When you do a pay run, a separate payroll transaction is recorded for each employee in the pay run. This transaction allocates each part of the pay to various expense and liability accounts. | UI Expand |

|---|

| expanded | true |

|---|

| title | To view a payroll transaction |

|---|

| - Go to the Banking menu and choose Transaction history.

- In the Account field, choose your wages bank account (the one you specified when setting up payroll).

- In the From and To fields, select the date range for the pay.

- Click the reference number (which starts with PY) to open the transaction.

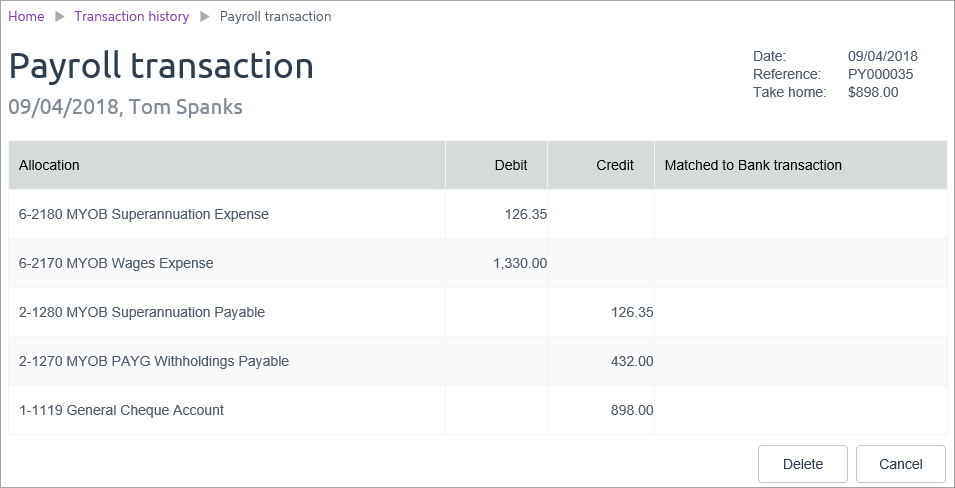

The payroll transaction is displayed:

|

This example shows:- The debits and credits which make up the transaction

- The first four allocations in the list represent the components of the pay:

- two allocations for superannuation ($126.35), being a debit (expense) to your business, and a matching credit (liability) which goes to the employee's super fund)

- the wage expense to your business for this employee's pay ($1330.00)

- PAYG (tax) withheld from the employee's pay ($432.00)

- The last allocation in the list represents the employee's net pay ($898.00), allocated to account 1111-9 General Cheque Account (the account set as the Bank account for paying wages in your payroll settings)

If you use bank feedsWhen you pay your PAYG/PAYE to the ATO (Australia) or IRD (New Zealand), the spend money transaction will be automatically matched to the corresponding payroll transaction. For super payments made through MYOB's super portal (Australia only), when the super payment transaction appears in your bank feed, just allocate it to your Superannuation Payable liability account. If any of your employees have a salary sacrifice agreement you'll need to allocate this amount to the Payroll Deductions account. |