- Created by admin, last modified by AdrianC on Apr 11, 2016

https://help.myob.com/wiki/x/Rwic

ANSWER ID:11087

AccountEdge Pro and Network Edition, Australia only

Sometimes an employee's allowance needs to be taxed at a different rate to the rest of their pay. This is done using a wage category to ally the allowance to the employee's pay, then using a deduction category to deduct the allowances flat rate of tax.

The example we'll use is a travel allowance which is taxed at a flat rate of 5%, but the rest of the employee's pay is taxed at the normal rate. However, the same approach can be used for any flat tax rate on an allowance.

This task involves creating a new wage category which you will assign to the employee(s) eligible for the allowance. This wage category will be exempt from tax (we'll take care of the flat tax rate in the next task).

- Go to the Payroll command centre and click Payroll Categories.

- Click the Wages tab.

- Click New.

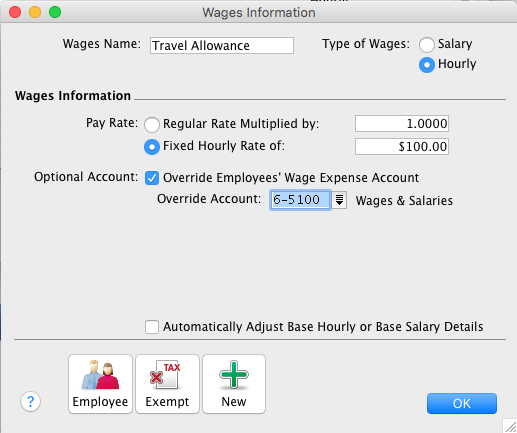

- Enter the details for the allowance as shown in this example.

- Click Exempt on the Wages Information window (as shown above).

- Select PAYG Withholding. This will exclude the allowance from being taxed at the normal PAYG rate.

- Click OK to return to the Wages Information window.

- Click Employee on the Wages Information window.

- Select the employees to whom this allowance applies.

- Click OK to return to the Wages Information window.

- Click OK again.

This category will ensure the flat rate of tax fro the allowance is deducted from the employee's pay.

- Go to the Payroll command centre and click Payroll Categories.

- Click the Deductions tab.

- Click New.

- Enter the Deduction Name.

- Enter the PAYG Withholding Payable as your Linked Payable Account.

- Enter the Calculation Basis as 5% of Travel Allowance. See our example below.

- Click Employee and select the employees to whom this category applies.

- Click OK to save the category.

When you process the employee's pay, the Travel Allowance category will be included in their pay and the deduction category will ensure the allowance is taxed at 5% without affecting the rest of their pay.

Rounding and payment summaries

- Tax is normally rounded to an even dollar. You may need to manually round the tax amount when processing the employee's pay.

- When preparing your payment summaries, the deduction category would typically be selected in the Total Tax Withheld section at Step 4 of the Payment Summary Assistant. However, check with your accounting advisor or the ATO about how to handle payroll categories on your payment summaries.