- Created by admin, last modified by AdrianC on Jan 31, 2017

This information applies to MYOB AccountRight version 19. For later versions, see our help centre.

https://help.myob.com/wiki/x/UQGc

ANSWER ID:9121

AccountRight Plus, Premier and Enterprise, Australia only

An employee might be owed back pay to account for a wage increase, or to make up for an incorrect pay rate.

Back pay is the difference between:

- how much the employee should have been paid over the back pay period, and

- how much the employee was actually paid.

Once you've worked out the back pay amount, you can include it on the employee's next pay.

Before proceeding, make sure you've updated the employee's pay details to reflect their updated wage.

OK, let's step you through how to handle back pay.

The easiest way to work this out is to review a sample pay for the employee.

- Start a new pay run for the employee.

- Click the zoom arrow to review their pay details on the Pay Employee window.

- Take note of the gross pay and PAYG Withholding values. Here's our example for a weekly pay:

- If necessary, multiply the values based on the number of weeks of back pay that is due.

- Cancel the pay without saving.

The Payroll Activity (Detail) report provides this information.

- Run the Payroll Activity (Detail) report for the back pay period (Reports > Index to Reports > Payroll > Employees > Activity Detail).

- Filter the report.

- Select the employee who is owed back pay.

- Specify a date range to capture the back pay period.

- Take note of the employee's Wages and Taxes values.

To calculate the back pay, subtract what the employee was actually paid from what they should have been paid.

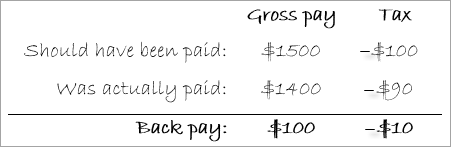

This example shows the employee should have been paid $1500 in gross pay but was actually paid $1400. This also determines that an additional $10 of tax should have been withheld.

To be able to add back pay to an employee's pay, add the Back Pay wage category to their card.

- Go to Card File > Cards List > Employee tab > open the employee's card.

- Click the Payroll Details tab.

- Click Wages.

- Select the Back Pay wage category.

- Click OK.

- Click Close to close the Cards List.

You can now include the back pay in the employee's next pay.

- Start a new pay run for the employee.

- Click the zoom arrow to review their pay details on the Pay Employee window.

- Determine the PAYG Withholding payable:

- Take note of the PAYG Withholding value shown in the employee's pay.

- Add the back pay tax amount calculated above to work out the total tax payable.

- Enter the gross back pay value against the Back Pay category.

- Change the PAYG Withholding value to the figure you calculated at step 3. Here's our example with $100 entered against the Back Pay wage category and the PAYG Withholding value adjusted.

- Record the pay.