- Created by Suchi Govindarajan, last modified on Oct 11, 2017

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 2 Next »

https://help.myob.com/wiki/x/kwVNAQ

If you have existing data, you can migrate MAS, Accounts and AO Classic general ledgers to an MYOB Ledger.

The migration process has three tasks:

| 1. Configure the ledger | 2. Migrate to MYOB Ledger | 3. Check post-migration logs |

|---|---|---|

Migration includes ledger details, Charts of Accounts and closing balances of the financial year. Migration is always for the full financial year. Comparative figures are migrated into MYOB Ledger, so you can use the figures for review processing and produce financial statements with up to 5 years of figures.

Migration does not make any changes to MAS.

Configure the ledger

Configure the ledger

Before migrating, you need to configure the ledger as MAS, Accounts or AO Classic.

Statutory Reporter only works with an AccountRight or Essentials data source. For clients with a MAS ledger data source, use the MAS reporter for that client.

You can use Workpapers for clients with a MAS ledger data source.

- Go to the client’s Client Accounting > Trial Balance (Workpapers) tab.

On the Tasks bar, click Edit Configuration Details. The Client Configuration window appears.

From the Product drop-down list, select MAS , Accounts or AO Classic GL .

Enter the location of the ledger in the MAS ledger, Accounts ledger or AO Classic ledger field.

If you're going to migrate an MYOB AE Assets 2.4 Accounts ledger to MYOB Assets Live, select a current-year ledger.

Click OK. The Configured Ledger Details are displayed on the right of the Workpapers tab.

Migrate to MYOB Ledger

Migrate to MYOB Ledger

- Go to the client’s Client Accounting > Workpapers tab.

- On the Tasks bar, click Migrate to AE ledger or Migrate to AO ledger.

The Migrate data window appears and the Source product field displays the general ledger type that you are migrating. The following ledger details are automatically retrieved from your existing ledger:

Name The name of the configured existing ledger. Client code The client code for the selected client's ledger. Entity type

The entity type defined when you configured the ledger. Select a different entity type from the drop down if required.

If the client is configured using legacy ledgers the Entity type defaults to <Select Entity>. You can edit this as required.Current year end date The last day of the current year in the selected client’s ledger. Start date for new AE/AO Ledger The date from which you want to start using the AE Ledger. - If you are not using an MYOB standard chart, click in the ledger account column in the table at the bottom of the Migrate data window and enter the correct value to use for each account in the list.

The specified codes are displayed against these accounts after migration in the Workpapers tab and the Manage Accounts window.

If you are using an MYOB standard chart, the ledger account values displayed in the table at the bottom of the window are correct. - Click OK.

If an error message is displayed because the ledger that you are migrating is out of balance, ensure your existing ledger is in balance and repeat the procedure.

When the migration is successfully completed, the Migration summary window appears displaying the migration details, including the prior year balances available (from and to dates).

Check post-migration logs

Check post-migration logs

After migrating to MYOB Ledger, review the migration log and check the tax codes.

If you closed the Migration summary window after migrating, on the Tasks bar, click Migration summary. The Migration summary window appears.

Review the summary and click Close.

On the Tasks bar, click View migration log. The Migration Log window for the client appears.

Optionally, to export the migration log to Microsoft Excel, click Export to Excel.

Review the migration log and action any errors or warnings:

Warnings

Warnings in the migration log indicate that some data was not migrated. This is normally because the configured ledger does not support migration of this kind of data. For example: For Account code ***, the account name is migrated as Unknown Account Name.

The following warning message is displayed for every successful migration: Please verify the GST rate for each account code.

Errors

Errors in the migration log are an indication that the data was not migrated.

If the migration is initiated for a general ledger which has already been migrated to an AE Ledger, the following error message is displayed: The ledger already exists in the AE Ledger system.

When the ledger balances are not the same and migration fails, the following error message is displayed: Please balance the ledger and re-migrate.

- If you migrated from a MAS ledger, open the MAS ledger and go to Setup > Master Files > GST Table. The Master GST Table window appears.

- If you migrated from an Accounts ledger, open the Accounts ledger and go to Ledger > Accounts and Subaccount Titles.

Compare your tax codes to this chart.

Tax types chartMAS

accountsAccount Range Accounts

accountsAccount Rage Assets (CAP)640–869Assets800–809820–828829–869892–894700–719870–891895–899650–655658–673656–657674–699739720–738766–769770–790760–765740–759791–794795Cost of Sales (GST)250–279280–299Cost of Sales11–3132–3839–40105–110130–139111–129140–209Equity (NTR)500–639Equity518–519535–541542–546530–534526–527547548549560–569580–609570–576577–579528–529610–649Expenses (GST)218–229300–479Expenses41–89280–494520–525Income (GST)230–249190–196216–217Income1–10259–273210–212213–27990–104Liabilities (NTR)870–999Liabilities900–916917–925926–949955956–958950–953959954975–984960–965966–974985986–988989–993994–998999Other Expenses (NTR)480–499Other Income495–517Other Income (NTR) 100–189197–209210–215- If you migrated from a MAS ledger and your tax codes don't match those in the chart:

- In the Master GST Table, add or edit the GST rates.

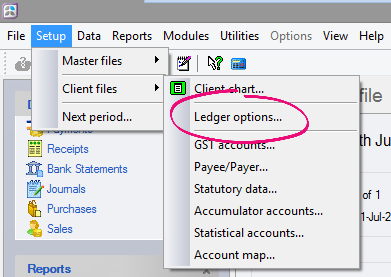

GST levels 1–14 are generally MYOB defaults. - Go to Setup > Client Files > Ledger Options.

- Enter G in the Tax Type value field.

- In the Master GST Table, add or edit the GST rates.

- If you migrated from an Accounts ledger and your tax codes don't match those in the chart:

- In Accounts, enter the correct account code in the Code field and press [Enter] on the keyboard.

Configuring the client (AE Help)

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.