...

...

If you have existing data, you can migrate MAS, Accounts and AO Classic general ledgers to an MYOB Ledger.

The migration process has three tasks:

| 1. Configure the ledger | 2. Migrate to MYOB Ledger | 3. Check post-migration logs |

|---|

Image Removed Image Removed |  Image Removed Image Removed |  Image Removed Image Removed |

| UI Text Box |

|---|

|

Migration includes ledger details, Charts of Accounts and closing balances of the financial year. Migration is always for the full financial year. Comparative figures are migrated into MYOB Ledger, so you can use the figures for review processing and produce financial statements with up to 5 years of figures. Migration does not make any changes to MAS. |

...

Before migrating, you need to configure the ledger as MAS, Accounts or AO Classic.

Statutory Reporter only works with an AccountRight or Essentials data source. For clients with a MAS ledger data source, use the MAS reporter for that client.

You can use Workpapers for clients with a MAS ledger data source.

| UI Expand |

|---|

| title | To configure the ledger |

|---|

|

- Go to the client’s Client Accounting > Trial Balance (Workpapers) tab.

On the Tasks bar, click Edit Configuration Details. The Client Configuration window appears. From the Product drop-down list, select MAS , Accounts or AO Classic GL . Enter the location of the ledger in the MAS ledger, Accounts ledger or AO Classic ledger field. | UI Text Box |

|---|

| If you're going to migrate an MYOB AE Assets 2.4 Accounts ledger to MYOB Assets Live, select a current-year ledger. |

Click OK. The Configured Ledger Details are displayed on the right of the Workpapers tab.

|

...

Image RemovedMigrate to MYOB Ledger

Image RemovedMigrate to MYOB Ledger

...

| title | To migrate an existing ledger to MYOB ledger |

|---|

...

The following ledger details are automatically retrieved from your existing ledger:

...

Entity type

...

If an error message is displayed because the ledger that you are migrating is out of balance, ensure your existing ledger is in balance and repeat the procedure.

When the migration is successfully completed, the Migration summary window appears displaying the migration details, including the prior year balances available (from and to dates).

Image Removed Check post-migration logs

Image Removed Check post-migration logs

After migrating to MYOB Ledger, review the migration log and check the tax codes.

...

| title | To review the migration log |

|---|

...

If you closed the Migration summary window after migrating, on the Tasks bar, click Migration summary. The Migration summary window appears.

...

Review the summary and click Close.

...

On the Tasks bar, click View migration log. The Migration Log window for the client appears.

...

Optionally, to export the migration log to Microsoft Excel, click Export to Excel.

Review the migration log and action any errors or warnings:

...

Warnings

Warnings in the migration log indicate that some data was not migrated. This is normally because the configured ledger does not support migration of this kind of data. For example: For Account code ***, the account name is migrated as Unknown Account Name.

The following warning message is displayed for every successful migration: Please verify the GST rate for each account code.

Errors

Errors in the migration log are an indication that the data was not migrated.

If the migration is initiated for a general ledger which has already been migrated to an AE Ledger, the following error message is displayed: The ledger already exists in the AE Ledger system.

When the ledger balances are not the same and migration fails, the following error message is displayed: Please balance the ledger and re-migrate.

| UI Expand |

|---|

| title | To check the tax codes |

|---|

|

- If you migrated from a MAS ledger, open the MAS ledger and go to Setup > Master Files > GST Table. The Master GST Table window appears.

Image Removed Image Removed - If you migrated from an Accounts ledger, open the Accounts ledger and go to Ledger > Accounts and Subaccount Titles.

Compare your tax codes to this chart. | UI Expand |

|---|

| MAS

accounts | Account Range | Accounts

accounts | Account Rage |

|---|

Assets (CAP) | 640–869 | Assets | 800–809 820–828 829–869 892–894 700–719 870–891 895–899 650–655 658–673 656–657 674–699 739 720–738 766–769 770–790 760–765 740–759 791–794 795 | Cost of Sales (GST) | 250–279 280–299 | Cost of Sales | 11–31 32–38 39–40 105–110 130–139 111–129 140–209 | Equity (NTR) | 500–639 | Equity | 518–519 535–541 542–546 530–534 526–527 547 548 549 560–569 580–609 570–576 577–579 528–529 610–649 | Expenses (GST) | 218–229 300–479 | Expenses | 41–89 280–494 520–525 | Income (GST) | 230–249 190–196 216–217 | Income | 1–10 259–273 210–212 213–279 90–104 | Liabilities (NTR) | 870–999 | Liabilities | 900–916 917–925 926–949 955 956–958 950–953 959 954 975–984 960–965 966–974 985 986–988 989–993 994–998 999 | Other Expenses (NTR) | 480–499 | Other Income | 495–517 | | Other Income (NTR) | 100–189 197–209 210–215 | | |

