You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 13 Next »

This information applies to MYOB AccountRight version 19. For later versions, see our help centre.

https://help.myob.com/wiki/x/0Ajq

AccountRight Plus, Premier and Enterprise, Australia only

From 1 January 2017, tax rates will change for working holiday makers who are in Australia on a 417 or 462 visa (the 'backpacker tax').

Under this new tax scale, you should withhold 15% from every dollar earned by a working holiday maker up to $37,000 with foreign resident tax rates applying from $37,001. See the ATO for more details.

You should start withholding at these rates from the first pay run after 1 January 2017.

Registering with the ATO

If you currently employ, or are likely to employ working holiday makers, you must register by 31 January 2017 to avoid penalties. Register from the ATO website.

How to withhold the working holiday maker tax

Until we release an update containing the updated tax tables, you can use the Withholding Variation tax table set to 15% for working holiday makers earning $0-37,000. After the worker earns above $37,000 you can assign them the applicable Foreign Resident tax table.

Already paid working holiday makers in 2016? If you've already paid a working holiday maker in 2016 and you'll continue paying that worker in 2017, you'll need to set up a new employee card for them. This will ensure two payment summaries are produced for these employees.

If you paid working holiday makers in 2016 who will be paid with the new tax rate in 2017, you need to issue two payment summaries for these periods:

- July 1 - December 31 2016

- January 1 - June 30 2017

For AccountRight to issue two payment summaries for a working holiday maker, you'll need to terminate their current employee card and create a new employee card.

Here's how to do it:

- Enter a Termination Date in the working holiday maker's current employee card.

- Go to Card File > Cards List > Employee tab > click the zoom arrow to open their card.

- Click the Payroll Details tab.

- In the Termination Date field, enter 31/12/2016. You can use the Card ID field on the Profile tab to enter something to identify this as the terminated employee card, e.g. OLD.

- Click OK.

- Click Yes to the confirmation message.

- Create a new employee card for the working holiday maker.

- Go to Card File > Cards List > Employee tab > click New.

- Enter the same employee details from their original card. You can use the Card ID field on the Profile tab to enter something to identify this as a reinstated employee card, e.g. NEW.

- On the Payroll Details tab, enter a Start Date of 01/01/2017.

- Click Taxes and set a 15% withholding variation rate as described in the next task.

- Click OK. You can now use this card when paying the employee from 1 January 2017.

When you run the Payment Summary Assistant two payment summaries will be generated for the working holiday maker. To confirm the amounts on the payment summaries, run the Payroll Activity Summary report (Reports menu > Index to Reports > Payroll tab). If needed, you can change values when reviewing the payment summaries.

- Go to the Card File command centre and click Cards List.

- Click the Employee tab.

- Click the zoom arrow to open the employee's card. If you've created a new employee card (as described above) open this card.

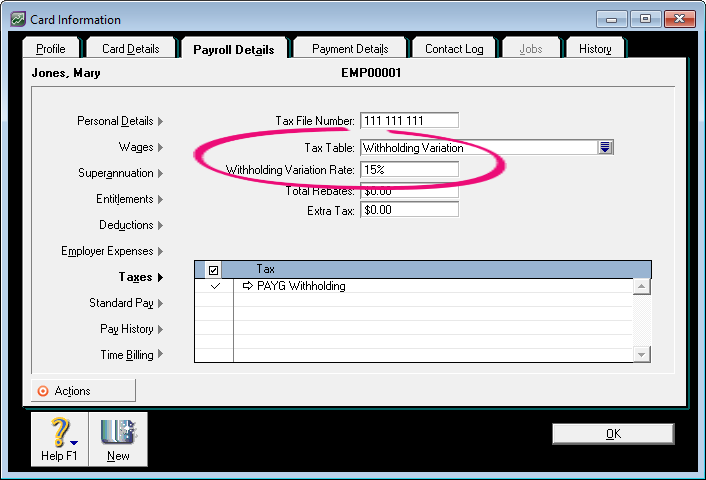

- Click the Payroll Details tab then click Taxes.

- In the Tax Table field, select Withholding Variation.

- In the Withholding Variation Rate field, enter 15%.

- Click OK.

Repeat these steps for each working holiday maker you employ.

Important: You'll need to manually track your working holiday makers' gross earnings for the payroll year by running the Payroll Activity Summary report (Reports menu > Index to Reports > Payroll tab). Once a worker exceeds $37,000, repeat the above steps to assign the worker the applicable Foreign Resident tax table. Check with the ATO if you're unsure which tax table to assign.

FAQs

If you don't register for the working holiday maker tax, you'll need to use the applicable Foreign Resident tax table for working holiday makers. If you're not sure which tax table to use, check with the ATO.

If you withhold 15% for working holiday makers without registering, you may be penalised by the ATO.

You must withhold 47% from payments to working holiday makers if:

- They have not provided you with their tax file number (TFN),

- have not claimed an exemption from quoting their TFN, or

- have not advised that they have applied for a TFN.

Working holiday makers who earned income between 1 July and 31 December 2016 and continue earning income up to 30 June 2017 will require two payment summaries. This is an ATO requirement because the tax change introduces two separate rates of taxation within the same financial year.

You can set up a new employee card as described above to allow AccountRight to generate two payment summaries for working holiday makers. One payment summary will be for the period 1 July 2016 - 31 December, and the second payment summary will be for 1 January - 30 June 2017.