You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 4 Next »

https://help.myob.com/wiki/x/jIsCBg

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Lump Sum E amounts stopped being reported from any pays completed before upgrading to v4.66.

This impacts pays with a Lump sum in arrears payment (aka Lump Sum E) from the Tax Year you started using STP v4 to the last closed pay before upgrading to v4.66.

We expect this to impact PayEvents, Update Events and Finalisations 2022/23 tax year.

If you started using STPv4 in the 2021/22 tax year, then this will also impact any amendments, i.e. re-finalisations of 2021/22.

This issue has been caused by an enhancement introduced in v4.66 to cater for capturing the Lump Sum E Derived Tax Year.

To facilitate the ability to record a Lump Sum E Derived Tax Year, the PayGlobal schema was changed and STP was also changed to stop it from using TransHistoricalMaster.LumpSumE as its data source.

Remind you that PayGlobal does not usually back-fill new tables or new fields with historical data records.

Inform you to review all “Lump sum in Arrears” payments that would be reported via STP v4 to confirm whether the amount related on one or more previous tax years, i.e. “Lump sum in Arrears” payments in pays linked to the 2022/23. Payments made in the 2022/21 tax year only need to be checked if you turned STPv4 on during the 2021/22 tax year.

Inform you that you would need to have your

HistoricalLumpSumEtable manually updated via SQL script.

This impacts pays from the Tax Year you started using STP v4 to the last closed pay before upgrading to v4.66. We expect this only impacts the 2022/23 tax year.

Then you do not need to do anything.

The ATO’s preference is that you send an Update Event to un-do the Finalisation, i.e. let the ATO know some/all of your data is not tax ready yet. Once the missing data has been added to your database you can re-finalise (i.e. send a new Finalisation Event).

If not all employees are impacted you may want to complete this step just for those employees that are impacted.

You will need to get the missing data added to your database before sending the finalisation for 2022/23.

For online services customers

We are in the process of completing this check for you. We will provide you with a report outlining the impacted employees and pay sequences.

For on-premise customers

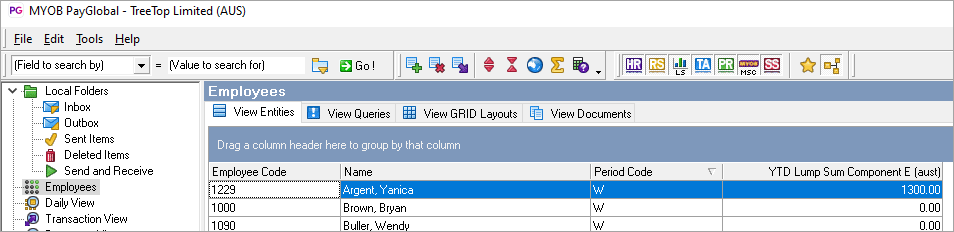

If you haven’t rolled your accumulators for 2022/23 yet, then you can use the Employee’s main browse grid to create a basic employee grid report to show Lump Sum E.

If you have rolled your accumulators for 2022/23 - you can run the File Analysis Report (CSV) - PGPRHIST003V report described in the next FAQ or run a the following SQL query

select thm.paysequence,thm.employeecode,thm.LumpEfrom transhistoricalmaster as thminner join TransPerPaySequence tpps on tpps.PaySequence = thm.PaySequenceWhere tpps.YTDCode = ‘TY2223'

Note: The ‘YTD Code’ will be unique to each customer database.

For online services customers

We are in the process of completing this step for you. We will provide you with a report outlining the impacted employees and pay sequences. However you are more than welcome to also run the File Analysis Report (CSV) - PGPRHIST003V, report as described for on-premise customers

For on-premise customers

You can either:

Run the File Analysis Report (CSV) - PGPRHIST003V,

Filters required: Period Type = Y.YTD, Period Range = 2022/23 tax year, Allowances = All allowances with ‘Lump Sum in Arrears’ set to Yes. Sorting by Employee.Employeecode and Virtualhistoricaltransaction.PaySequence.

If you turned STPv4 on during the 2021/22 tax year, then you will need to run this report again with Period Range = 2021/22 tax year.Run a SQL script <insert script here>

Firstly you will need to review the extracted transaction data to identify whether the “Lump sum in Arrears” payments related to a single tax year or if the transaction needs to be split across multiple tax years. This task can only be completed by you.

Then you need convert the extracted transaction data into a data source that can be used to populate the HistoricalLumpSumE table. Who completes this task is dependant on whether you are an online services customer or an on-premise customer.

The HistoricalLumpSumE table is structured as follows:

Field Name | Details |

|---|---|

EmployeeCode | Identifies the employee the Lump Sum E payment belongs to |

PaySequence | Identifies the pay sequence the payment came from |

PayPeriodYTDCode | This is the YTD Code representing the ‘Lump Sum E Derived Tax Year’. |

Total Amount | This is the consolidated total amount from the ‘Lump sum in arrears’ allowances for the same employee, pay sequence and ‘Lump Sum E Derived Tax Year’. |

For online services customers

Our professional services team will inject the data for you. After you have completed a review the data we extracted.

For on-premise customers

You can do this step yourself using this SQL Update script <insert script>.

Or you can engage with our professional services team to complete this task for you. This is chargeable work and will be charged at time and materials rates due to the varying transaction volumes per customer database.

For STP, PayGlobal now uses the HistoricalLumpSumE table (added in v4.66).

The HistoricalLumpSumE table gets populated when you close a pay. It consolidates Lump Sum E data from the HistoricalAllowance table by: Employee Code, Pay Sequence, PayPeriodYTDCode (aka Lump Sum E Derived Tax Year) and gives a Total amount for this combination.

When the STP submissions are generated, PayGlobal gets the reportable YTD amounts from HistoricalLumpSumE table by selecting all the records for the employee where the Pay Sequence belongs to the Payer/Tax Year being reported, then it groups the records by the Lump Sum E Derived Tax Year. Note: Lump Sum E will only be reported if the total YTD amount for the Payer/Tax year being reported (i.e. irrespective of the derived tax year((s)) is equal to or great than $1200.00.