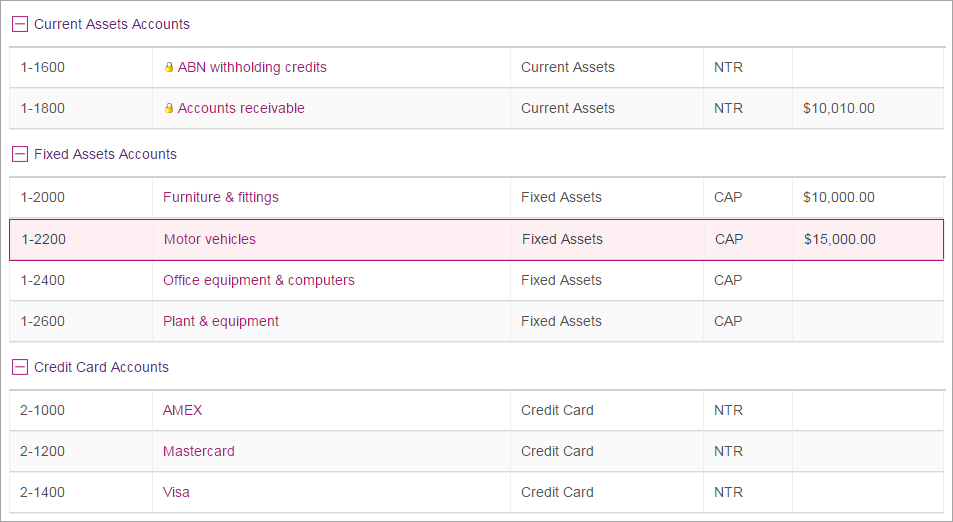

| Record depreciationVehicles and equipment owned by your company will lose value as they age—this is called depreciation. To record this, you can allocate part of the cost of vehicles and equipment as an expense to your business each year you benefit from their use. There are several methods of recording depreciation. Consult an accounting advisor (such as your accountant) to see which method is best for your business. |

| div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

|  Image Added Image Added

|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

|  Image Added Image Added

|

| div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

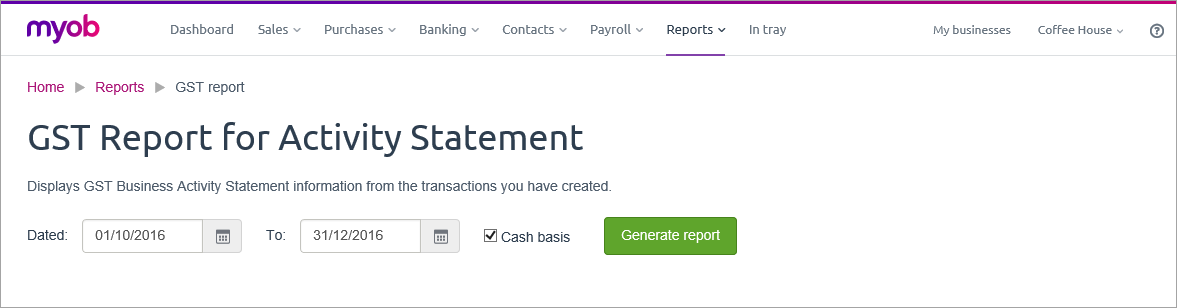

| Lodge your activity statementMYOB Essentials can help you lodge your activity statement by providing you with information about your business's GST over a specific period. There are several different GST reports available to you to help you prepare your BAS (Australia only) or your GST return (New Zealand only). Once you've made sure your GST settings are correct, head over to the Business reports section in MYOB Essentials to get started. | UI Text Box |

|---|

| Need help with this task? Consult an accounting advisor (such as your accountant) or consider inviting them to access your MYOB Essentials business. For more information see Invite your accountant. |

|

|

| div |

|---|

| | div |

|---|

| class | col-lg-6 col-md-8 col-sm-12 |

|---|

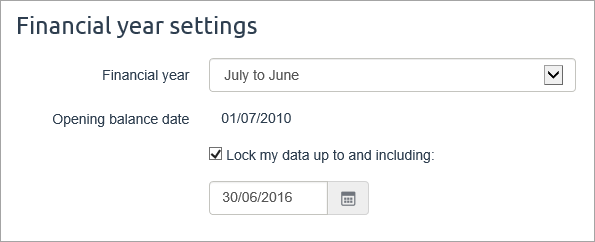

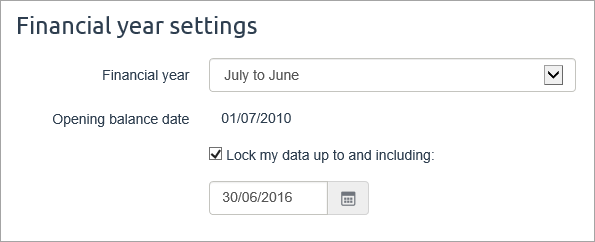

| Lock periodsAfter you've completed all of your month-end tasks, you should lock that period so that you're ready to start the next one. By locking the period, you'll prevent anyone from inadvertently creating, editing or deleting transactions in a period in which you don’t want transactions to be modified. If you need to make any changes to a locked period, you can unlock the period at any time. |

| div |

|---|

| class | col-lg-6 col-md-4 col-sm-12 |

|---|

|  Image Added Image Added

|

|

|

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.