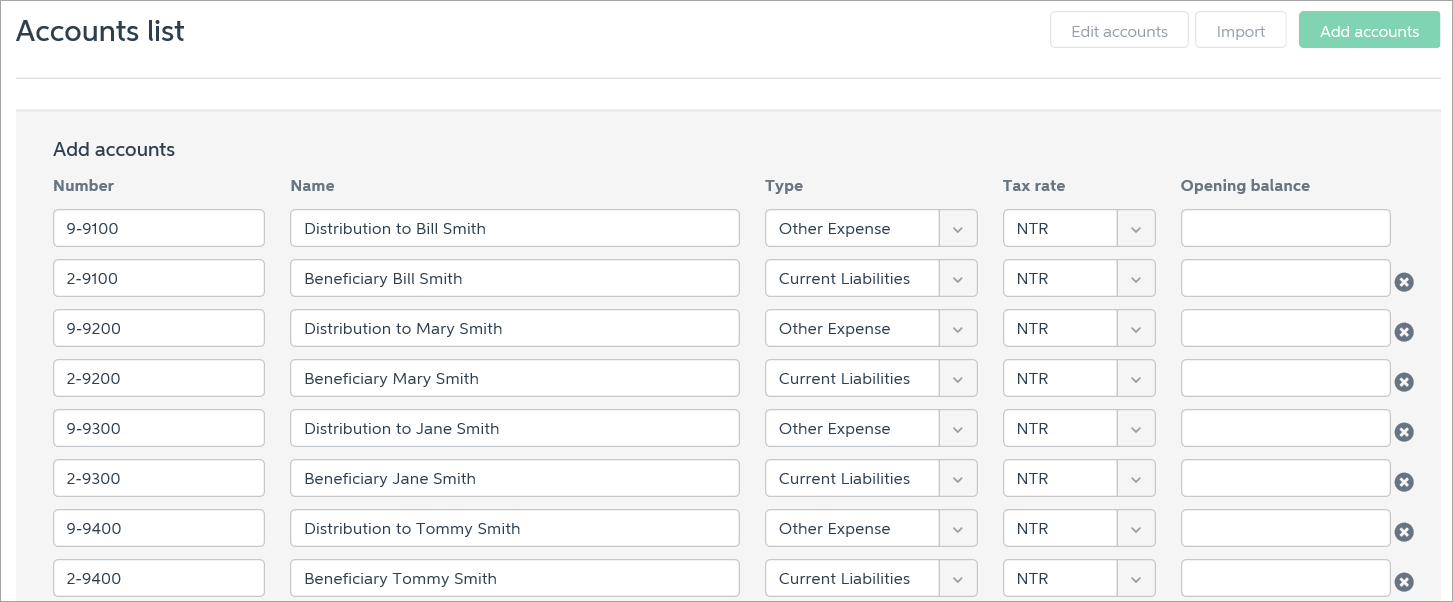

Modify your accounts listYour MYOB Essentials accounts list will need to be adjusted slightly to reflect the distributions made to the beneficiaries. Set up liability accounts (using Account Type "Current Liabilities") for distributions made to the beneficiaries, but not yet paid. The account numbers will start with "2-", for example 2-9100. Each beneficiary should have a liability account. Set up other expense accounts (using Account Type "Other Expense") called distribution to beneficiaries. The account numbers will start with "9-", for example 9-9100. Once again, each beneficiary should have a distribution account. To create accounts, click your business name and choose Accounts list, then click Add accounts. Learn more about creating accounts.

Here's our list of example accounts - check with your accounting advisor about the best account setup for your requirements.

|