The ATO has introduced a new Deductions schedule (DDCTNS) to lodge with a 2019 individual tax return. See Claiming deductions on the ATO website. If you're claiming a deduction in your individual tax return, the DDCTNS is mandatory.| Keypoints |

|---|

| - You'll now enter deductions into the DDCTNS instead of directly in each label D1–D15 (apart of D11).

- We've added the new Deductions schedule (DDCTNS) and updated worksheets that integrate with it.The way you enter deductions has changed.made this easier by updating a bunch of our worksheets, which will now integrate into the DDCTNS and, the relevant return label. Learn how to use the new DDCTNS.

- The DDCTNS schedule is lodged to the ATO, along with the 2019 Individual tax return.

|

When do you need a DDCTNS?If you're claiming a deduction at any of the individual return labels ticked below, you'll need to complete a DDCTNS.  Image Modified Image Modified

| D1 Work-related car deductions |  Image Modified Image Modified

| |  Image Modified Image Modified

| D2 Work-related travel expenses |  Image Modified Image Modified

| D10 Cost of managing tax affairs |  Image Modified Image Modified

| D3 Work-related clothing, laundry and dry-cleaning expenses |

Image Removed Image Removed Image Added Image Added

| D11 - Deductible amount of undeducted purchase price of a foreign pension or annuity * |  Image Modified Image Modified

| D4 Work-related self-education expenses |  Image Modified Image Modified

| D12 Personal superannuation contributions |  Image Modified Image Modified

| D5 Other work-related expenses |  Image Modified Image Modified

| D13 Deduction for project pool |  Image Modified Image Modified

| D6 Low-value pool deduction |  Image Modified Image Modified

| D14 Forestry-managed investment scheme deduction |  Image Modified Image Modified

| D7 Interest deductions |  Image Modified Image Modified

| D15 Other deductions |  Image Modified Image Modified

| | | |

Completing the new DDCTNSYou can no longer enter data directly into the deduction labels D1–D15, with the exception of label D11. Instead, you'll enter data either directly into the new DDCTNS or, in a supporting worksheet, which is then transferred to the DDCTNS. | UI Expand |

|---|

| title | Accessing To access the DDCTNS |

|---|

| You can navigate to it from 2 places: | Section |

|---|

| Column |

|---|

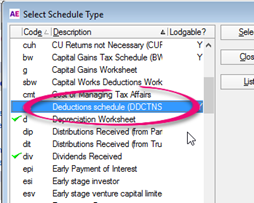

| 1 Select Preparation > Schedule  Image Removed Image Removed

|

| Column |

|---|

| 2 Select it from ATO Schedules.  Image Removed Image Removed

|

|

| There are three ways to access the new DDCTNS from within a 2017 Individual tax return: - From the Preparation menu:

- Follow the menu Preparation > Schedule.

- Double-click Deductions schedule (DDCTNS) to open.

- From the ATO Schedules list:

- Click Deductions schedule (DDCTNS) under ATO Schedules on the Navigation bar.

- From the deduction item:

- Click the Deductionss & Losses tab

- Click the field in Item D2, D3, D7, D8 or D15E and press ENTER.

|

| UI Expand |

|---|

| title | Completing Entering data into the DDCTNS |

|---|

| You can no longer enter data directly into the deduction labels D1–D15, with the exception of label D11. The DDCTNS opens if there is no supporting worksheet at the deduction labels. You can only see one data-entry row. To add a row, press CTRL+INSERT. To delete a row, press CTRL+DELETE. | UI Text Box |

|---|

| | The ATO has recommended that you group your expenses, for example, you have a total stationery expense rather than individual stationery items.The table below shows the: - the differences between the schedules and worksheets available in 2018, and 2019 the schedules /or worksheets in the 2019 tax year

- the maximum entries allowed for each labelnumber of entries per item.