|

- If you migrated from a MAS ledger and your tax codes don't match those in the chart:

- In the Master GST Table, add or edit the GST rates.

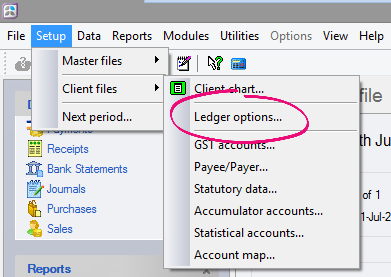

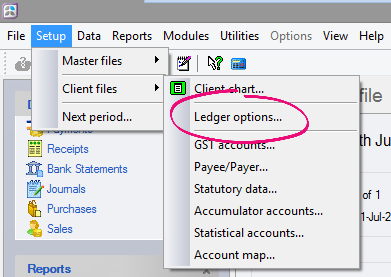

GST levels 1–14 are generally MYOB defaults. - Go to Setup > Client Files > Ledger Options.

Image Removed Image Removed - Enter G in the Tax Type value field.

- If you migrated from an Accounts ledger and your tax codes don't match those in the chart:

- In Accounts, enter the correct account code in the Code field and press [Enter] on the keyboard.

|

| HTML Wrap |

|---|

| width | 15% |

|---|

| class | col span_1_of_5 |

|---|

|

| |

| HTML Wrap |

|---|

| float | left |

|---|

| class | col span_1_of_5 |

|---|

|

| Panelbox |

|---|

| name | yellow |

|---|

| title | You are in MYOB Ledger module... |

|---|

| | HTML Wrap |

|---|

| | HTML |

|---|

<style>

#container {

text-align: justify;

-ms-text-justify: distribute-all-lines;

text-justify: distribute-all-lines;

display:inline-block;

width:100%;

white-space: nowrap;

overflow:hidden !important;

overflow-x:hidden !important;

margin-left:-5px;

margin-right:-5px;

margin-top:-3px;

margin-bottom:-3px;

}

.box img {

height:100%;

width:100%;

}

.stretch {

width: 100%;

height: 110%;

display: inline-block;

font-size: 0;

line-height: 0

}

.box {

display:inline-block;

}

</style>

<div id="container">

<div class="box">

<a href="http://help.myob.com/ps/wiki/x/d44x"><img src="/wiki/download/attachments/21824856/step1.png?api=v2"></a>

</div> |

|

| Panelbox |

|---|

| name | purple |

|---|

| title | Tasks in this module |

|---|

| | HTML Wrap |

|---|

| | Page Tree |

|---|

| expandCollapseAll | true |

|---|

| root | MYOB Ledger module 1. Setting up MYOB Ledger |

|---|

|

|

|

| Panelbox |

|---|

| name | grey |

|---|

| title | Related topics |

|---|

| |

|

|

| HTML Wrap |

|---|

|

| UI Button |

|---|

| color | green |

|---|

| size | large |

|---|

| link | Module 1. Setup |

|---|

| text | Setup > |

|---|

| title | << Migrating to or creating MYOB Ledger |

|---|

| url | http://help.myob.com/ps/wiki/x/2Y0x |

|---|

|

| UI Button |

|---|

| color | green |

|---|

| size | large |

|---|

| link | Module 1. Setup |

|---|

| text | Setup > |

|---|

| title | Checking the accounts >> |

|---|

| url | http://help.myob.com/ps/wiki/x/BY4x |

|---|

|

|

Just a sec...

We're taking you to the new workflow!

| Redirect |

|---|

| delay | 5 |

|---|

| location | cah:Move your data to MYOB Ledger |

|---|

|

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.