| Keypoints |

|---|

- How you're charged for using payroll in MYOB depends on your subscription plan

- The number of employees you can pay is determined by the limits in your plan

- Some plans charge a fee for each employee you pay in a month

- You can easily upgrade and downgrade your plan to meet your changing payroll needs

|

Limits and fees are based on your planWhen you subscribed to MYOB Business, you chose a plan. How you're charged for using payroll in MYOB depends on your plan. You can do as many pay runs as you want a month, but there may be limits and fees on the number of employees you can pay according to your plan: You can view your plan and limits in My Account (open MYOB > click your business name > My account > Manage my product). You can view available plans and pricing by visiting the MYOB website (Australia | New Zealand). Also take a look at the MYOB Business terms of use (Australia | New Zealand). Limits A limit is the maximum number of unique employees you can pay in a calendar month according to your plan. Once you've paid an employee, you can pay them as many times as you want in that month without affecting your limit. If your plan has a limit and you want to pay more than the included number of employees you need to upgrade your plan. If it's a one-off you can choose to go back to your original plan afterwards, but you'll need to pay for the upgraded plan until the end of the current billing period. If you don't go back to your original plan, you'll continue to pay for the upgraded plan. | UI Text Box |

|---|

| Example Your plan has a limit that allows you to pay two employees per month. In the run up to Christmas you employ two additional temporary employees. This means you'll go over your limit, so you upgrade your plan. This takes effect immediately so you can pay them as soon as you need to. You let the additional employees go in January, leaving you with your original two employees. At that point you can choose to go back to your original plan, which will apply from the start of February. |

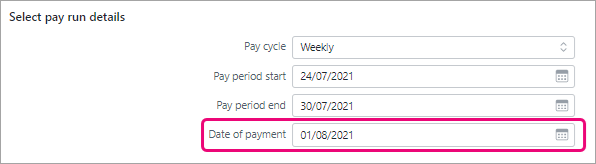

To change your plan, click your business name > My account > Manage my product > Change plan. When applying a limit, MYOB uses the Date of payment field in the pay run to determine which month each pay run falls in:

| UI Text Box |

|---|

| Example If you're paying employees for a pay period in the month of July, but the Date of payment is in August, the employees in this pay run will contribute to your limit for August.

|

FeesSome plans charge a fee for each employee you pay within a calendar month. You only pay this fee once per employee per month. Once you've paid an employee, you can pay them as many times as you want in that month. The fee is incurred the first time you pay each employee in a month, on the date you submit the pay run. The fee is added to your MYOB monthly subscription invoice. To view your invoices, click your business name > My account > View my bills. | UI Text Box |

|---|

Example You record a pay on 30 July with a Date of payment of 1 August. The fee will be incurred on 30 July and included in your invoice for August. |

| UI Text Box |

|---|

| | Who can incur fees? Any user with permission to submit pay runs can incur fees on behalf of your business. Learn more about user roles and permissions. |

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | Is the business owner included in payroll limits? |

|---|

| If they're set up as an employee and paid in a pay run in MYOB, then they are included in payroll limits. |

| UI Expand |

|---|

| title | Are zero dollar pays included in payroll limits? |

|---|

| No. If you process a pay where the net payment is zero, for example to send an employee's latest year-to-date amounts to the ATO, the pay won't be included in payroll limits. |

| UI Expand |

|---|

| title | Are pay deletions and reversals included in payroll limits? |

|---|

| If you delete or reverse an employee's pay, that employee will be included in payroll limits for that month. So it's a good idea to double-check who you're paying before recording a pay run. |

| UI Expand |

|---|

| title | What if one employee finishes and another starts in the same month? |

|---|

| If you need to pay a new employee and you've already reached your monthly limit, you'll need to upgrade your plan. You can always downgrade your plan afterwards, or you can stay on the upgraded plan to keep paying the increased number of employees. |

|