You can view a list of suggested tier levels for your employees based on their payroll information. These suggestions are based on details like pay basis (salary or hourly), employment status (full time, part time or casual), and pay runs processed in February or June. Because each business is different, the way employees are set up and paid will always vary. This means that sometimes a tier level can't be suggested. In these cases, and to confirm the suggestions, you can check the employee's payroll details to determine their tier level. To view JobKeeper tier suggestions: - If it isn't already, open the Payroll reporting centre (Payroll menu > Payroll Reporting).

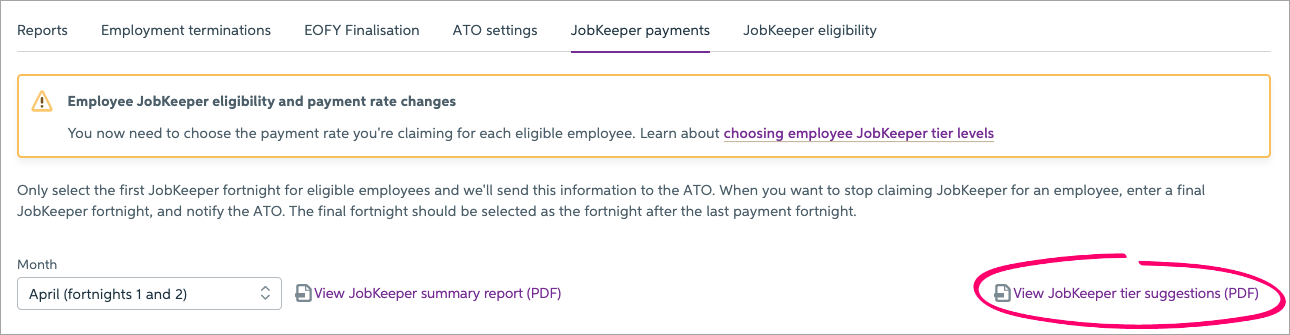

- Click the JobKeeper payments tab.

- Click View JobKeeper tier suggestions (PDF).

- Select the employees to include in the report.

- Click View report. The report opens displaying the hours worked for February and/or June. Where possible, a tier level will be suggested for each employee. Here's an example:

Confirming employee tier levelsWhere possible, the above report will suggest employee tiers, but it's up to you to notify the ATO of the correct tiers for your employees. Here are some tips for gathering information about your employees to help work out their tier levels. You should also check the ATO's information about the 80-hour threshold for employees for help determining tier levels. - Check if the employee is paid an hourly rate or an annual salary, and their default hours per week (Payroll menu > Employees > click to open an employee's details > Employee details tab)

- View Past pay runs to see a summary of each employee's pays for February or June. You can also view their pay slips for these pays (Reports menu > All reports > Past pay runs)

- Run the Pay item transactions report for February and June to see details of the pay items you've paid employees (Reports menu > All reports > Pay item transactions)

|