For information on the deduction item, including how to complete the label, click the link in the table. schedule/| Schedule or worksheet | 2019 |

|---|

schedule/| Schedule or worksheet | 2019 ATO Pre-fill | Maximum entries |

|---|

|

| UI Text Box |

|---|

| For more than 10 deduction items, enter the first 9, then total the amount of the additional items into the 10th item. |

dissection travel dissection (pre-fill data from the ATO) | Other work-related expense (pwe) |

(pre-fill data from the ATO and manual data-entry)DDCTNS and depreciation worksheet | or value entered directly in the return(pre-fill data from the ATO and manual data-entry)(pre-fill data from the ATO and manual data-entry)Label E - Enter the value directly in the returnLabel J - Generic schedule

Other deductions (ode) |

Label E - DDCTNSLabel J - Generic schedule

Other deductions (ode) | | 100 |

| UI Expand |

|---|

| | UI Expand |

|---|

| title | Data-entry from the DDCTNS |

|---|

| Item D7 - Interest deductions- Click label I in the tax return to open the DDCTNS.

- Scroll down to D7 Interest deductions and fill in the description and the amount.

To add a record, click the  Image Removed icon located near the Return properties. Image Removed icon located near the Return properties.

Image Removed Image Removed | UI Text Box |

|---|

| If the last field you enter is immediately before the total for the worksheet, either tab-off the field or save the schedule otherwise your changes won't be saved. |

- Click Deductions from depreciation worksheets or Deductions from motor vehicle worksheets (mve) to edit them.

- The amount at D7 total integrates to item D7 label I Interest deductions in the main return.

|

| UI Expand |

|---|

| title | Data-entry from a supporting schedule |

|---|

| - Click label E to open an Other Work Related Expenses worksheet.

- Enter the description and amount for all the items, then close the worksheet.

Image Removed Image Removed - The amount at D5 total in the DDCTNS is shown at item D5 label E Other work-related expenses in the income tax return.

|

|

Rolling over deductions from 2018 to 2019 | At D1, MYOB Tax will consolidate records if you have more than 10 motor vehicle expense (mve) worksheets. Motor vehicles using the cents per kilometre (km) method integrate to the Deductions schedule (DDCTNS) first, in descending km order, followed by log book method. This ensures the consolidated record doesn't breach the 5000km limit. In the DDCTNS, you'll only see one data-entry row for each item. The ATO has recommended that you group your expenses. For example — rather than listing individual stationery items (such as pen, pencil, stapler), just report the total stationary expense. However, you can still add additional rows as required: - To add additional rows, click in the relevant field then click

Image Added on the toolbar. You can also press CTRL + INSERT on the keyboard. Image Added on the toolbar. You can also press CTRL + INSERT on the keyboard. - To delete rows you no longer need, click in the relevant row then click

Image Added on the toolbar. You can also press CTRL + DELETE on the keyboard. Image Added on the toolbar. You can also press CTRL + DELETE on the keyboard.

Image Added Image Added

Where you exceed the maximum limit of records at D2 to D15, consolidate the remaining records with the description Consolidated remaining amounts. Refer to the specific item help topic for more details. |

| UI Expand |

|---|

| title | Preparing supporting worksheets |

|---|

| To help you in your calculations, we've updated a bunch of the supporting worksheets to integrate into the Deductions schedule (DDCTNS). These these worksheets are not lodged to the ATO, but will instead integrate into the DDCTNS. You might notice that data entry fields for these items is unavailable in the DDCTNS. This is because the value in this field come from a supporting worksheet. To enter the data, click in the field and press Enter on the keyboard to open the worksheet. Fill in the worksheet as per normal. To transfer the values from the worksheet into the DDCTNS, click  Image Added on the toolbar or press F6 on the keyboard. The total is integrated to the relevant item in the DDCTNS. Image Added on the toolbar or press F6 on the keyboard. The total is integrated to the relevant item in the DDCTNS. |

Other changes| UI Expand |

|---|

| title | Rollover and schedule data |

|---|

| By introducing the new DDCTNS, we've changed or replaced some worksheets and grids. |

Only the Depreciation worksheet and the Motor vehicle worksheet will rollover to 2019. You must As a result, only the following worksheets will roll over to 2019: - Depreciation worksheet (d)

- Motor vehicle worksheet (mve)

- Personal superannuation contributions worksheet (psc)

You'll need to create all other deductions worksheets for 2019. |

Tax office copy PDFThere is no | UI Expand |

|---|

| The ATO PDF version of the DDCTNS |

.is not available and therefore not included in the ATO-PDF copy print. For paper lodgments, print amounts at deduction items and action codes at D1, D3 and D4 in the main income tax return. |

|