MYOB Essentials, Australia only | UI Text Box |

|---|

| STP finalisation deadline extension As part of Single Touch Payroll reporting, usually you need to finalise your payroll information by 14 July. But the ATO recognise the impacts of COVID-19 on the Australian community, so if you need additional time you can complete your STP finalisation up until 31 July. Learn more on the ATO website. |

When you finalise: - you're letting the ATO know that you've completed all pays for the payroll year

- the status of the employee's income statement in myGov changes to Tax ready so they can pre-fill and lodge their tax return.

| Checklist |

|---|

| - Enter all pays up to 30 June (pays recorded in July which include June pay dates aren't included in the finalised year)

- Fix any incorrect pays

- Check that all pay runs sent during the payroll year have been accepted by the ATO.

- Note that rejected reports retain a Rejected status. This is OK if reports since the rejected one have been accepted by the ATO.

|

Start by checking your year-to-date totals. If you've terminated any employees during the payroll year, make sure you've notified the ATO about them. Then you're ready to finalise. If you're stuck or feeling unsure, try our free eLearning to discover everything you need to know about finalising your payroll information. | UI Expand |

|---|

| title | 1. Check year-to-date totals |

|---|

| Before finalising, it's a good idea to check the year-to-date (YTD) amounts you've sent to the ATO for the payroll year. - Go to the Payroll menu and choose Payroll reporting centre.

- Click the EOFY Finalisation tab.

- Choose the Payroll year.

Check your YTD totals—there are a few ways you can do this: | UI Expand |

|---|

| title | YTD total (at a glance) |

|---|

| Check the displayed Gross Payments (YTD) and PAYG withholding (YTD) amounts. These are the total amounts sent to the ATO for all your employees.

|

| UI Expand |

|---|

| title | YTD verification report |

|---|

| Click YTD verification report to display a PDF report showing the total of all ATO reporting category amounts sent to the ATO for all employees.

Where are the RFBA amounts? An employee's reportable fringe benefit amounts are reported to the ATO when you finalise, so won't display on the YTD verification report until after they're finalised. |

| UI Expand |

|---|

| title | Summary of payments (employee level) |

|---|

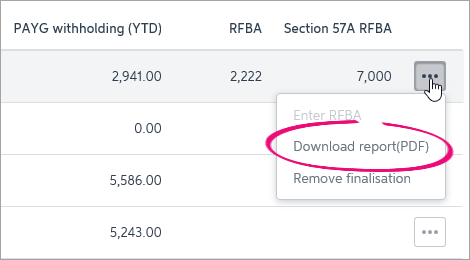

| Run the Summary of payments report (click the ellipsis  button for an employee and choose Download report(PDF)). This PDF report shows a summary of all ATO reporting category amounts sent to the ATO for an employee (gross payments, PAYG withholding, allowances, etc.). button for an employee and choose Download report(PDF)). This PDF report shows a summary of all ATO reporting category amounts sent to the ATO for an employee (gross payments, PAYG withholding, allowances, etc.).

Where are the RFBA amounts? An employee's reportable fringe benefit amounts are reported to the ATO when you finalise, so won't display on the summary of payments report until after they're finalised. |

What if something looks wrong?| UI Expand |

|---|

| title | Check your ATO reporting categories |

|---|

| Check that your payroll categories have been assigned the correct ATO reporting category. For help choosing the right one, see Assign ATO reporting categories for Single Touch Payroll reporting or speak to your accounting advisor. To check which ATO reporting categories have been assigned to your pay items, go to the Payroll menu and choose Pay Items. Then check the ATO reporting category column.

| UI Text Box |

|---|

| If you add or change the ATO reporting category in a pay item, enter a $0 pay for any employees who have been paid using that pay item. See below for steps to enter a $0 pay. |

|

| UI Expand |

|---|

| title | Check your payroll detail report |

|---|

| Use the Payroll Detail report to confirm the accuracy of the Gross Payment amounts reported on your employees' Summary of payments reports. Compare the Taxable earnings amount with the Gross Payments amount on each employee's Summary of payments report. | Report | Description |

|---|

| Payroll Detailed | The Taxable earnings include all pay items and doesn't reduce the taxable wages by pay items that don't have an ATO reporting category. | | Summary of Payments | The gross payments amount is reduced by any pay items that don't have an ATO reporting category. | |

| UI Expand |

|---|

| To ensure the latest year-to-date amounts are sent to the ATO for an employee, you can record a $0 (zero dollar) pay for them. It's like a regular pay but you'll remove all hours and amounts. When the $0 pay is recorded, you'll be prompted to declare and send the details to the ATO. The employee's YTD amounts are then sent to the ATO. - Process a $0.00 pay for the employee by removing all hours and amounts (Payroll menu > Enter pay).

- Complete the pay as you normally do.

|

|

| UI Expand |

|---|

| title | 2. Notify the ATO of terminated employees |

|---|

| As part of processing an employee's final pay, you need to notify the ATO. This lets the ATO know the employee's termination date and any ETP components in their final pay. Here's how: - Go to the Payroll menu and choose Payroll reporting.

- Click Employment terminations.

- Select the employee, choose the Employee end date, then click Notify the ATO.

- Enter your name as the authorised declarer and click Send.

This declaration is processed in the same way other Single Touch Payroll reports are. They must have a status of Accepted in the payroll reporting centre before you can finalise your STP information. |

| UI Expand |

|---|

| title | 3. Finalise your Single Touch Payroll information |

|---|

| Finalising your Single Touch Payroll information is done in just a few clicks. | UI Expand |

|---|

| title | Click to see finalisation in action! |

|---|

|

|

- Go to the Payroll menu and choose Payroll Reporting.

- Click the EOFY Finalisation tab and choose the Payroll year you're finalising.

- If you need to report fringe benefits for an employee (what is this?):

- Click the ellipsis

button for the employee and choose Enter RFBA. button for the employee and choose Enter RFBA. Enter in both the: Click Add amounts.

- Select each employee you want to finalise, then click Set as Final.

- Enter your name and click Send.

Each employee that has been finalised will have the Final indicator ticked. You can let these employees know that they can now sign in to myGov. Once they see the status of their income statement change to Tax ready, they can start the process of lodging their tax return. What's next?Each employee that has been finalised will have the Final indicator ticked in the payroll reporting centre. You can let these employees know that they can now sign in to myGov to complete their tax returns. That's right—you don't need to complete payment summaries for them! You're ready to start processing pays from 1 July for the new payroll year. |

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | Why don't my STP reports match the ATO's Business Portal? |

|---|

| Why don't my STP reports match the ATO's Business Portal?Each STP report sent to the ATO includes the employer pay period information and the employee year-to-date (YTD) amounts. As the ATO doesn't allow you to delete these reports, the Business Portal will show every pay run declared through STP, including ones that you have deleted or reversed in your software. So, in most cases, if you've made payroll adjustments the Business Portal may not match your STP reports. And that's OK. Just make sure you check year-to-date totals in MYOB Essentials before finalising. See To check year-to-date totals, above. |

| UI Expand |

|---|

| title | Why is an employee missing from the EOFY Finalisation list? |

|---|

| Why is an employee missing from the EOFY Finalisation list?Only employees who have been paid in the current payroll year appear in the EOFY Finalisation list. If an employee isn't listed, check that at least one pay been recorded for the year, after setting up STP. If you've checked these things and an employee still isn't showing, record a $0 (zero dollar) pay for employee. Remove all hours and amounts from the pay. When the $0 pay is recorded, you'll be prompted to declare and send the details to the ATO. The employee's YTD amounts are then sent to the ATO and the employee will appear in the finalisation list.

|

| UI Expand |

|---|

| title | Will my YTD totals be correct if I've only started reporting part of the way into the financial year? |

|---|

| Will my YTD totals be correct if I've only started reporting part of the way into the financial year?The ATO does not receive the details of individual pay runs, only the year-to-date payroll amounts. So, provided you've submitted a pay after setting STP, the latest year-to-date totals will be submitted. Still, we recommend you check your YTD amounts prior to finalising. |

| UI Expand |

|---|

| title | How do I undo a finalisation? |

|---|

| How do I undo a finalisation?You can undo an individual employee's finalisation. When you do, the employee's income statement in myGov will no longer be Tax ready so they won't be able to pre-fill and lodge their tax return. - Go to the Payroll menu and choose Payroll Reporting.

- Click the EOFY Finalisation tab.

- Choose the Payroll year.

- Click the ellipsis

button for the employee and choose Remove finalisation. button for the employee and choose Remove finalisation. - Enter the name of the Authorised sender and click Send. The Final indicator tick is removed for the employee. If it's still there, click a different tab then return to the EOFY Finalisation tab.

- When you're ready, you can finalise the employee again.

|

|